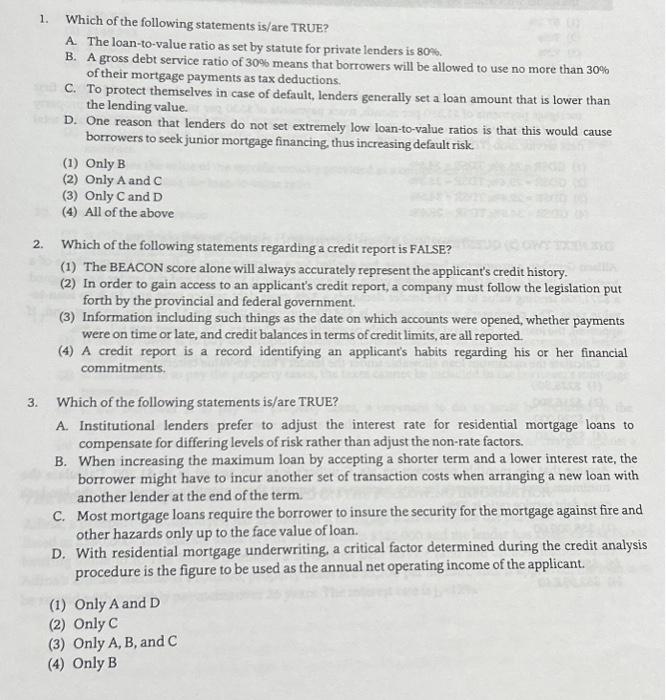

1. Which of the following statements is/are TRUE? A. The loan-to-value ratio as set by statute for private lenders is 80%. B. A gross debt service ratio of 30% means that borrowers will be allowed to use no more than 30% of their mortgage payments as tax deductions. C. To protect themselves in case of default, lenders generally set a loan amount that is lower than the lending value. D. One reason that lenders do not set extremely low loan-to-value ratios is that this would cause borrowers to seek junior mortgage financing, thus increasing default risk. (1) Only B (2) Only A and C (3) Only C and D (4) All of the above 2. Which of the following statements regarding a credit report is FALSE? (1) The BEACON score alone will always accurately represent the applicant's credit history. (2) In order to gain access to an applicant's credit report, a company must follow the legislation put forth by the provincial and federal government. (3) Information including such things as the date on which accounts were opened, whether payments were on time or late, and credit balances in terms of credit limits, are all reported. (4) A credit report is a record identifying an applicant's habits regarding his or her financial commitments. 3. Which of the following statements is/are TRUE? A. Institutional lenders prefer to adjust the interest rate for residential mortgage loans to compensate for differing levels of risk rather than adjust the non-rate factors. B. When increasing the maximum loan by accepting a shorter term and a lower interest rate, the borrower might have to incur another set of transaction costs when arranging a new loan with another lender at the end of the term. C. Most mortgage loans require the borrower to insure the security for the mortgage against fire and other hazards only up to the face value of loan. D. With residential mortgage underwriting, a critical factor determined during the credit analysis procedure is the figure to be used as the annual net operating income of the applicant. (1) Only A and D (2) Only C (3) Only A, B, and C (4) Only B