Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Which of the following is not a CPP benefit? a. Retirement pension b. Survivor benefit c. Death benefit d. Allowance for survivor 2. Demi

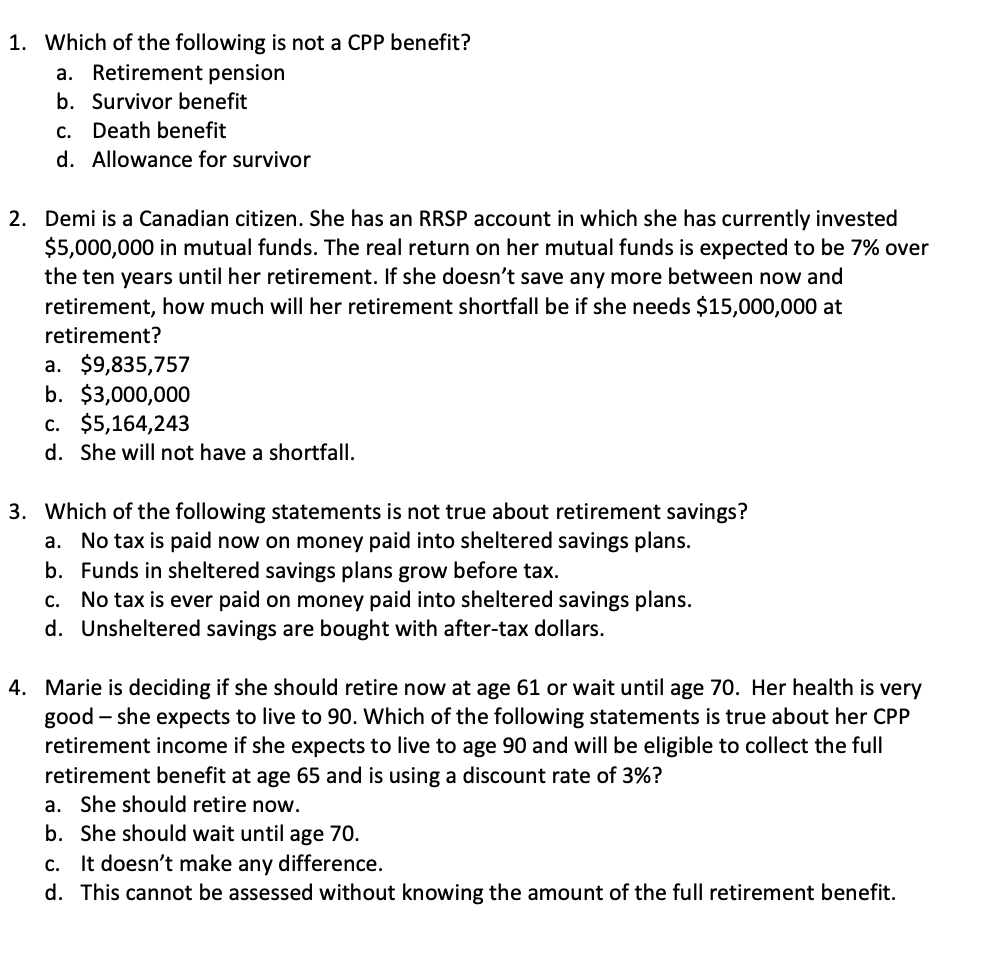

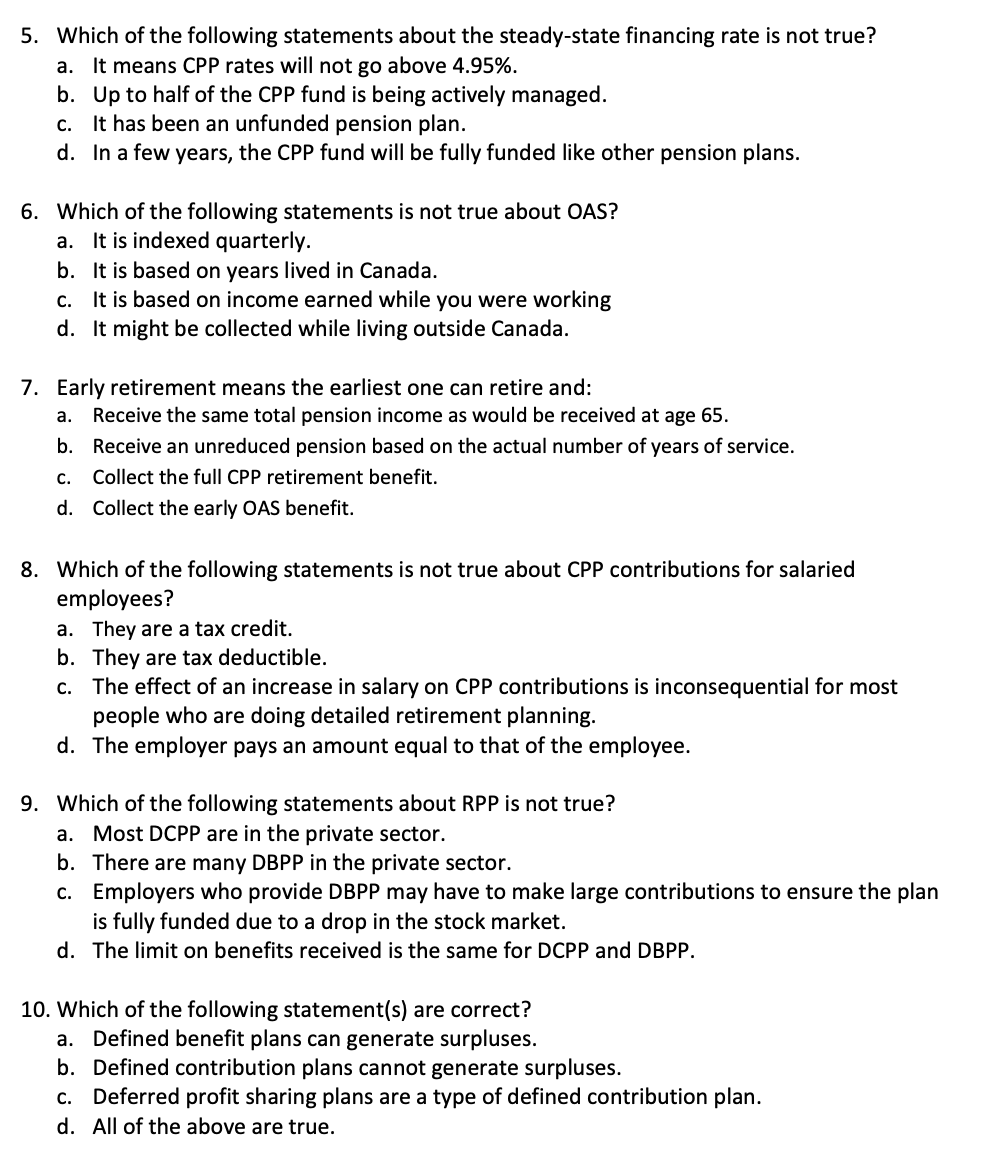

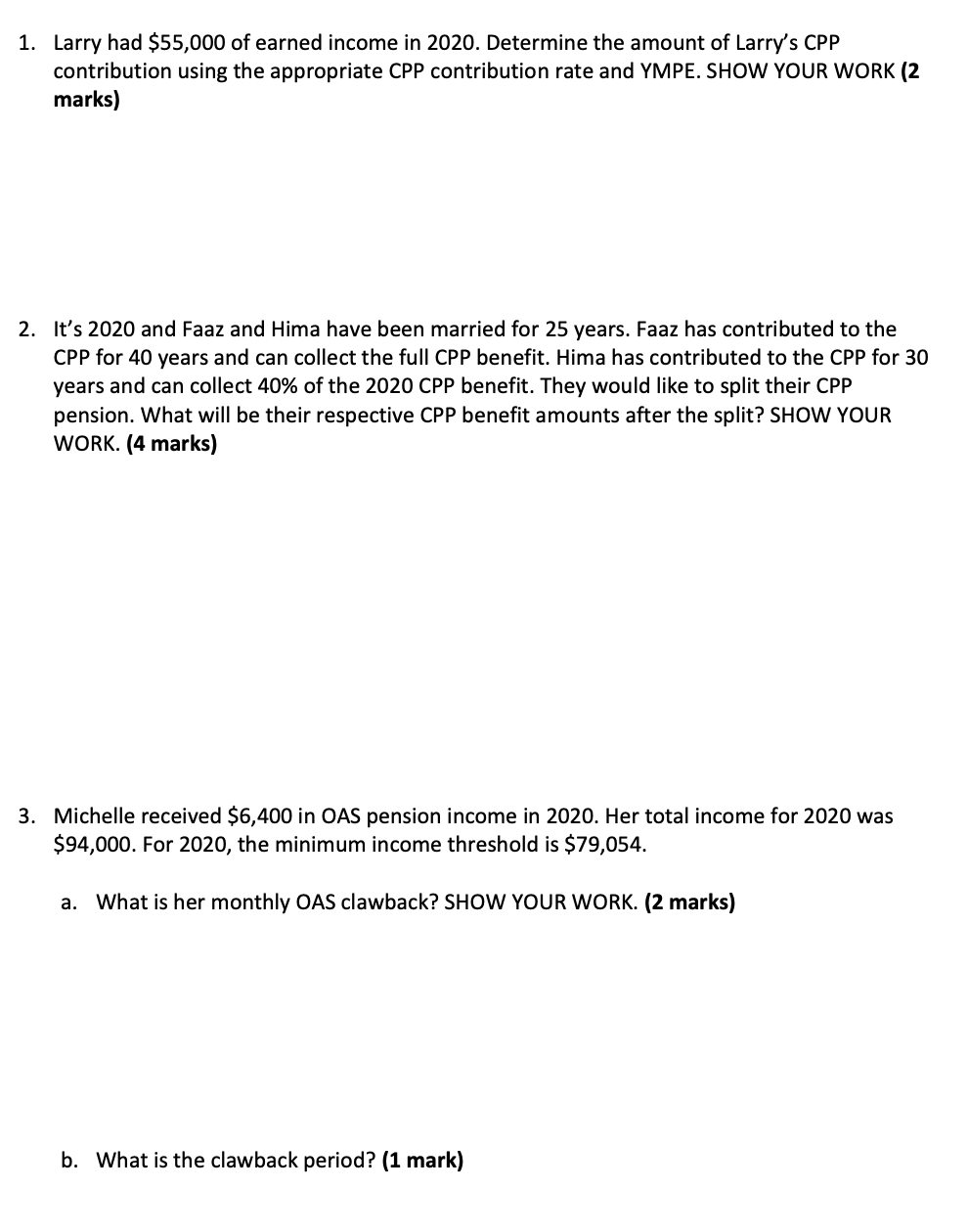

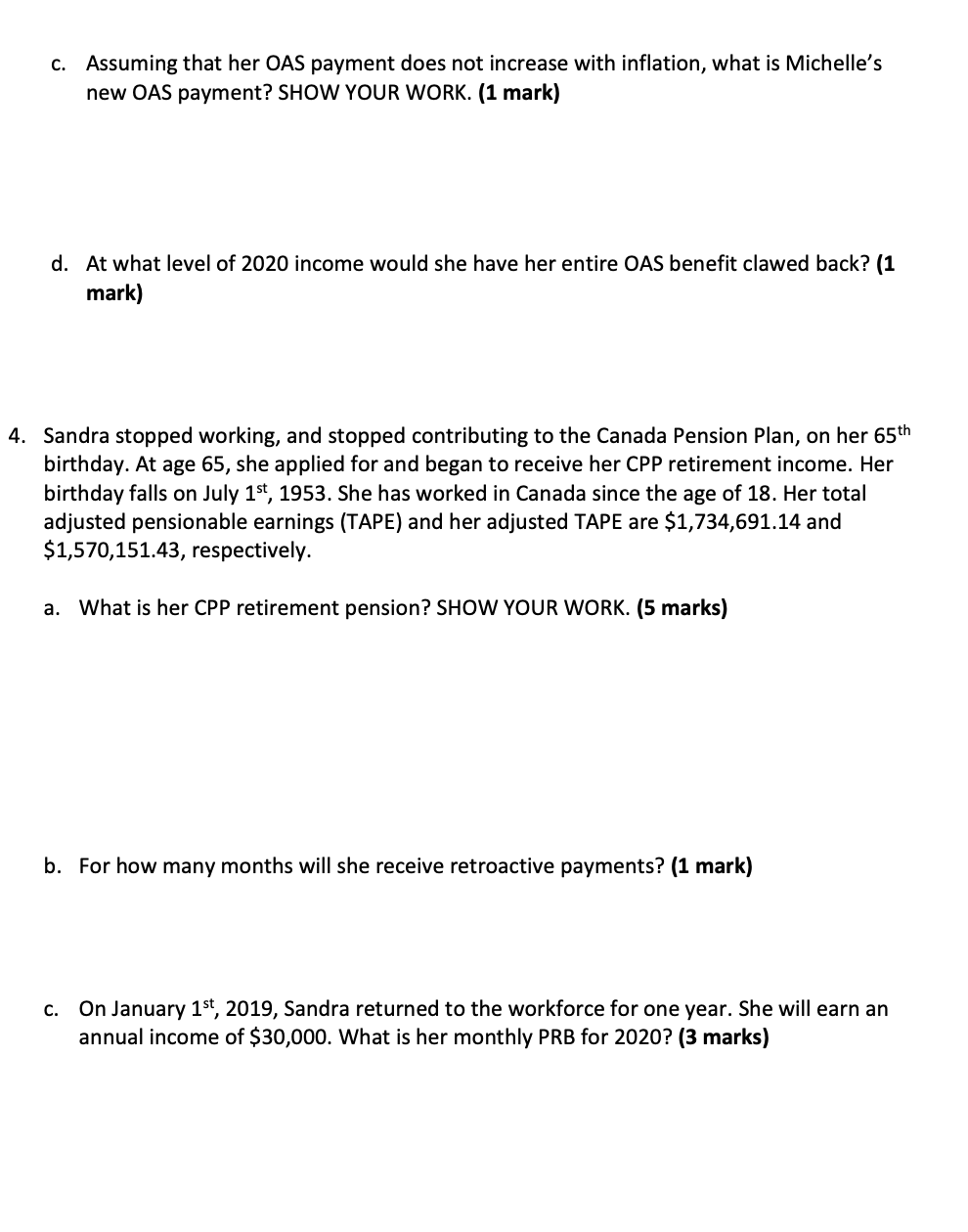

1. Which of the following is not a CPP benefit? a. Retirement pension b. Survivor benefit c. Death benefit d. Allowance for survivor 2. Demi is a Canadian citizen. She has an RRSP account in which she has currently invested $5,000,000 in mutual funds. The real return on her mutual funds is expected to be 7% over the ten years until her retirement. If she doesn't save any more between now and retirement, how much will her retirement shortfall be if she needs $15,000,000 at retirement? a. $9,835,757 b. $3,000,000 C. $5,164,243 d. She will not have a shortfall. 3. Which of the following statements is not true about retirement savings? a. No tax is paid now on money paid into sheltered savings plans. b. Funds in sheltered savings plans grow before tax. C. No tax is ever paid on money paid into sheltered savings plans. d. Unsheltered savings are bought with after-tax dollars. 4. Marie is deciding if she should retire now at age 61 or wait until age 70. Her health is very good - she expects to live to 90. Which of the following statements is true about her CPP retirement income if she expects to live to age 90 and will be eligible to collect the full retirement benefit at age 65 and is using a discount rate of 3%? a. She should retire now. b. She should wait until age 70. It doesn't make any difference. d. This cannot be assessed without knowing the amount of the full retirement benefit. C. 5. Which of the following statements about the steady-state financing rate is not true? a. It means CPP rates will not go above 4.95%. b. Up to half of the CPP fund is being actively managed. c. It has been an unfunded pension plan. d. In a few years, the CPP fund will be fully funded like other pension plans. 6. Which of the following statements is not true about OAS? a. It is indexed quarterly. b. It is based on years lived in Canada. C. It is based on income earned while you were working d. It might be collected while living outside Canada. 7. Early retirement means the earliest one can retire and: a. Receive the same total pension income as would be received at age 65. b. Receive an unreduced pension based on the actual number of years of service. C. Collect the full CPP retirement benefit. d. Collect the early OAS benefit. 8. Which of the following statements is not true about CPP contributions for salaried employees? a. They are a tax credit. b. They are tax deductible. C. The effect of an increase in salary on CPP contributions is inconsequential for most people who are doing detailed retirement planning. d. The employer pays an amount equal to that of the employee. 9. Which of the following statements about RPP is not true? a. Most DCPP are in the private sector. b. There are many DBPP in the private sector. C. Employers who provide DBPP may have to make large contributions to ensure the plan is fully funded due to a drop in the stock market. d. The limit on benefits received is the same for DCPP and DBPP. 10. Which of the following statement(s) are correct? a. Defined benefit plans can generate surpluses. b. Defined contribution plans cannot generate surpluses. C. Deferred profit sharing plans are a type of defined contribution plan. d. All of the above are true. 11. Which of the following statements is not true? a. The maximum possible retirement benefit from a DBPP depends on the maximum allowable years of service. b. The maximum possible retirement benefit from a DCPP is the same as for a DBPP. c. There is no maximum benefit for DCPP. d. If a retiree dies, the spouse can receive some of the retiree's pension benefits. 12. Henry's company provides him with a defined contribution pension plan. The maximum amount of pension he can receive for each year of service is: a. 2% p.a. times his YMPE b. 2% p.a. times his pensionable earnings c. $1,722.22 d. There is no maximum 13. Which of the following is not true? a. Before age 65, an employee must have actually retired to receive a pension. b. After age 65, an employee can receive both a pension and earned income from the same company. C. A person who is collecting a pension can still make contributions to the plan to increase future benefits. d. A person age 73 who is still working cannot make contributions to a RPP. 14. For a defined benefit pension plan, all of the following are true except: a. Benefits might increase each year to reflect inflation. b. Benefits might be integrated with CPP retirement income. Benefits must end when the retiree dies. d. A common-law spouse can receive benefits after the retiree dies. C. 15. Normal retirement age means: a. An employee cannot retire with a full pension before age 60. b. The age at which an employee can received the full amount for each year of service. C. Age 65. d. There is no minimum number of years of service. 1. Larry had $55,000 of earned income in 2020. Determine the amount of Larry's CPP contribution using the appropriate CPP contribution rate and YMPE. SHOW YOUR WORK (2 marks) 2. It's 2020 and Faaz and Hima have been married for 25 years. Faaz has contributed to the CPP for 40 years and can collect the full CPP benefit. Hima has contributed to the CPP for 30 years and can collect 40% of the 2020 CPP benefit. They would like to split their CPP pension. What will be their respective CPP benefit amounts after the split? SHOW YOUR WORK. (4 marks) 3. Michelle received $6,400 in OAS pension income in 2020. Her total income for 2020 was $94,000. For 2020, the minimum income threshold is $79,054. a. What is her monthly OAS clawback? SHOW YOUR WORK. (2 marks) b. What is the clawback period? (1 mark) C. Assuming that her OAS payment does not increase with inflation, what is Michelle's new OAS payment? SHOW YOUR WORK. (1 mark) d. At what level of 2020 income would she have her entire OAS benefit clawed back? (1 mark) 4. Sandra stopped working, and stopped contributing to the Canada Pension Plan, on her 65th birthday. At age 65, she applied for and began to receive her CPP retirement income. Her birthday falls on July 1st, 1953. She has worked in Canada since the age of 18. Her total adjusted pensionable earnings (TAPE) and her adjusted TAPE are $1,734,691.14 and $1,570,151.43, respectively. a. What is her CPP retirement pension? SHOW YOUR WORK. (5 marks) b. For how many months will she receive retroactive payments? (1 mark) c. On January 1st, 2019, Sandra returned to the workforce for one year. She will earn an annual income of $30,000. What is her monthly PRB for 2020? (3 marks) 5. In 2020, Iris and her employer each contributed $4,000 to her DBPP which will pay her a pension of 1.5% for every year of service based on the three years of income. Her salary for 2020 was $72,000 and the three best years average $71,000. a. What is Iris's pension adjustment for 2020? Calculate the benefit earned using all 3 methods described in class. SHOW ALL YOUR WORK. (3 marks) b. How much can she contribute to her RRSP in 2021? (2 marks) C. If she began collecting her pension in 2021, how much would it be if she had 33 years of service? (1 mark) 6. Wally is a member of a contributory DCPP to which Wally and his employer each contribute 6% of his salary each year. Wally made $70,000 in 2020. What is the maximum Wally's company can contribute to a DPSP for Wally in 2020? SHOW ALL YOUR WORK. (2 marks) 1. Which of the following is not a CPP benefit? a. Retirement pension b. Survivor benefit c. Death benefit d. Allowance for survivor 2. Demi is a Canadian citizen. She has an RRSP account in which she has currently invested $5,000,000 in mutual funds. The real return on her mutual funds is expected to be 7% over the ten years until her retirement. If she doesn't save any more between now and retirement, how much will her retirement shortfall be if she needs $15,000,000 at retirement? a. $9,835,757 b. $3,000,000 C. $5,164,243 d. She will not have a shortfall. 3. Which of the following statements is not true about retirement savings? a. No tax is paid now on money paid into sheltered savings plans. b. Funds in sheltered savings plans grow before tax. C. No tax is ever paid on money paid into sheltered savings plans. d. Unsheltered savings are bought with after-tax dollars. 4. Marie is deciding if she should retire now at age 61 or wait until age 70. Her health is very good - she expects to live to 90. Which of the following statements is true about her CPP retirement income if she expects to live to age 90 and will be eligible to collect the full retirement benefit at age 65 and is using a discount rate of 3%? a. She should retire now. b. She should wait until age 70. It doesn't make any difference. d. This cannot be assessed without knowing the amount of the full retirement benefit. C. 5. Which of the following statements about the steady-state financing rate is not true? a. It means CPP rates will not go above 4.95%. b. Up to half of the CPP fund is being actively managed. c. It has been an unfunded pension plan. d. In a few years, the CPP fund will be fully funded like other pension plans. 6. Which of the following statements is not true about OAS? a. It is indexed quarterly. b. It is based on years lived in Canada. C. It is based on income earned while you were working d. It might be collected while living outside Canada. 7. Early retirement means the earliest one can retire and: a. Receive the same total pension income as would be received at age 65. b. Receive an unreduced pension based on the actual number of years of service. C. Collect the full CPP retirement benefit. d. Collect the early OAS benefit. 8. Which of the following statements is not true about CPP contributions for salaried employees? a. They are a tax credit. b. They are tax deductible. C. The effect of an increase in salary on CPP contributions is inconsequential for most people who are doing detailed retirement planning. d. The employer pays an amount equal to that of the employee. 9. Which of the following statements about RPP is not true? a. Most DCPP are in the private sector. b. There are many DBPP in the private sector. C. Employers who provide DBPP may have to make large contributions to ensure the plan is fully funded due to a drop in the stock market. d. The limit on benefits received is the same for DCPP and DBPP. 10. Which of the following statement(s) are correct? a. Defined benefit plans can generate surpluses. b. Defined contribution plans cannot generate surpluses. C. Deferred profit sharing plans are a type of defined contribution plan. d. All of the above are true. 11. Which of the following statements is not true? a. The maximum possible retirement benefit from a DBPP depends on the maximum allowable years of service. b. The maximum possible retirement benefit from a DCPP is the same as for a DBPP. c. There is no maximum benefit for DCPP. d. If a retiree dies, the spouse can receive some of the retiree's pension benefits. 12. Henry's company provides him with a defined contribution pension plan. The maximum amount of pension he can receive for each year of service is: a. 2% p.a. times his YMPE b. 2% p.a. times his pensionable earnings c. $1,722.22 d. There is no maximum 13. Which of the following is not true? a. Before age 65, an employee must have actually retired to receive a pension. b. After age 65, an employee can receive both a pension and earned income from the same company. C. A person who is collecting a pension can still make contributions to the plan to increase future benefits. d. A person age 73 who is still working cannot make contributions to a RPP. 14. For a defined benefit pension plan, all of the following are true except: a. Benefits might increase each year to reflect inflation. b. Benefits might be integrated with CPP retirement income. Benefits must end when the retiree dies. d. A common-law spouse can receive benefits after the retiree dies. C. 15. Normal retirement age means: a. An employee cannot retire with a full pension before age 60. b. The age at which an employee can received the full amount for each year of service. C. Age 65. d. There is no minimum number of years of service. 1. Larry had $55,000 of earned income in 2020. Determine the amount of Larry's CPP contribution using the appropriate CPP contribution rate and YMPE. SHOW YOUR WORK (2 marks) 2. It's 2020 and Faaz and Hima have been married for 25 years. Faaz has contributed to the CPP for 40 years and can collect the full CPP benefit. Hima has contributed to the CPP for 30 years and can collect 40% of the 2020 CPP benefit. They would like to split their CPP pension. What will be their respective CPP benefit amounts after the split? SHOW YOUR WORK. (4 marks) 3. Michelle received $6,400 in OAS pension income in 2020. Her total income for 2020 was $94,000. For 2020, the minimum income threshold is $79,054. a. What is her monthly OAS clawback? SHOW YOUR WORK. (2 marks) b. What is the clawback period? (1 mark) C. Assuming that her OAS payment does not increase with inflation, what is Michelle's new OAS payment? SHOW YOUR WORK. (1 mark) d. At what level of 2020 income would she have her entire OAS benefit clawed back? (1 mark) 4. Sandra stopped working, and stopped contributing to the Canada Pension Plan, on her 65th birthday. At age 65, she applied for and began to receive her CPP retirement income. Her birthday falls on July 1st, 1953. She has worked in Canada since the age of 18. Her total adjusted pensionable earnings (TAPE) and her adjusted TAPE are $1,734,691.14 and $1,570,151.43, respectively. a. What is her CPP retirement pension? SHOW YOUR WORK. (5 marks) b. For how many months will she receive retroactive payments? (1 mark) c. On January 1st, 2019, Sandra returned to the workforce for one year. She will earn an annual income of $30,000. What is her monthly PRB for 2020? (3 marks) 5. In 2020, Iris and her employer each contributed $4,000 to her DBPP which will pay her a pension of 1.5% for every year of service based on the three years of income. Her salary for 2020 was $72,000 and the three best years average $71,000. a. What is Iris's pension adjustment for 2020? Calculate the benefit earned using all 3 methods described in class. SHOW ALL YOUR WORK. (3 marks) b. How much can she contribute to her RRSP in 2021? (2 marks) C. If she began collecting her pension in 2021, how much would it be if she had 33 years of service? (1 mark) 6. Wally is a member of a contributory DCPP to which Wally and his employer each contribute 6% of his salary each year. Wally made $70,000 in 2020. What is the maximum Wally's company can contribute to a DPSP for Wally in 2020? SHOW ALL YOUR WORK. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started