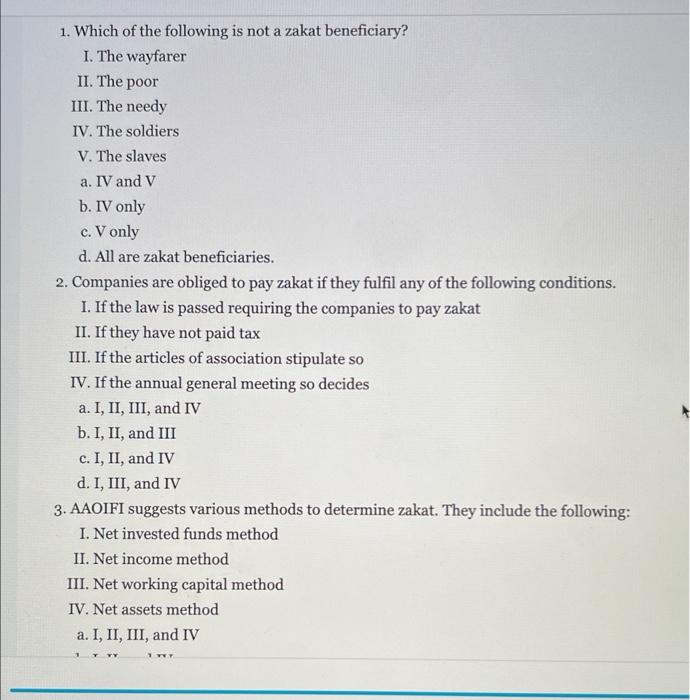

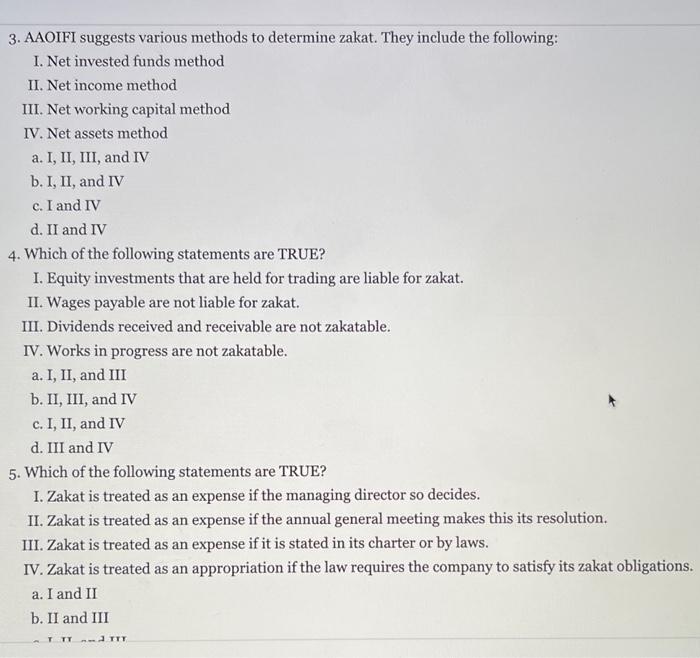

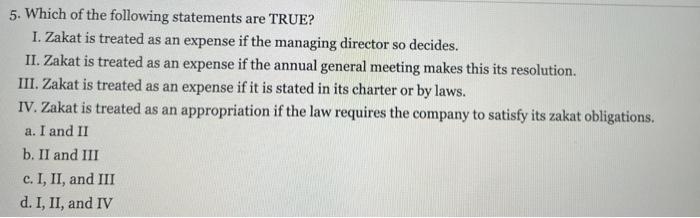

1. Which of the following is not a zakat beneficiary? I. The wayfarer II. The poor III. The needy IV. The soldiers V. The slaves a. IV and V b. IV only c. V only d. All are zakat beneficiaries. 2. Companies are obliged to pay zakat if they fulfil any of the following conditions. I. If the law is passed requiring the companies to pay zakat II. If they have not paid tax III. If the articles of association stipulate so IV. If the annual general meeting so decides a. I, II, III, and IV b. I, II, and III c. I, II, and IV d. I, III, and IV 3. AAOIFI suggests various methods to determine zakat. They include the following: I. Net invested funds method II. Net income method III. Net working capital method IV. Net assets method a. I, II, III, and IV 3. AAOIFI suggests various methods to determine zakat. They include the following: I. Net invested funds method II. Net income method III. Net working capital method IV. Net assets method a. I, II, III, and IV b. I, II, and IV c. I and IV d. II and IV 4. Which of the following statements are TRUE? I. Equity investments that are held for trading are liable for zakat. II. Wages payable are not liable for zakat. III. Dividends received and receivable are not zakatable. IV. Works in progress are not zakatable. a. I, II, and III b. II, III, and IV c. I, II, and IV d. III and IV 5. Which of the following statements are TRUE? I. Zakat is treated as an expense if the managing director so decides. II. Zakat is treated as an expense if the annual general meeting makes this its resolution. III. Zakat is treated as an expense if it is stated in its charter or by laws. IV. Zakat is treated as an appropriation if the law requires the company to satisfy its zakat obligations. a. I and II b. II and III 5. Which of the following statements are TRUE? I. Zakat is treated as an expense if the managing director so decides. II. Zakat is treated as an expense if the annual general meeting makes this its resolution. III. Zakat is treated as an expense if it is stated in its charter or by laws. IV. Zakat is treated as an appropriation if the law requires the company to satisfy its zakat obligations. a. I and II b. II and III c. I, II, and III d. I, II, and IV