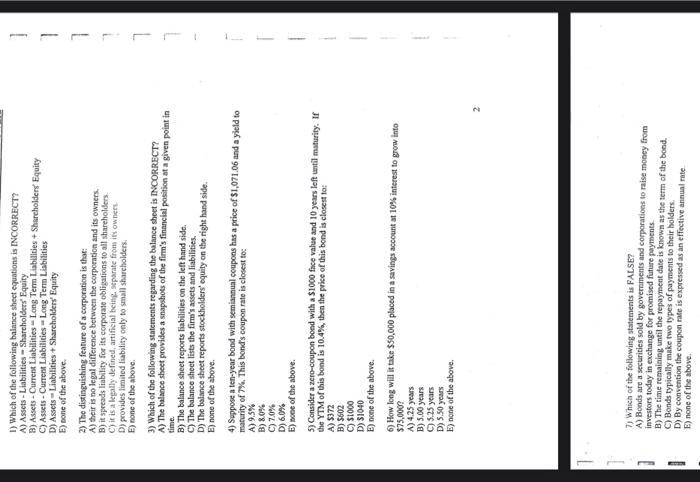

1) Which of the following balance sheet equations is INCORRECT? A) Assets - Liabilities - Sharcholders" Equity B) Assets - Current Liabilities - Long Tenn Liabilities + Shsreholders' Equity C) Assets - Current Liabilities = Long Tern Liabilities D) Assets = Liabilities + Sharcholders' Equity E) pone of the above. 2) The distinguishing feature of a eorporation is that: A) their is no legal difference betwoen the corporation and its owners. B) it spreads liability for its corporase obligations to all shareholders. C) if is a legally defined, artificial beithe, stparate from ifs ownert D) provides limited labbility only to small shareholders. E) none of the above. 3) Which of the following statements regarding the balance sheet is DNOORRECT? A) The balance sbeet provides a snapshots of the flrm's financial position at a given point in time. B) The balance sheet reports liabilities on the left hand side. C) The balance sheet lists the firr's arsets and liabilities. D) The balance sheet reports stockholders' equity on the right hand side. E) none of the above. 4) Suppose a ten-year bood with semiannual soupons has a price of $1,071.06 and a yield to maturity of 7%. This bond's coupon rate is closest to: A) 9.5% B) 8.0% C) 7.0% D) 6.0% E) toon of the above. 5) Consider a zero-coupon boed with a $1000 foce value and 10 years left wetil maturity. If the YTM of this bond is 10.4%, then the price of this bond is closest to: A) 5372 B) 5602 C) 51000 D) $1040 E) none of the above. 6) How long will it take $50,000 placed in a savings account at 10% interest to grow into $75.0009 A) 4.25 years B) 5.00 years C) 5.25 years D) 5.50 years E) none of the above. 2 7) Whica of the following statements is FALSE? A) Bonds are a secturities sold by govermments and corporations to raise money from investors today in exchange for promisod futture payments. B) The time remaiaing until the repayment date is known as the term of the bood. C) Bonds typically make two types of payments to their bolders. D) By convention the coupon nate is expressed as an eiffective annual rate. E) none of the above