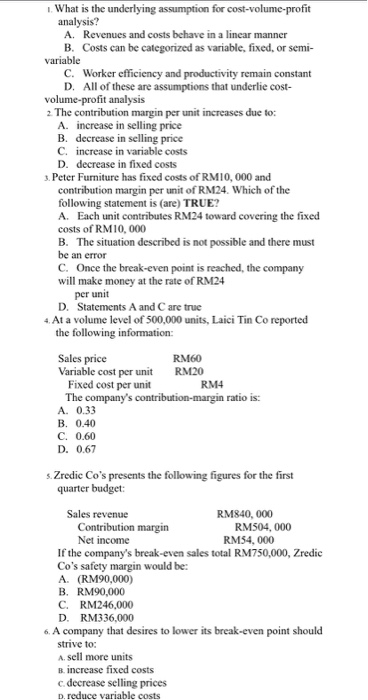

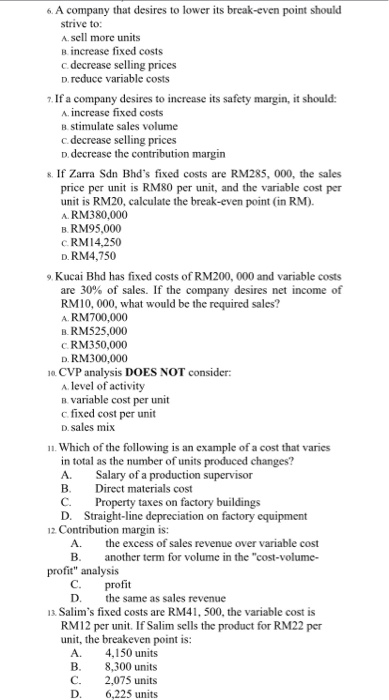

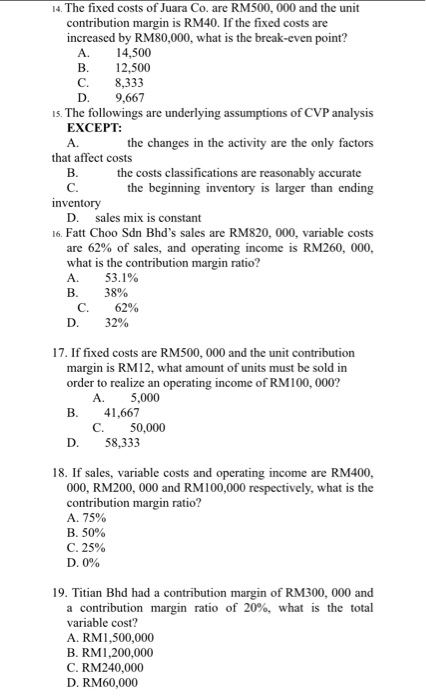

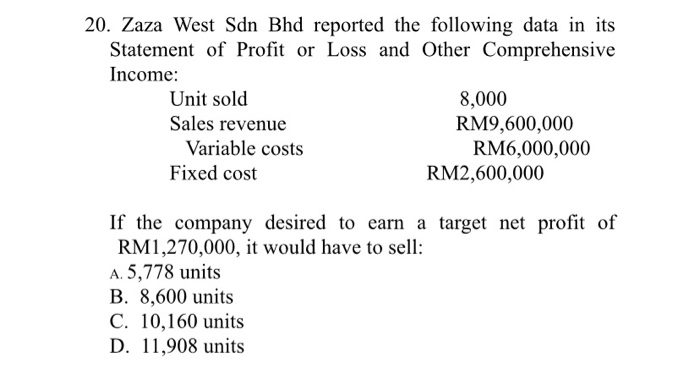

1. What is the underlying assumption for cost-volume-profit analysis? A. Revenues and costs behave in a linear manner B. Costs can be categorized as variable, fixed, or semi- variable C. Worker efficiency and productivity remain constant D. All of these are assumptions that underlie cost- volume-profit analysis 2. The contribution margin per unit increases due to: A. increase in selling price B. decrease in selling price C. increase in variable costs D. decrease in fixed costs 3. Peter Furniture has fixed costs of RM10,000 and contribution margin per unit of RM24. Which of the following statement is (are) TRUE? A. Each unit contributes RM24 toward covering the fixed costs of RM10,000 B. The situation described is not possible and there must be an error C. Once the break-even point is reached the company will make money at the rate of RM24 per unit D. Statements A and Care true 4. At a volume level of 500,000 units, Laici Tin Co reported the following information: Sales price RM60 Variable cost per unit RM20 Fixed cost per unit RM4 The company's contribution-margin ratio is: A. 0.33 B. 0.40 C. 0.60 D. 0.67 Zredic Co's presents the following figures for the first quarter budget: Sales revenue RM840,000 Contribution margin RM504,000 Net income RM54,000 If the company's break-even sales total RM750,000, Zredie Co's safety margin would be: A (RM90,000) B. RM90,000 C. RM246,000 D. RM336,000 6. A company that desires to lower its break-even point should strive to: A sell more units B. increase fixed costs c decrease selling prices D. reduce variable costs 6. A company that desires to lower its break-even point should strive to: A. sell more units B. increase fixed costs c decrease selling prices D. reduce variable costs 7. If a company desires to increase its safety margin, it should: A increase fixed costs B. stimulate sales volume c decrease selling prices D. decrease the contribution margin 8. If Zarra Sdn Bhd's fixed costs are RM285, 000, the sales price per unit is RM80 per unit, and the variable cost per unit is RM20, calculate the break-even point (in RM). A. RM380,000 B. RM95.000 cRM14,250 D. RM4,750 9 Kucai Bhd has fixed costs of RM200,000 and variable costs are 30% of sales. If the company desires net income of RM10,000, what would be the required sales? A. RM700,000 B. RMS25,000 c RM350,000 D. RM300,000 1. CVP analysis DOES NOT consider: A level of activity B. variable cost per unit cfixed cost per unit D. sales mix 11. Which of the following is an example of a cost that varies in total as the number of units produced changes? A. Salary of a production supervisor B Direct materials cost C. Property taxes on factory buildings D. Straight-line depreciation on factory equipment 12 Contribution margin is: A. the excess of sales revenue over variable cost B. another term for volume in the "cost-volume- profit" analysis c. D. the same as sales revenue 13. Salim's fixed costs are RM41, 500, the variable cost is RM12 per unit. If Salim sells the product for RM22 per unit, the breakeven point is: 4,150 units B. 8,300 units 2,075 units D. 6,225 units profit A. C. 14. The fixed costs of Juara Co. are RM500,000 and the unit contribution margin is RM40. If the fixed costs are increased by RM80,000, what is the break-even point? A. 14,500 B. 12,500 C. 8,333 D. 9,667 15. The followings are underlying assumptions of CVP analysis EXCEPT: A. the changes in the activity are the only factors that affect costs B. the costs classifications are reasonably accurate c. the beginning inventory is larger than ending inventory D. sales mix is constant 16. Fatt Choo Sdn Bhd's sales are RM820, 000, variable costs are 62% of sales, and operating income is RM260, 000, what is the contribution margin ratio? A 53.1% B. 38% C. 62% D. 32% 17. If fixed costs are RM500,000 and the unit contribution margin is RM12, what amount of units must be sold in order to realize an operating income of RM100,000? A. 5,000 B. 41,667 C. 50,000 D. 58,333 18. If sales, variable costs and operating income are RM400, 000, RM200,000 and RM100,000 respectively, what is the contribution margin ratio? A. 75% B. 50% C.25% D. 0% 19. Titian Bhd had a contribution margin of RM300,000 and a contribution margin ratio of 20%, what is the total variable cost? A. RM1,500,000 B.RM1,200,000 C. RM240,000 D. RM60,000 20. Zaza West Sdn Bhd reported the following data in its Statement of Profit or Loss and Other Comprehensive Income: Unit sold 8,000 Sales revenue RM9,600,000 Variable costs RM6,000,000 Fixed cost RM2,600,000 If the company desired to earn a target net profit of RM1,270,000, it would have to sell: A. 5,778 units B. 8,600 units C. 10,160 units D. 11,908 units