Question

The assignment is based on the following documents A case study: Snap Inc.s IPO Snap Inc.s IPO prospectus An Excel file containing daily share price

The assignment is based on the following documents A case study: Snap Inc.s IPO Snap Inc.s IPO prospectus An Excel file containing daily share price of Snap from its IPO to March 2020 (Snap shareprice)

Snaps Annual Report 2020

Read the above documents and the IPO book (e-copy available on Blackboard) to answer the following questions. You can use external references/material from credible sources (such as the financial press and journal articles):

(i) An IPO marks a strategic milestone for a company. (a) What may have motivated Snap to go public? (b) In your opinion, why did Snap choose to list on the New York Stock Exchange (NYSE) instead of Nasdaq? (c) Why do you think Snap chose to conduct its IPO in 2017? (d) What can you say about the primary and secondary shares sold in the Snap IPO? How did Snap plan to use the proceeds of the IPO? (e) Explain the unusual share structure of Snap. How would new investors be affected by Snaps share structure? (20 marks) (ii) What is an IPO over-allotment (Greenshoe) option? Describe the over-allotment option included in Snaps IPO? (5 marks) (iii) The underwriting investment bank takes on a central role in the IPO process. (a) What are the key tasks executed by the underwriter?

2. (b) What are primary considerations when selecting an underwriter? (c) Often, multiple underwriters are involved. In the case of Snap, a syndicate of 7 underwriters was involved in the IPO. What are the main motivations for syndication? (d) How much compensation was paid to the underwriters of Snap? How does it compare to the average compensation paid to underwriters in US IPOs? (e) What do you understand by price-stabilization activities conducted by the underwriter(s)? Do you think the underwriters were involved in pricestabilization of the Snap IPO? (25 marks) (iv) Describe what happens during book-building of an IPO. What price range was used for book building of the Snap IPO? Why do you think Snap priced its offering above the initial book-building price range? (10 marks)

(v) Without conducting a formal valuation analysis and based on the information given in the case study, the IPO prospectus and external resources (such as media coverage at the time of the IPO), discuss the pricing of the Snap IPO. Would you have invested in Snap at the offer price of $17? (10 marks)

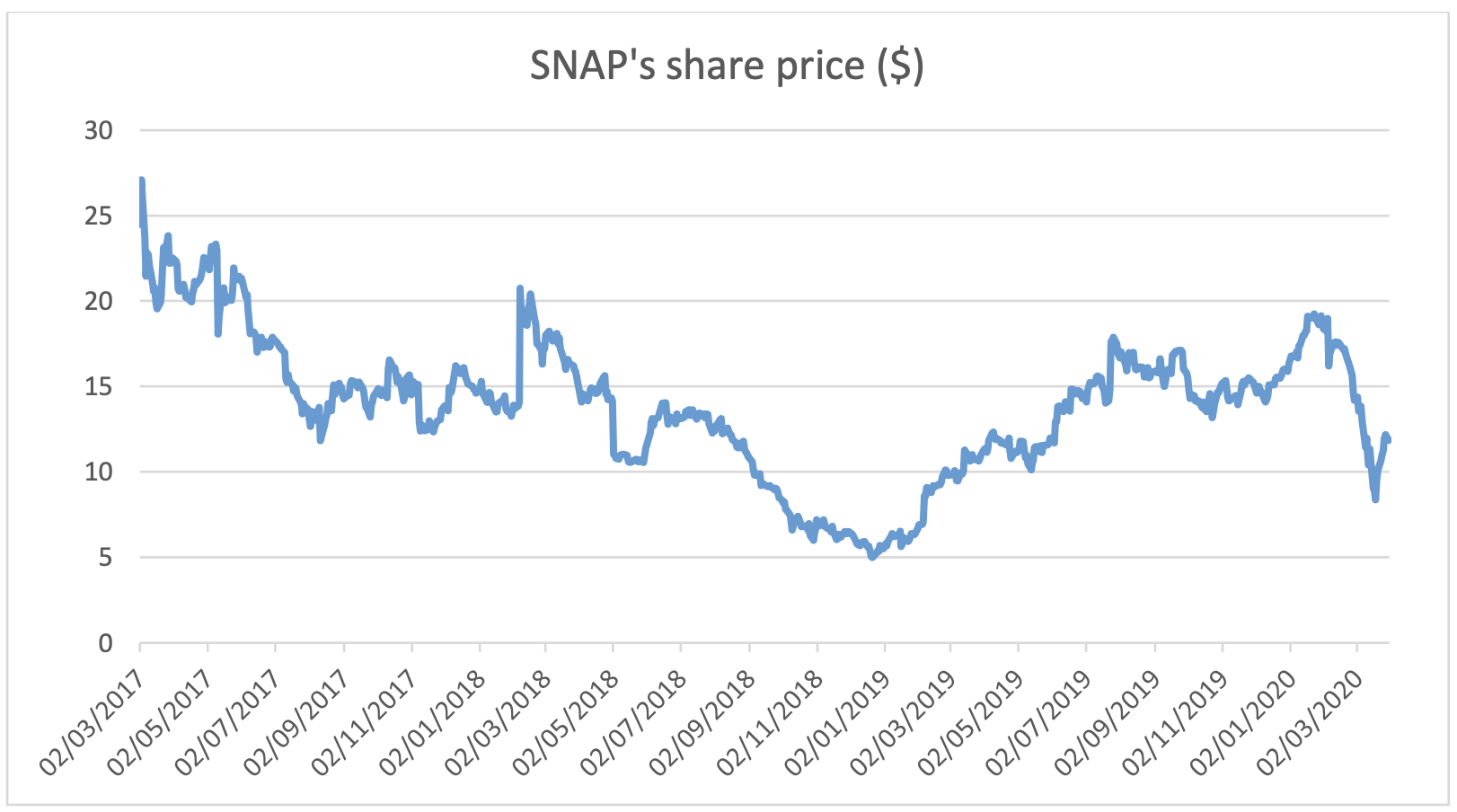

(vi) What are IPO lock-up agreements? Describe the lock-up agreement of the Snap IPO. Was the Snap lockup agreement in line with that of other IPOs in the US? (8 marks) (vii) The diagram below shows the performance of Snap shares from March 2017 to March 2020. The first day of public trading of Snaps shares was 2nd March 2017.

Shares were sold in the IPO at an offer price of $17.00. More information on daily share price movements is available in the Excel file (Snap shareprice). 3. Source: Yahoo Finance Based on a visual examination of the chart above, how does the performance of the Snap IPO compare with average IPO performance documented by past empirical studies i. in terms of the short term (1st trading day or the first week of trading)? ii. and over the longer term (3 years)? Past studies have suggested a number of explanations for short-run underpricing and long-run underperformance of IPOs. Discuss the ones which you think are relevant to Snaps case? (12 marks) (viii) In the light of the main theories of capital structure, provide a discussion of the evolution of the capital structure of Snap in the initial three years after its IPO. You will find Snaps Annual Report 2020 helpful in answering this question.

SNAP's share price ($) 30 25 20 15 10 5 0 02/03/2017 02/05/2017 02/07/2017 02/01/2018 02/05/2018 02/03/2019 02/05/2019 02/01/2019 02/09/2018 02/11/2018 02/09/2019 02/11/2019 02/01/2020 02/03/2018 02/07/2018 02/07/2019 02/03/2020 02/09/2017 02/11/2017 SNAP's share price ($) 30 25 20 15 10 5 0 02/03/2017 02/05/2017 02/07/2017 02/01/2018 02/05/2018 02/03/2019 02/05/2019 02/01/2019 02/09/2018 02/11/2018 02/09/2019 02/11/2019 02/01/2020 02/03/2018 02/07/2018 02/07/2019 02/03/2020 02/09/2017 02/11/2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started