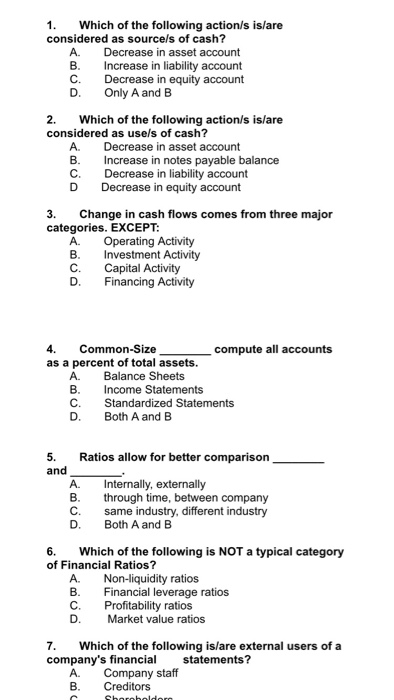

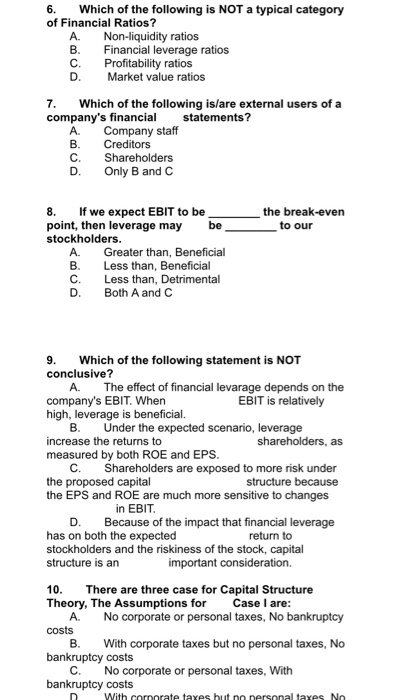

1. Which of the following action/s is/are considered as sourcels of cash? A. Decrease in asset account B. Increase in liability account c. Decrease in equity account Only A and B D. 2. Which of the following action/s is/are considered as usels of cash? A. Decrease in asset account Increase in notes payable balance C. Decrease in liability account D Decrease in equity account B. 3. Change in cash flows comes from three major categories. EXCEPT: Operating Activity Investment Activity Capital Activity D. Financing Activity 4. Common-Size compute all accounts as a percent of total assets. A Balance Sheets B. Income Statements Standardized Statements D. Both A and B C. 5. and Ratios allow for better comparison A B. Internalls Internally, externally through time, between company same industry, different industry Both A and B C. D. 6. Which of the following is NOT a typical category of Financial Ratios? A. Non-liquidity ratios B. Financial leverage ratios C. Profitability ratios D. Market value ratios 7. Which of the following is/are external users of a company's financial statements? Company staff B. Creditors Sharobaldor 6. Which of the following is NOT a typical category of Financial Ratios? A. Non-liquidity ratios B. Financial leverage ratios C. Profitability ratios D M arket value ratios 7. Which of the following is/are external users of a company's financial statements? A. Company staff Creditors C. Shareholders D. Only B and C _ the break-even to our 8. If we expect EBIT to be point, then leverage may be stockholders. A. Greater than, Beneficial B. Less than, Beneficial Less than, Detrimental D. Both A and C 9. Which of the following statement is NOT conclusive? A. The effect of financial levarage depends on the company's EBIT. When EBIT is relatively high, leverage is beneficial. B. Under the expected scenario, leverage increase the returns to shareholders, as measured by both ROE and EPS. C. Shareholders are exposed to more risk under the proposed capital structure because the EPS and ROE are much more sensitive to changes in EBIT. D. Because of the impact that financial leverage has on both the expected return to stockholders and the riskiness of the stock, capital structure is an important consideration. 10. There are three case for Capital Structure Theory, The Assumptions for Case I are: A. No corporate or personal taxes, No bankruptcy costs B. With corporate taxes but no personal taxes, No bankruptcy costs C. No corporate or personal taxes, With bankruptcy costs n With corporate taxes but no personal taxes No