Answered step by step

Verified Expert Solution

Question

1 Approved Answer

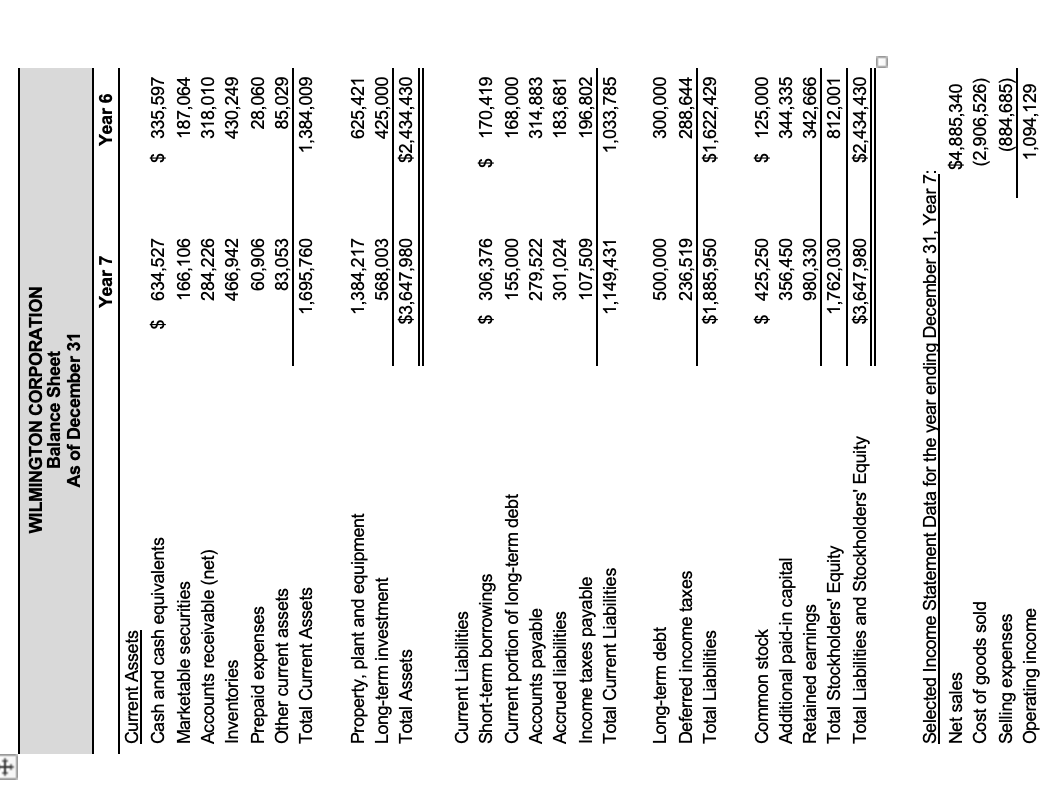

1. What was Wilmington Corporations return on net operating assets (RNOA) in Year 7? Assume a statutory tax rate of 37%. 2 . What was

1. What was Wilmington Corporations return on net operating assets (RNOA) in Year 7? Assume a statutory tax rate of 37%.

2. What was Wilmington Corporations net operating profit margin (NOPM) in Year 7? Assume a statutory tax rate of 37%.

13.8%

31.0%

29.9%

14.6%

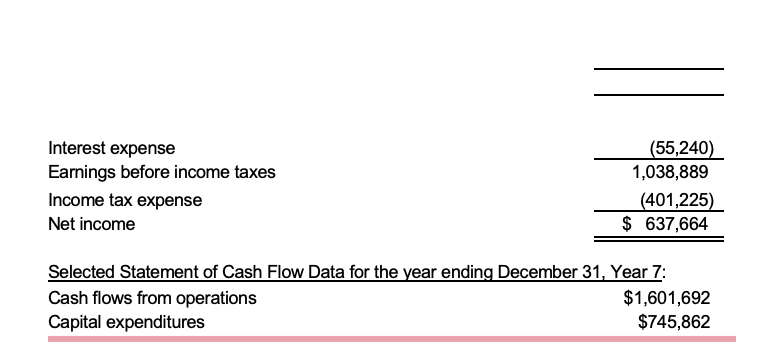

WILMINGTON CORPORATION Balance Sheet As of December 31 Selected Income Statement Data for the year ending December 31, Year 7: Net sales $4,885,340 Cost of goods sold (2,906,526) Selling expenses Operating income 1,094,129(884,685) Interest expense Earnings before income taxes Income tax expense Net income (55,240)1,038,889(401,225)$637,664 Selected Statement of Cash Flow Data for the year ending December 31, Year 7: Cash flows from operations $1,601,692 Capital expenditures $745,862Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started