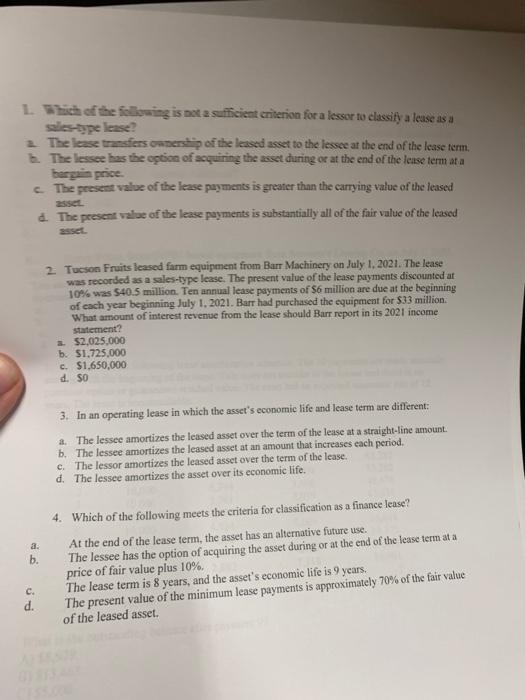

1. Which of the following is not a sufficient criterion for a lessor to classify a leuse as a sales-type lease? 2. The lease transfers ownership of the leased asset to the lessee at the end of the lease term. The lessee has the option of acquiring the asset during or at the end of the lease term at a bargain price c. The present value of the lease payments is greater than the carrying value of the leased d. The present value of the lease payments is substantially all of the fair value of the leased 2 Tucson Fruits leased farm equipment from Barr Machinery on July 1, 2021. The lease was recorded as a sales-type lease. The present value of the lease payments discounted at 10% was $40.5 million. Ten annual lease payments of $6 million are due at the beginning of each year beginning July 1, 2021. Barr had purchased the equipment for $33 million What amount of interest revenue from the lease should Barr report in its 2021 income statement? $2,025.000 b. 51.725,000 c. $1.650.000 d. So 3. In an operating lease in which the asset's economic life and lease term are different: a. The lessee amortizes the leased asset over the term of the lease at a straight-line amount b. The lessee amortizes the leased asset at an amount that increases cach period, c. The lessor amortizes the leased asset over the term of the lease. d. The lessee amortizes the asset over its economic life. a. b. 4. Which of the following meets the criteria for classification as a finance lease? At the end of the lease term, the asset has an alternative future use. The lessee has the option of acquiring the asset during or at the end of the lease term at a price of fair value plus 10% The lease term is 8 years, and the asset's economic life is 9 years. The present value of the minimum lease payments is approximately 70% of the fair value of the leased asset. C. d. 1. Which of the following is not a sufficient criterion for a lessor to classify a lease as a sales-type lease? a. The lease transfers ownership of the leased asset to the lessee at the end of the lease term. b. The lessee has the option of acquiring the asset during or at the end of the lease term at a bargain price c. The present value of the lease payments is greater than the carrying value of the leased d. The present value of the lease payments is substantially all of the fair value of the leased asset. asset 2. Tucson Fruits leased farm equipment from Barr Machinery on July 1, 2021. The lease was recorded as a sales-type lease. The present value of the lease payments discounted at 10% was $40.5 million. Ten annual lease payments of S6 million are due at the beginning of each year beginning July 1, 2021. Barr had purchased the equipment for $33 million What amount of interest revenue from the lease should Barr report in its 2021 income statement? a. $2,025.000 b. $1,725,000 c. $1,650,000 d. SO 3. In an operating lease in which the asset's economic life and lease term are different: a. The lessee amortizes the leased asset over the term of the lease at a straight-line amount b. The lessee amortizes the leased asset at an amount that increases each period. c. The lessor amortizes the leased asset over the term of the lease. d. The lessee amortizes the asset over its economic life. a. b. 4. Which of the following meets the criteria for classification as a finance lease? At the end of the lease term, the asset has an alternative future use. The lessee has the option of acquiring the asset during or at the end of the lease term at a price of fair value plus 10% The lease term is 8 years, and the asset's economic life is 9 years. The present value of the minimum lease payments is approximately 70% of the fair value of the leased asset c. d