1) Which country of countries in Europe (outside Ireland) would you recommend TMWC to concentrate on?

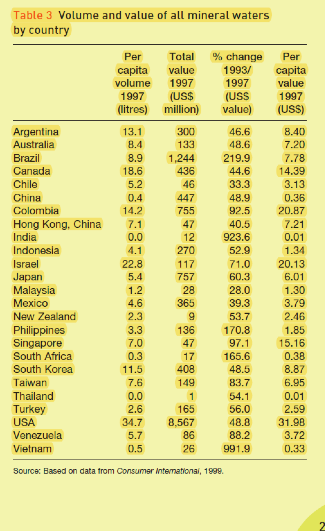

2)Which country or countries outside Europe would you recommend TMWC to concentrate on (use Table 3) ?

Information:

?

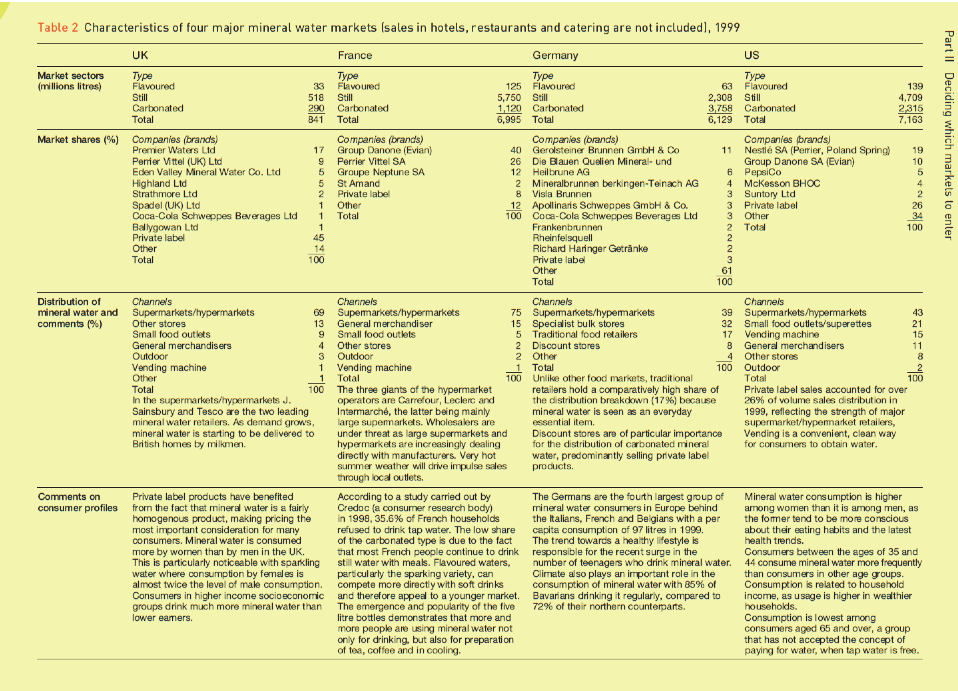

Table 2 Characteristics of four major mineral water markets [sales in hotels, restaurants and catering are not included], 1999 UK France Germany US I ll wed Market sectors Type Type Type Type millions litres) Favoured 36 Flavoured 125 Flavoured 63 Flavoured 139 Still 518 Still 5,750 Still 2,308 Still 4,709 Carbonated 280 Carbonated 1,120 Carbonated 3,758 Carbonated 2 315 Total 841 Total 6,995 Total 6,129 Total 7,163 Market shares (%) Companies (brand's) Companies (brand's) Companies (brands) Companies brand's) Premier Waters Lid Group Danone (Evian) 40 Gerolsteiner Brunnen GmbH & Co 11 Nestle SA (Perrier, Poland Spring Il Deciding which markets to enter Perrier Vittel (UK) Ltd Perrier Vittel SA 26 Eden Valley Mineral Water Co. Ltd Groupe Neptune SA 12 Die Blauen Quelien Mineral- und Heil brune AG Group Danone SA (Evian) PepsiCo Highland Lid St Amand Strathmore Ltd Mineralbrunnen berkingen-Teinach AG Mckesson BHOC Private label Visla Brunnen Suntory Ltd Spadel (UK) Ltd Other 12 Apollinaris Schweppes GmbH & Co. Private label Coca-Cola Schweppes Beverages Lid Total 00 Coca-Cola Schweppes Beverages Lid Other Ballygowan Ltd Frankenbrunnen SWNNNWWWAD Total 100 Private label Rheinfelsquell Other 14 Richard Haringer Getranke Total 100 Private label Other Total 100 Distribution of Channels Channels Channels Channels mineral water and Supermarkets/hypermarkets Supermarkets/hypermarkets Supermarkets/hypermarkets Supermarkets/hypermarkets comments (9%) Other stores General merchandiser Specialist bulk stores 32 Small food outlets/superettes Small food outlets Small food outlets Traditional food retailers 17 Vending machine 21 15 General merchandisers Other stores Discount stores 10 A B General merchandisers Outdoor Outdoor Other Other stores Vending machine Vending machine Total 100 Outdoor Other Total 100 100 Unlike other food markets, traditional Total 100 Total The three giants of the hypermarket retailers hold a comparatively high share of Private label sales accounted for over In the supermarkets/hypermarkets J. operators are Carrefour, Leclerc and the distribution breakdown (17%) because 26% of volume sales distribution in Sainsbury and Tesco are the two leading Intermarche, the latter being mainly mineral water is seen as an everyday 1999, reflecting the strength of major mineral water retailers. As demand grows, large supermarkets. Wholesalers are essential item. mineral water is starting to be delivered to under threat as large supermarkets and Discount stores are of particular importance supermarket/hypermarket retailers, Vending is a convenient, clean way British homes by milkmen. hyper markets are increasingly dealing for the distribution of carbonated mineral for consumers to obtain water. directly with manufacturers. Very hot water, predominantly selling private label summer weather will drive impulse sales products. through local outlets. Comments on Private label products have benefited According to a study carried out by The Germans are the fourth largest group of Mineral water consumption is higher consumer profiles from the fact that mineral water is a fairly Credoc (a consumer research body) in 1998, 35.6% of French households mineral water consumers in Europe behind homogenous product, making pricing the the Italians, French and Belgians with a per among women than it is among men, as the former tend to be more conscious most important consideration for many refused to drink tap water. The low share capita consumption of 97 litres in 1989. about their eating habits and the latest consumers. Mineral water is consumed of the carbonated type is due to the fact The trend towards a healthy lifestyle is health trends. more by women than by men in the UK. This is particularly noticeable with sparkling that most French people continue to drink still water with meals. Flavoured waters, responsible for the recent surge in the number of teenagers who drink mineral water. Consumers between the ages of 35 and 44 consume mineral water more frequently water where consumption by females is particularly the sparking variety, can compete more directly with soft drinks Climate also plays an important role in the consumption of mineral water with 85% of than consumers in other age groups. almost twice the level of male consumption. Consumption is related to household Consumers in higher income socio economic groups drink much more mineral water than and therefore appeal to a younger market. The emergence and popularity of the five Bavarians drinking it regularly, compared to 72% of their northern counterparts. income, as usage is higher in wealthier households. lower eamers. litre bottles demonstrates that more and Consumption is lowest among more people are using mineral water not only for drinking, but also for preparation consumers aged 65 and over, a group of tea, coffee and in cooling that has not accepted the concept of paying for water, when tap water is free.Table & Volume and value of all mineral waters by country FET Talal `` CHANCE Far Capita Capital VOLUME 1997 1957 "BLUE JUSS Nitros! million; ! Value! AnjanilinH ALLStraliz` H. ` 1:1:1 T. ED Brazil 1. 2:4 4 219.4 P.TE CENTENE 44. 5 GET 14.25 Chile 5. 2 3. 1.3 China 21. 4 4 47 Columbia 14.2 5 5 4 POET Hong Kong . China 40.4 Indie 12 Indonesla 1. 1 2TO 5 2.0 1. 21 |STEEL 2 2. 3 197 PI . D 20. 13 JAMIAT 5. 4 Malaysia 1 . 2 23.0 1. 20 4. 5 NEW ZEALAND FE Philippines 1.25 1 . 25 SINCENOTE 15. 15 South Africa 0.3 TES. B South Korcz 1 1. 5 B.BY TAIWAN H`. T G.ES Thailand TURKEY" 2. 5 2.59 5.41 LISA J1. 7 5. 7 CONZOUON B. TZ VATTIATTI Source: Based on data from Consumer international, TEST`