Answered step by step

Verified Expert Solution

Question

1 Approved Answer

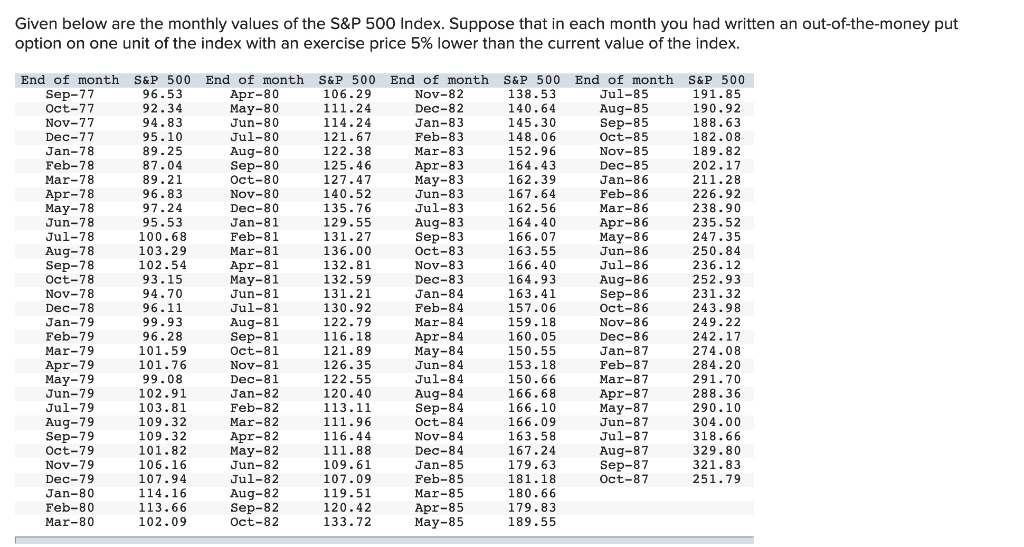

1) What would have been the average value of your gross monthly payouts on the puts over the 10-year period October 1977September 1987? (Round your

1) What would have been the average value of your gross monthly payouts on the puts over the 10-year period October 1977September 1987? (Round your answer to 4 decimal places.)

2) The standard deviation? (Round your answer to 4 decimal places.)

3) What would have been the average value of your gross monthly payouts on the puts if you extend the sample by one month to include October 1987? (Round your answer to 4 decimal places.)

4) The standard deviation? (Round your answer to 4 decimal places.)

Please show in EXCEL

Given below are the monthly values of the S&P 500 Index. Suppose that in each month you had written an out-of-the-money put option on one unit of the index with an exercise price 5% lower than the current value of the index. End of month S&P 500 End of month S&P 500 End of month Sep-77 96.53 Apr-80 106.29 Nov-82 Oct-77 92.34 May-80 111.24 Dec-82 Nov-77 94.83 Jun-80 114.24 Jan-83 Dec-77 95.10 Jul-80 121.67 Feb-83 Jan-78 89.25 Aug-80 122.38 Mar-83 Feb-78 87.04 Sep-80 125.46 Apr-83 Mar-78 89.21 Oct-80 127.47 May-83 Apr-78 96.83 Nov-80 140.52 Jun-83 May-78 97.24 Dec-80 135.76 Jul-83 Jun-78 95.53 Jan-81 129.55 Aug-83 Jul-78 100.68 Feb-81 131.27 Sep-83 Aug-78 103.29 Mar-81 136.00 Oct-83 Sep-78 102.54 Apr-81 132.81 Nov-83 Oct-78 93.15 May-81 132.59 Dec-83 Nov-78 94.70 Jun-81 131.21 Jan-84 Dec-78 96.11 Jul-81 130.92 Feb-84 Jan-79 99.93 Aug-81 122.79 Mar-84 Feb-79 96.28 Sep-81 116.18 Apr-84 Mar-79 101.59 Oct-81 121.89 May-84 Apr-79 101.76 Nov-81 126.35 Jun-84 May-79 99.08 Dec-81 122.55 Jul-84 Jun-79 102.91 Jan-82 120.40 Aug-84 Jul-79 103.81 Feb-82 113.11 Sep-84 Aug-79 109.32 Mar-82 111.96 Oct-84 Sep-79 109.32 Apr-82 116.44 Nov-84 Oct-79 101.82 May-82 111.88 Dec-84 Nov-79 106.16 Jun-82 109.61 Jan-85 Dec-79 107.94 Jul-82 107.09 Feb-85 Jan-80 114.16 Aug-82 119.51 Mar-85 Feb-80 113.66 Sep-82 120.42 Apr-85 Mar-80 102.09 Oct-82 133.72 May-85 S&P 500 End of month S&P 500 138.53 Jul-85 191.85 140.64 Aug-85 190.92 145.30 Sep-85 188.63 148.06 Oct-85 182.08 152.96 Nov-85 189.82 164.43 Dec-85 202.17 162.39 Jan-86 211.28 167.64 Feb-86 226.92 162.56 Mar-86 238.90 164.40 Apr-86 235.52 166.07 May-86 247.35 163.55 Jun-86 250.84 166.40 Jul-86 236.12 164.93 Aug-86 252.93 163.41 Sep-86 231.32 157.06 Oct-86 243.98 159.18 Nov-86 249.22 160.05 Dec-86 242.17 150.55 Jan-87 274.08 153.18 Feb-87 284.20 150.66 Mar-87 291.70 166.68 Apr-87 288.36 166.10 May-87 290.10 166.09 Jun-87 304.00 163.58 Jul-87 318.66 167.24 Aug-87 329.80 179.63 Sep-87 321.83 181.18 Oct-87 251.79 180.66 179.83 189.55 Given below are the monthly values of the S&P 500 Index. Suppose that in each month you had written an out-of-the-money put option on one unit of the index with an exercise price 5% lower than the current value of the index. End of month S&P 500 End of month S&P 500 End of month Sep-77 96.53 Apr-80 106.29 Nov-82 Oct-77 92.34 May-80 111.24 Dec-82 Nov-77 94.83 Jun-80 114.24 Jan-83 Dec-77 95.10 Jul-80 121.67 Feb-83 Jan-78 89.25 Aug-80 122.38 Mar-83 Feb-78 87.04 Sep-80 125.46 Apr-83 Mar-78 89.21 Oct-80 127.47 May-83 Apr-78 96.83 Nov-80 140.52 Jun-83 May-78 97.24 Dec-80 135.76 Jul-83 Jun-78 95.53 Jan-81 129.55 Aug-83 Jul-78 100.68 Feb-81 131.27 Sep-83 Aug-78 103.29 Mar-81 136.00 Oct-83 Sep-78 102.54 Apr-81 132.81 Nov-83 Oct-78 93.15 May-81 132.59 Dec-83 Nov-78 94.70 Jun-81 131.21 Jan-84 Dec-78 96.11 Jul-81 130.92 Feb-84 Jan-79 99.93 Aug-81 122.79 Mar-84 Feb-79 96.28 Sep-81 116.18 Apr-84 Mar-79 101.59 Oct-81 121.89 May-84 Apr-79 101.76 Nov-81 126.35 Jun-84 May-79 99.08 Dec-81 122.55 Jul-84 Jun-79 102.91 Jan-82 120.40 Aug-84 Jul-79 103.81 Feb-82 113.11 Sep-84 Aug-79 109.32 Mar-82 111.96 Oct-84 Sep-79 109.32 Apr-82 116.44 Nov-84 Oct-79 101.82 May-82 111.88 Dec-84 Nov-79 106.16 Jun-82 109.61 Jan-85 Dec-79 107.94 Jul-82 107.09 Feb-85 Jan-80 114.16 Aug-82 119.51 Mar-85 Feb-80 113.66 Sep-82 120.42 Apr-85 Mar-80 102.09 Oct-82 133.72 May-85 S&P 500 End of month S&P 500 138.53 Jul-85 191.85 140.64 Aug-85 190.92 145.30 Sep-85 188.63 148.06 Oct-85 182.08 152.96 Nov-85 189.82 164.43 Dec-85 202.17 162.39 Jan-86 211.28 167.64 Feb-86 226.92 162.56 Mar-86 238.90 164.40 Apr-86 235.52 166.07 May-86 247.35 163.55 Jun-86 250.84 166.40 Jul-86 236.12 164.93 Aug-86 252.93 163.41 Sep-86 231.32 157.06 Oct-86 243.98 159.18 Nov-86 249.22 160.05 Dec-86 242.17 150.55 Jan-87 274.08 153.18 Feb-87 284.20 150.66 Mar-87 291.70 166.68 Apr-87 288.36 166.10 May-87 290.10 166.09 Jun-87 304.00 163.58 Jul-87 318.66 167.24 Aug-87 329.80 179.63 Sep-87 321.83 181.18 Oct-87 251.79 180.66 179.83 189.55Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started