Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. What would the result be if Mattel chose to remain unhedged? Show how you arrived at your answer with numbers. Is this result certain

1. What would the result be if Mattel chose to remain unhedged? Show how you arrived at your answer with numbers. Is this result certain or risky?

2. What would the result be if Mattel chose to pursue a forward market hedge? Show how you arrived at your answer with numbers. Is this result certain or risky?

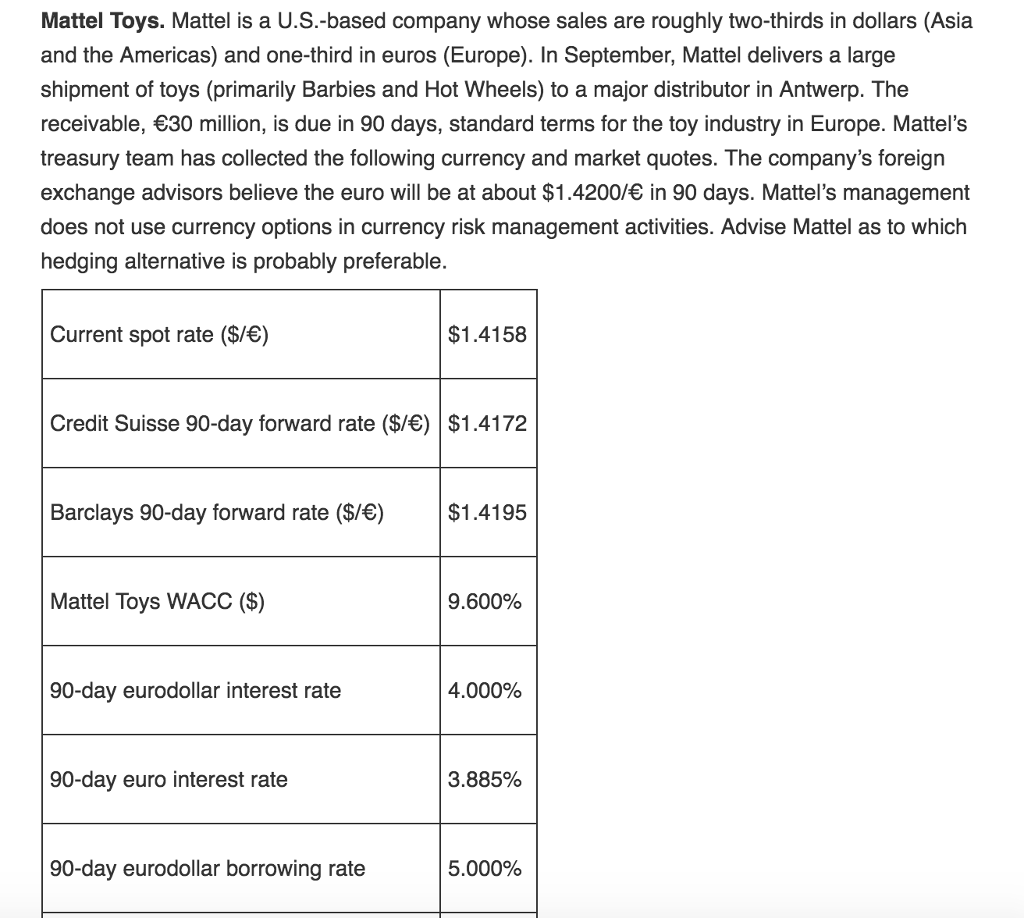

Mattel Toys. Mattel is a U.S.-based company whose sales are roughly two-thirds in dollars (Asia and the Americas) and one-third in euros (Europe). In September, Mattel delivers a large shipment of toys (primarily Barbies and Hot Wheels) to a major distributor in Antwerp. The receivable, 30 million, is due in 90 days, standard terms for the toy industry in Europe. Mattel's treasury team has collected the following currency and market quotes. The company's foreign exchange advisors believe the euro will be at about $1.4200/ in 90 days. Mattel's management does not use currency options in currency risk management activities. Advise Mattel as to which hedging alternative is probably preferable $1.4158 Current spot rate ($/) Credit Suisse 90-day forward rate ($/) $1.4172 Barclays 90-day forward rate ($/) $1.4195 Mattel Toys WACC 9.600% 4.000% 90-day eurodollar interest rate 90-day euro interest rate 3.885% 5.000% 90-day eurodollar borrowing rateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started