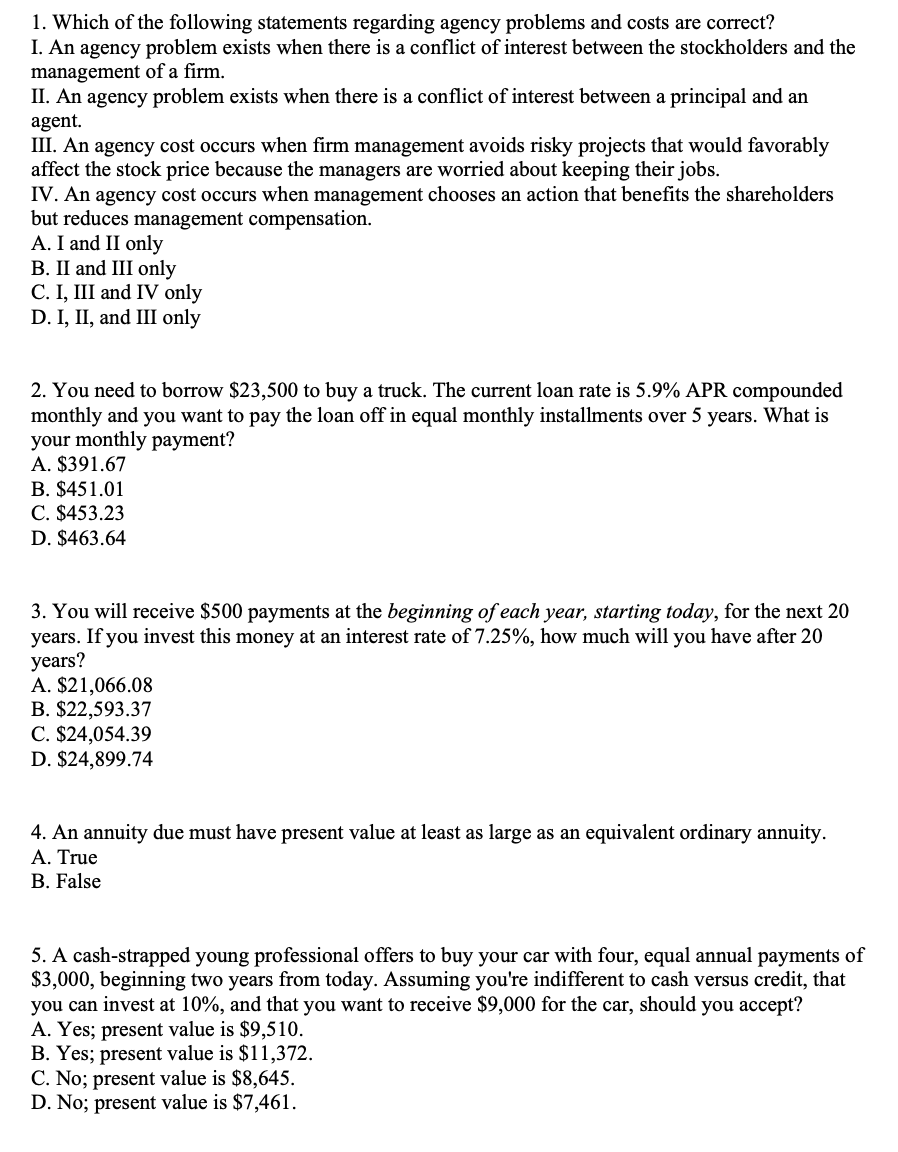

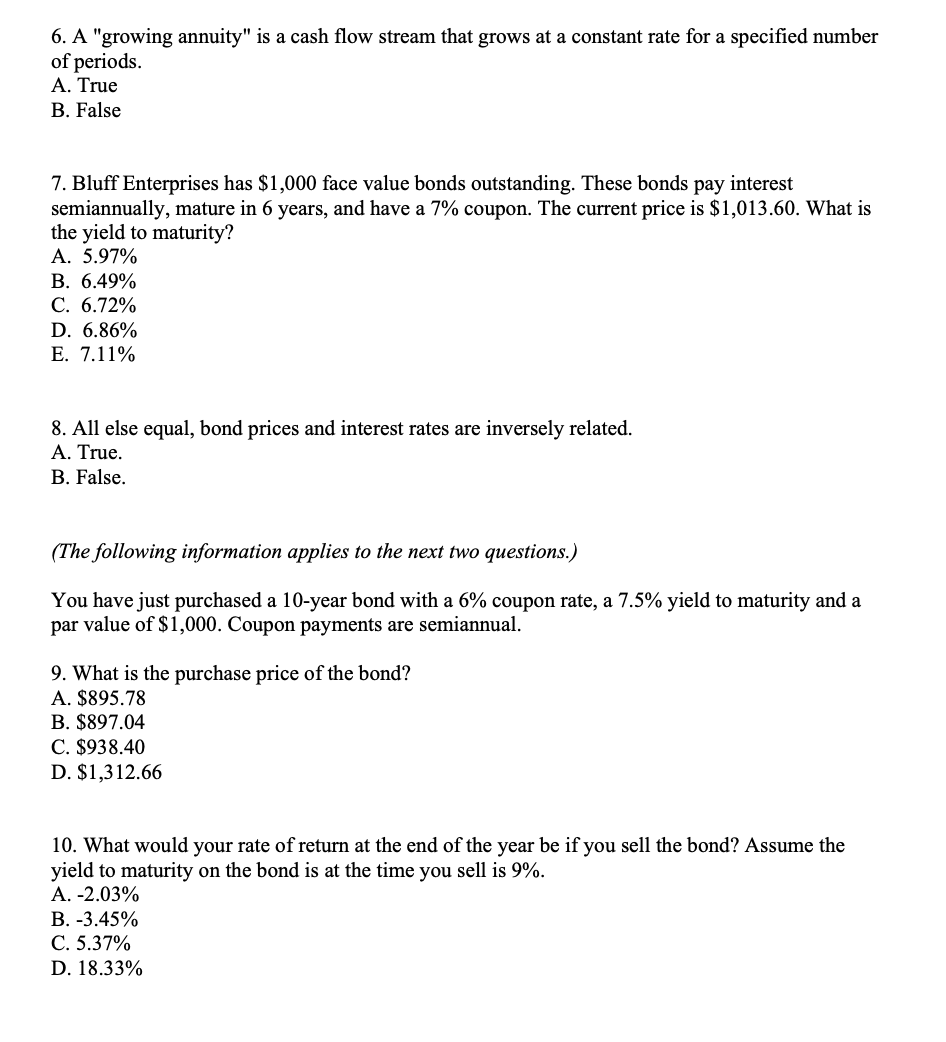

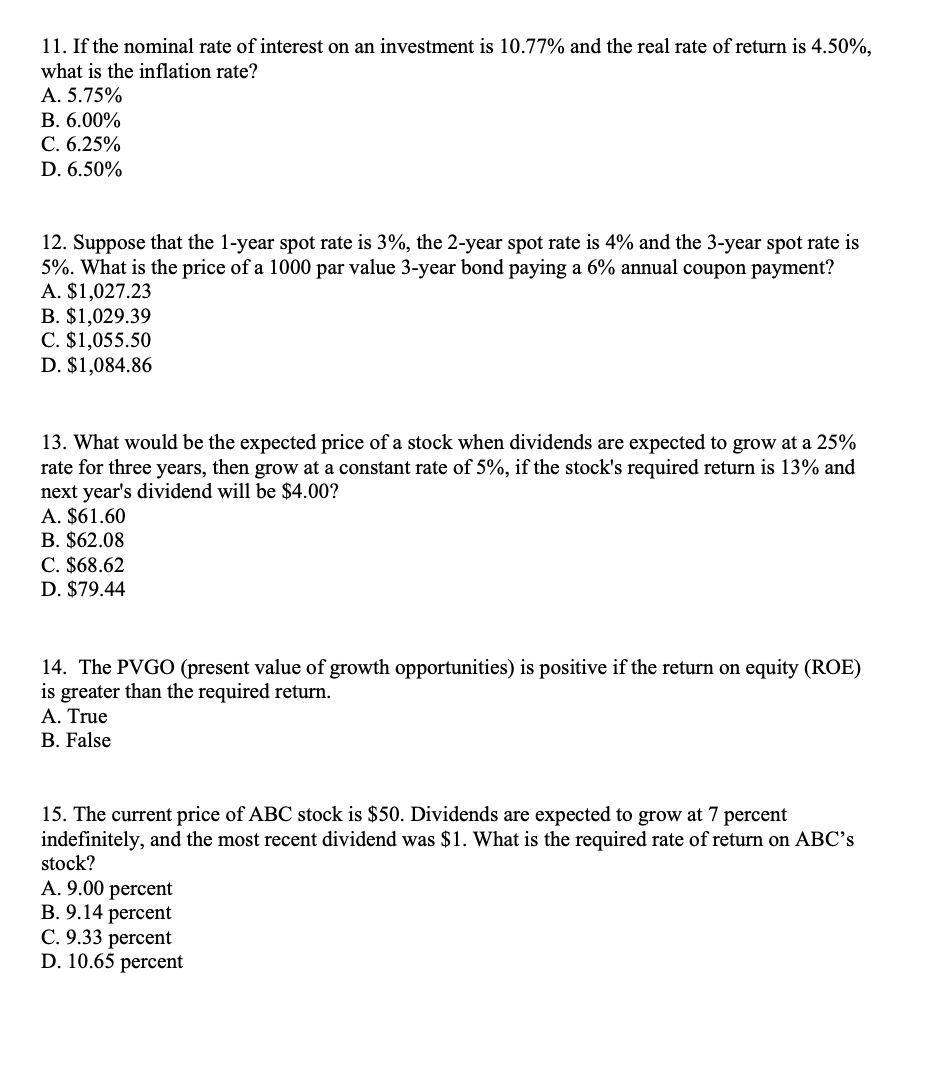

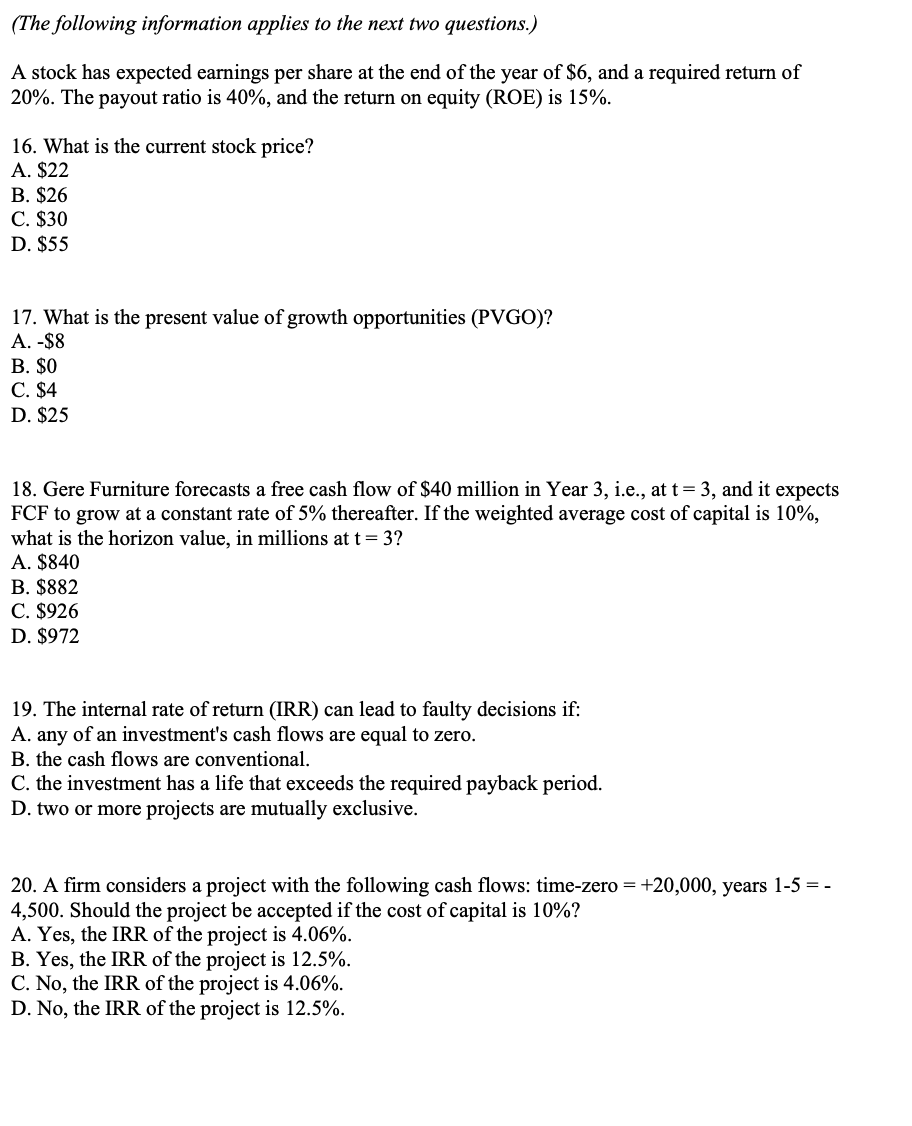

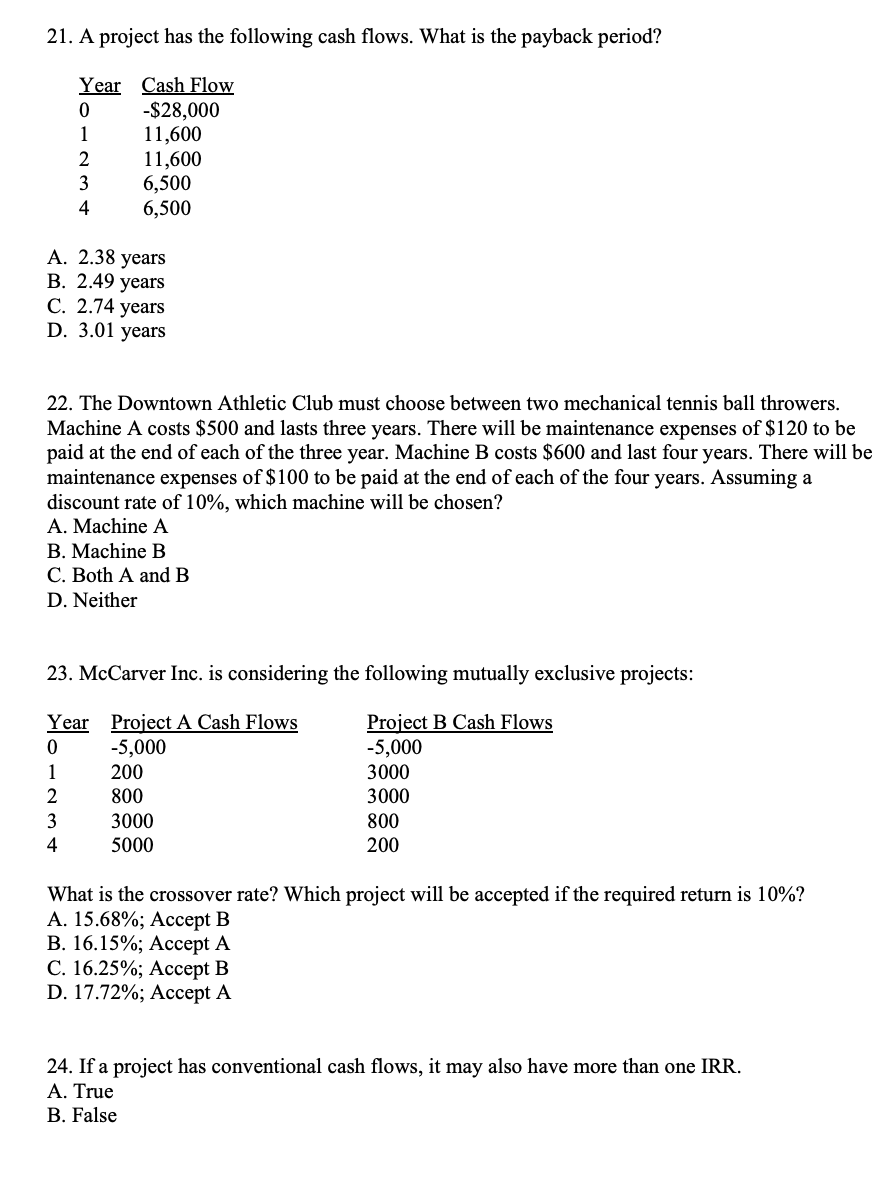

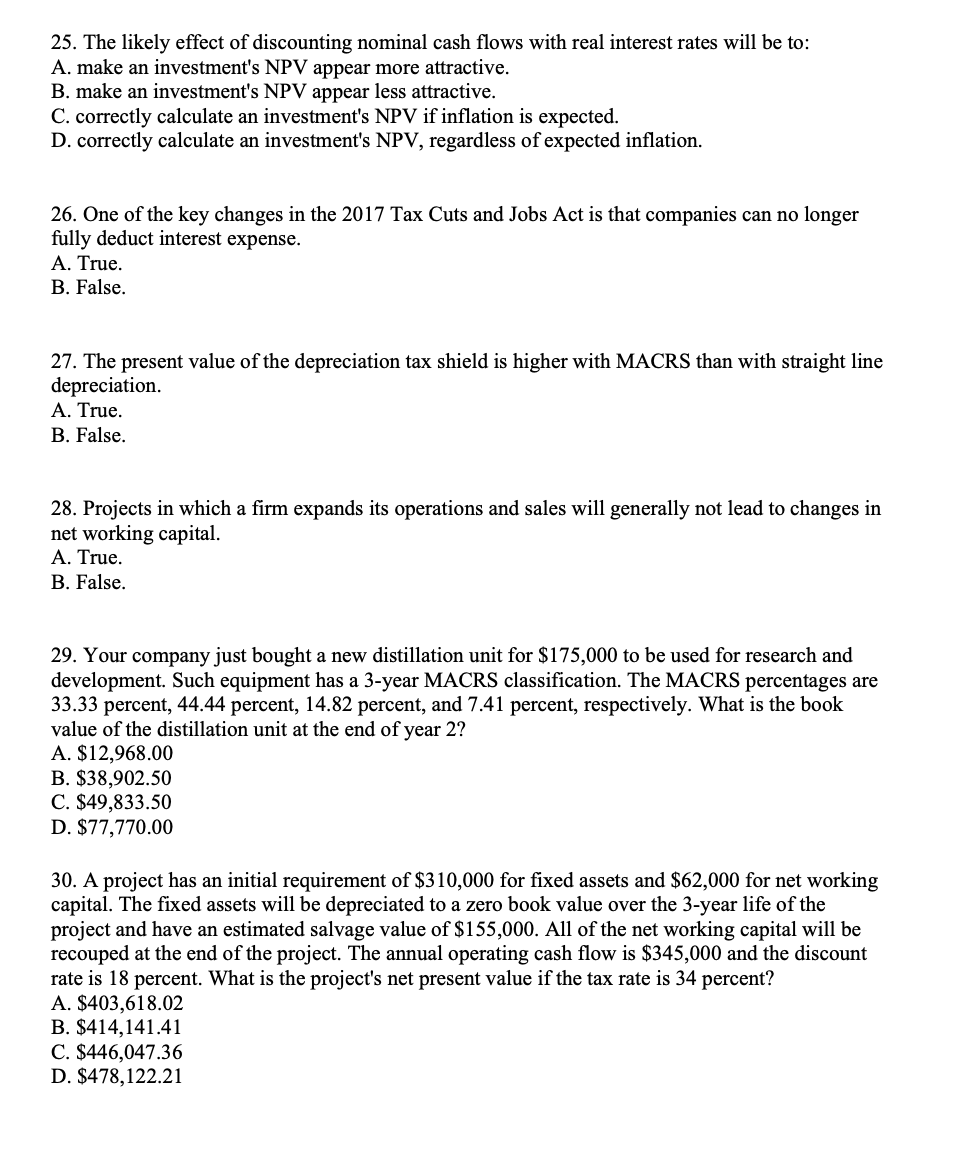

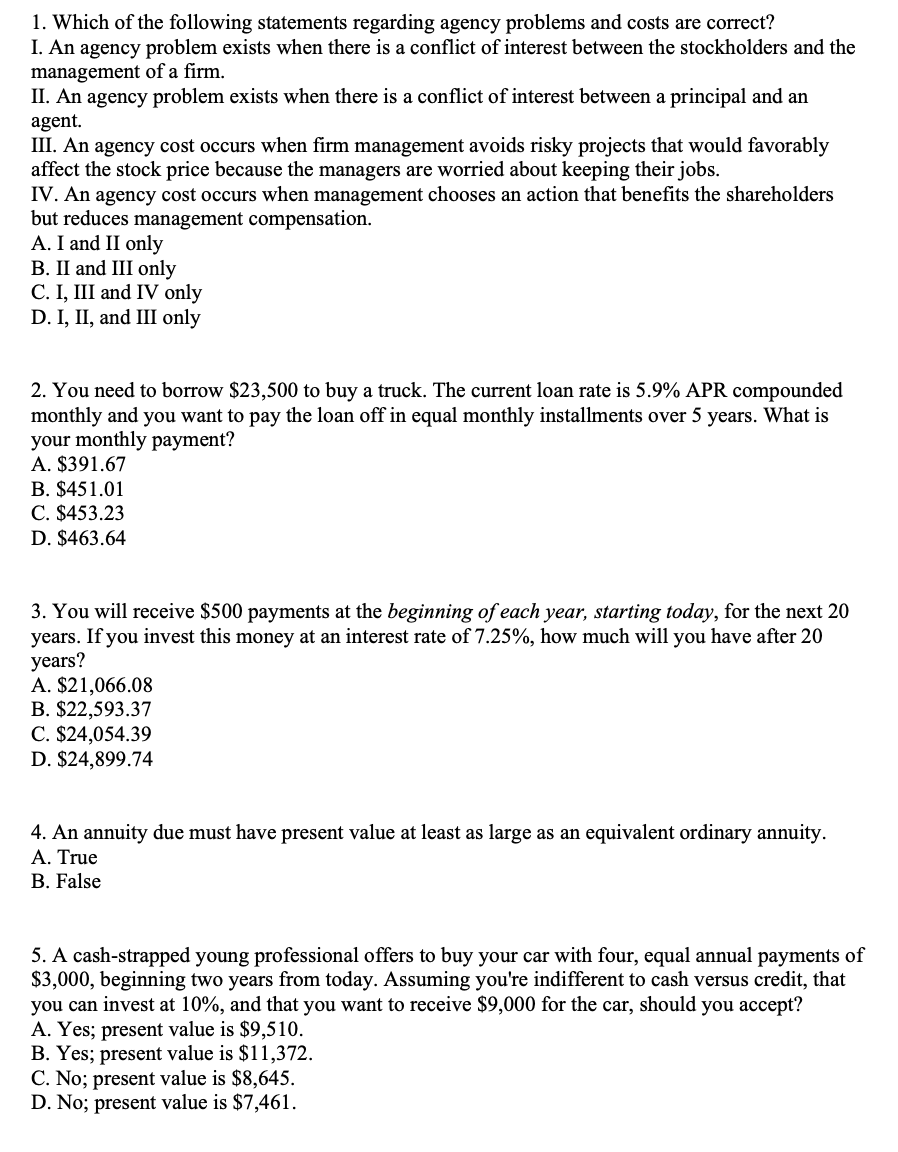

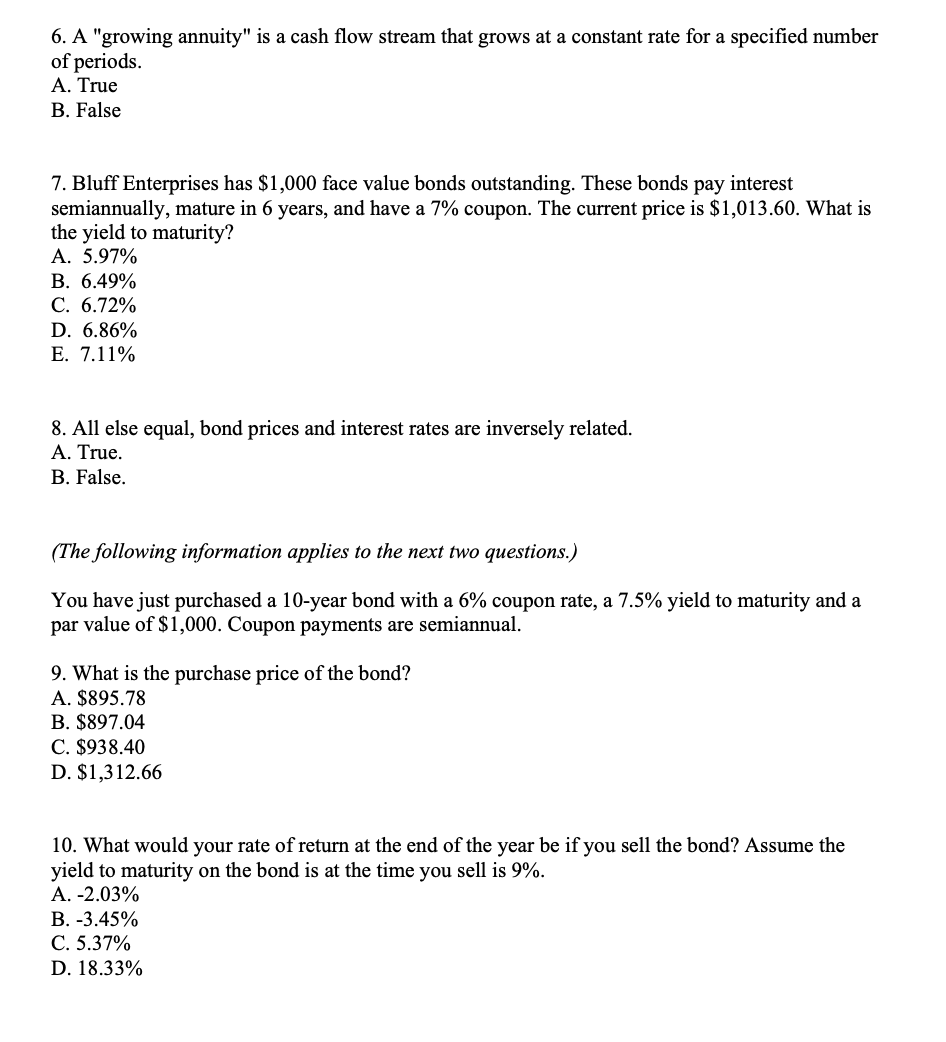

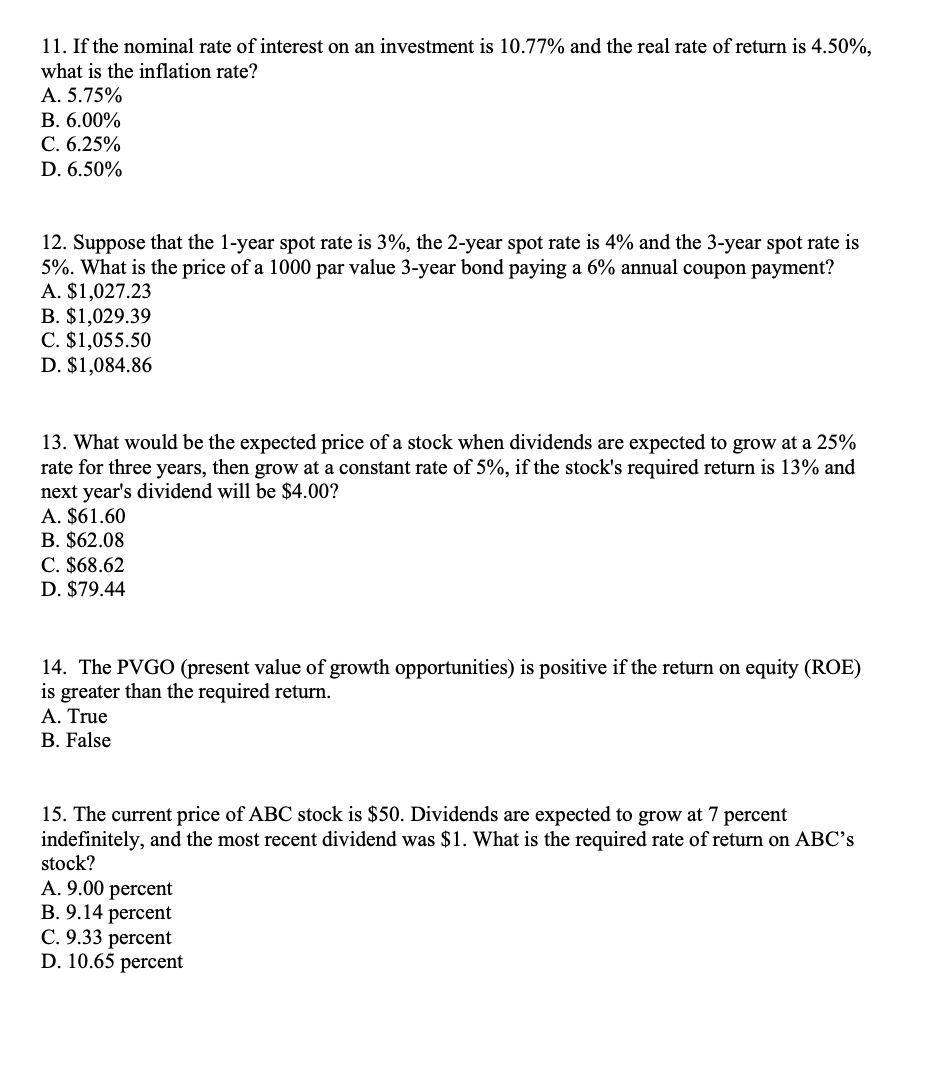

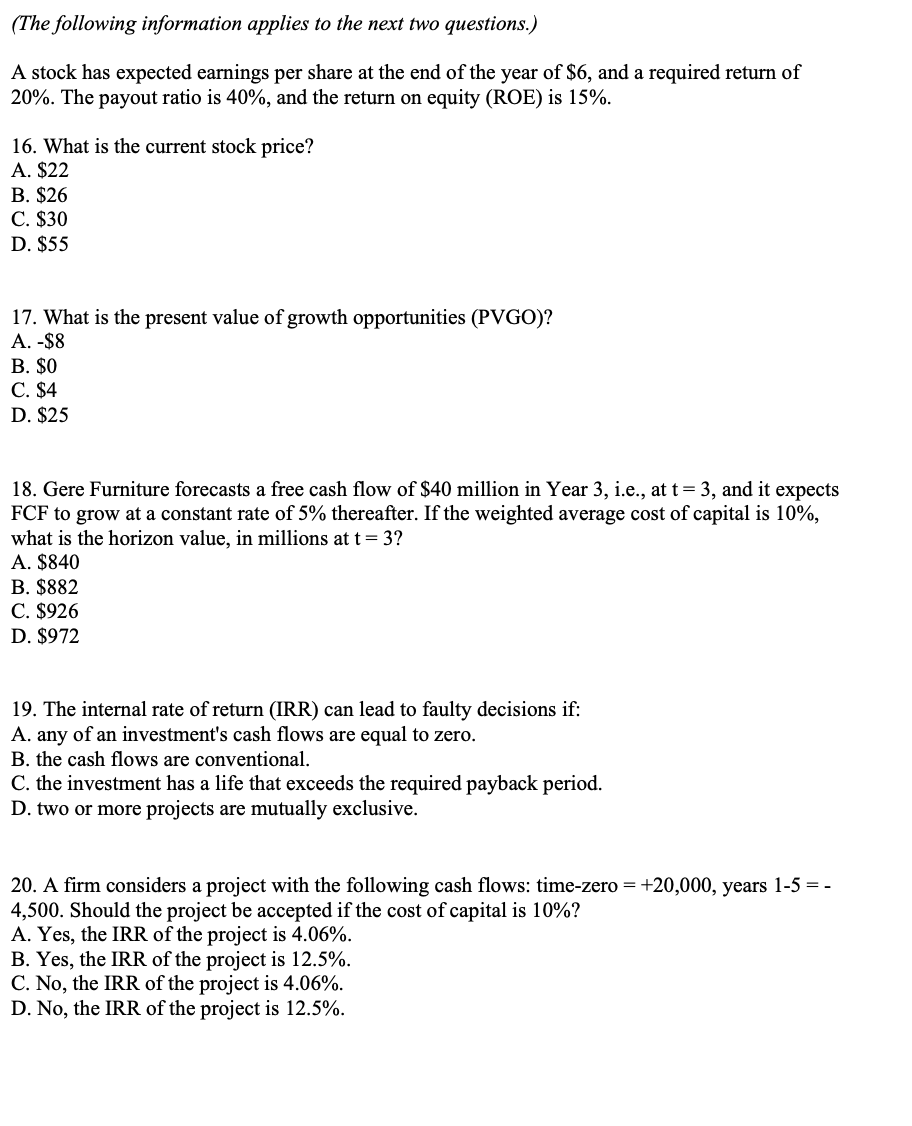

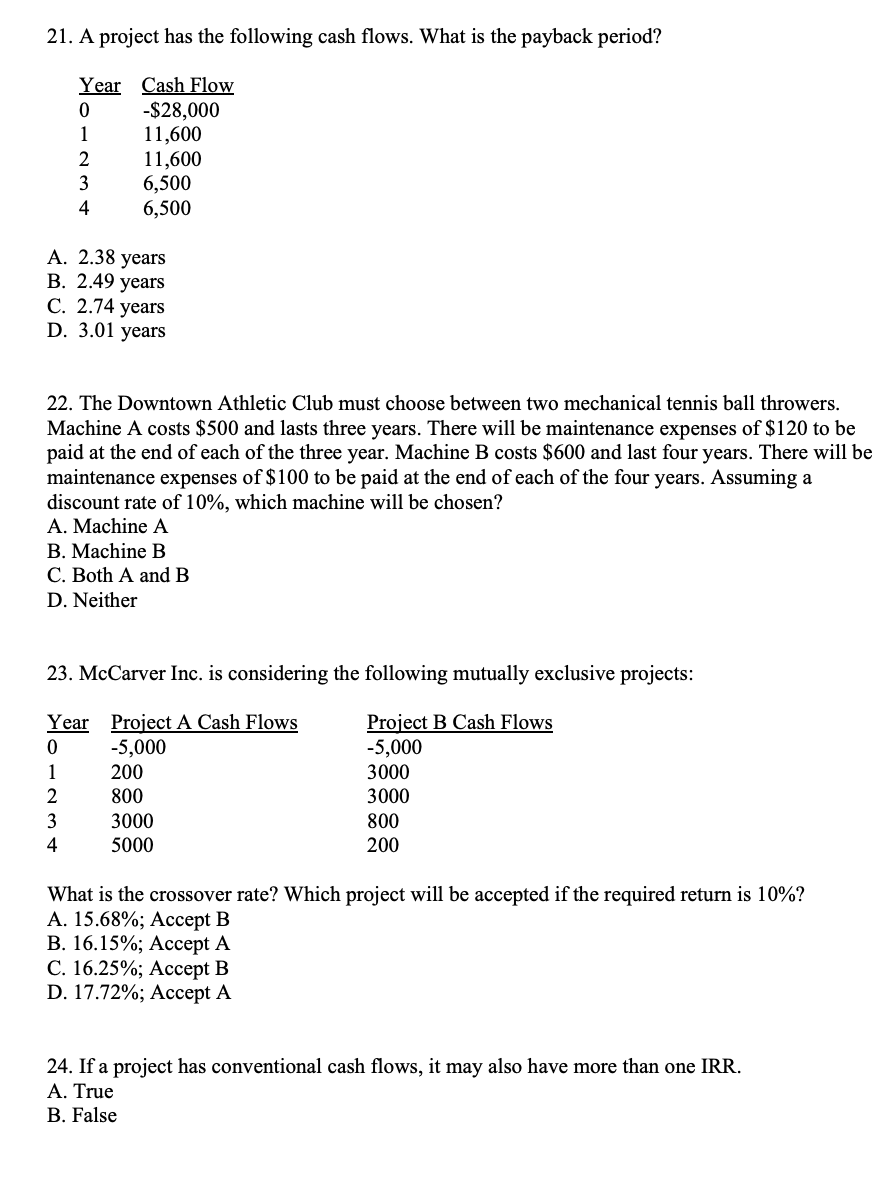

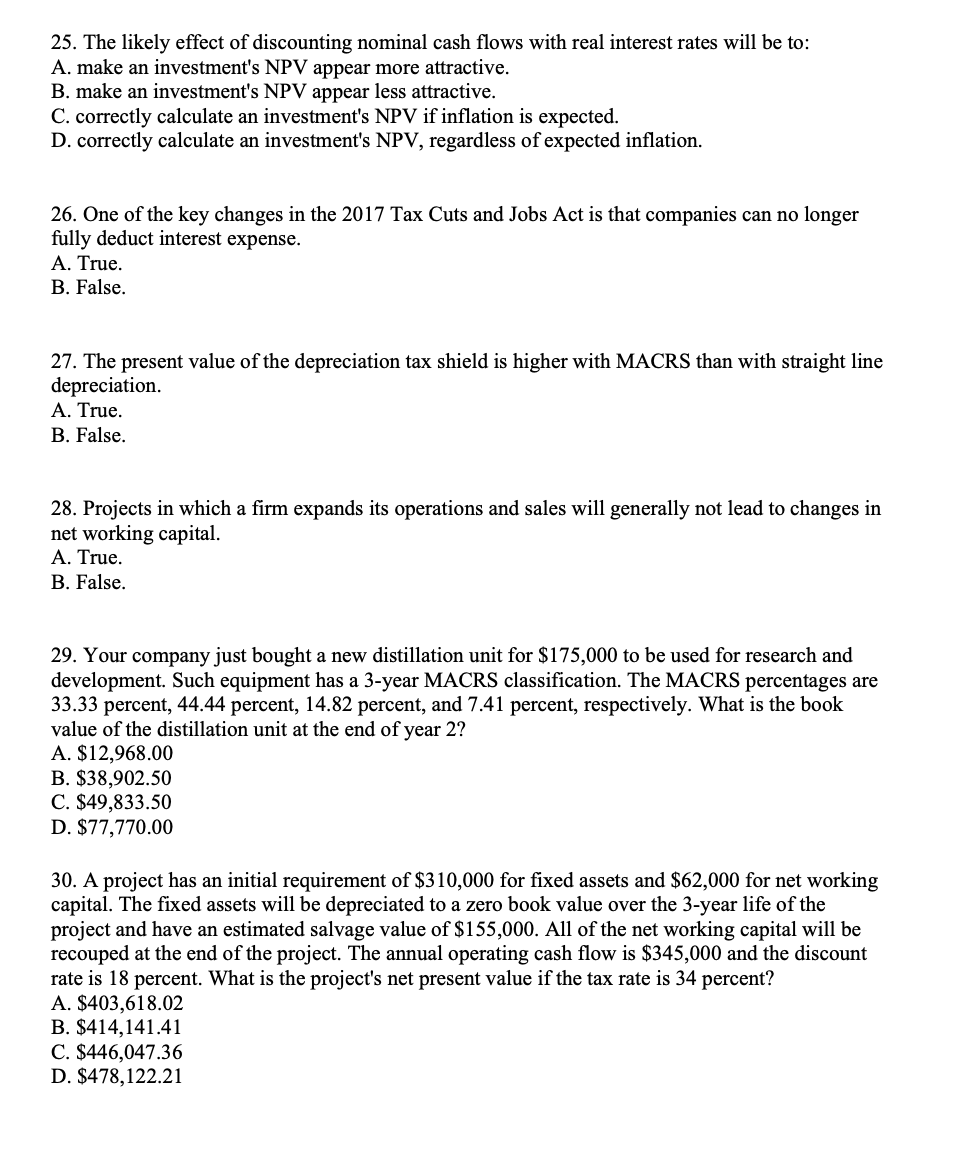

1. Which of the following statements regarding agency problems and costs are correct? I. An agency problem exists when there is a conflict of interest between the stockholders and the management of a firm. II. An agency problem exists when there is a conflict of interest between a principal and an agent. III. An agency cost occurs when firm management avoids risky projects that would favorably affect the stock price because the managers are worried about keeping their jobs. IV. An agency cost occurs when management chooses an action that benefits the shareholders but reduces management compensation. A. I and II only B. II and III only C. I, III and IV only D. I, II, and III only 2. You need to borrow $23,500 to buy a truck. The current loan rate is 5.9% APR compounded monthly and you want to pay the loan off in equal monthly installments over 5 years. What is your monthly payment? A. $391.67 B. $451.01 C. $453.23 D. $463.64 3. You will receive $500 payments at the beginning of each year, starting today, for the next 20 years. If you invest this money at an interest rate of 7.25%, how much will you have after 20 years? A. $21,066.08 B. $22,593.37 C. $24,054.39 D. $24,899.74 4. An annuity due must have present value at least as large as an equivalent ordinary annuity. A. True B. False 5. A cash-strapped young professional offers to buy your car with four, equal annual payments of $3,000, beginning two years from today. Assuming you're indifferent to cash versus credit, that you can invest at 10%, and that you want to receive $9,000 for the car, should you accept? A. Yes; present value is $9,510. B. Yes; present value is $11,372. C. No; present value is $8,645. D. No; present value is $7,461. 6. A "growing annuity" is a cash flow stream that grows at a constant rate for a specified number of periods. A. True B. False 7. Bluff Enterprises has $1,000 face value bonds outstanding. These bonds pay interest semiannually, mature in 6 years, and have a 7% coupon. The current price is $1,013.60. What is the yield to maturity? A. 5.97% B. 6.49% C. 6.72% D. 6.86% E. 7.11% 8. All else equal, bond prices and interest rates are inversely related. A. True. B. False. (The following information applies to the next two questions.) You have just purchased a 10-year bond with a 6% coupon rate, a 7.5% yield to maturity and a par value of $1,000. Coupon payments are semiannual. 9. What is the purchase price of the bond? A. $895.78 B. $897.04 C. $938.40 D. $1,312.66 10. What would your rate of return at the end of the year be if you sell the bond? Assume the yield to maturity on the bond is at the time you sell is 9%. A. -2.03% B. -3.45% C. 5.37% D. 18.33% 11. If the nominal rate of interest on an investment is 10.77% and the real rate of return is 4.50%, what is the inflation rate? A. 5.75% B. 6.00% C. 6.25% D. 6.50% 12. Suppose that the 1-year spot rate is 3%, the 2-year spot rate is 4% and the 3-year spot rate is 5%. What is the price of a 1000 par value 3-year bond paying a 6% annual coupon payment? A. $1,027.23 B. $1,029.39 C. $1,055.50 D. $1,084.86 13. What would be the expected price of a stock when dividends are expected to grow at a 25% rate for three years, then grow at a constant rate of 5%, if the stock's required return is 13% and next year's dividend will be $4.00? A. $61.60 B. $62.08 C. $68.62 D. $79.44 14. The PVGO (present value of growth opportunities) is positive if the return on equity (ROE) is greater than the required return. A. True B. False 15. The current price of ABC stock is $50. Dividends are expected to grow at 7 percent indefinitely, and the most recent dividend was $1. What is the required rate of return on ABC's stock? A. 9.00 percent B. 9.14 percent C. 9.33 percent D. 10.65 percent (The following information applies to the next two questions.) A stock has expected earnings per share at the end of the year of $6, and a required return of 20%. The payout ratio is 40%, and the return on equity (ROE) is 15%. 16. What is the current stock price? A. $22 B. $26 C. $30 D. $55 17. What is the present value of growth opportunities (PVGO)? A. -$8 B. $0 C. $4 D. $25 18. Gere Furniture forecasts a free cash flow of $40 million in Year 3, i.e., at t = 3, and it expects FCF to grow at a constant rate of 5% thereafter. If the weighted average cost of capital is 10%, what is the horizon value, in millions at t= 3? A. $840 B. $882 C. $926 D. $972 19. The internal rate of return (IRR) can lead to faulty decisions if: A. any of an investment's cash flows are equal to zero. B. the cash flows are conventional. C. the investment has a life that exceeds the required payback period. D. two or more projects are mutually exclusive. 20. A firm considers a project with the following cash flows: time-zero = +20,000, years 1-5 =- 4,500. Should the project be accepted if the cost of capital is 10%? A. Yes, the IRR of the project is 4.06%. B. Yes, the IRR of the project is 12.5%. C. No, the IRR of the project is 4.06%. D. No, the IRR of the project is 12.5%. 21. A project has the following cash flows. What is the payback period? Year Cash Flow 0 -$28,000 1 11,600 2 11,600 3 6,500 4 6,500 A. 2.38 years B. 2.49 years C. 2.74 years D. 3.01 years 22. The Downtown Athletic Club must choose between two mechanical tennis ball throwers. Machine A costs $500 and lasts three years. There will be maintenance expenses of $120 to be paid at the end of each of the three year. Machine B costs $600 and last four years. There will be maintenance expenses of $100 to be paid at the end of each of the four years. Assuming a discount rate of 10%, which machine will be chosen? A. Machine A B. Machine B C. Both A and B D. Neither 23. McCarver Inc. is considering the following mutually exclusive projects: Year Project A Cash Flows 0 -5,000 1 200 2 800 3 3000 4 5000 Project B Cash Flows -5,000 3000 3000 800 200 What is the crossover rate? Which project will be accepted if the required return is 10%? A. 15.68%; Accept B B. 16.15%; Accept A C. 16.25%; Accept B D. 17.72%; Accept A 24. If a project has conventional cash flows, it may also have more than one IRR. A. True B. False 25. The likely effect of discounting nominal cash flows with real interest rates will be to: A. make an investment's NPV appear more attractive. B. make an investment's NPV appear less attractive. C. correctly calculate an investment's NPV if inflation is expected. D. correctly calculate an investment's NPV, regardless of expected inflation. 26. One of the key changes in the 2017 Tax Cuts and Jobs Act is that companies can no longer fully deduct interest expense. A. True. B. False. 27. The present value of the depreciation tax shield is higher with MACRS than with straight line depreciation. A. True. B. False. 28. Projects in which a firm expands its operations and sales will generally not lead to changes in net working capital. A. True. B. False. 29. Your company just bought a new distillation unit for $175,000 to be used for research and development. Such equipment has a 3-year MACRS classification. The MACRS percentages are 33.33 percent, 44.44 percent, 14.82 percent, and 7.41 percent, respectively. What is the book value of the distillation unit at the end of year 2? A. $12,968.00 B. $38,902.50 C. $49,833.50 D. $77,770.00 30. A project has an initial requirement of $310,000 for fixed assets and $62,000 for net working capital. The fixed assets will be depreciated to a zero book value over the 3-year life of the project and have an estimated salvage value of $155,000. All of the net working capital will be recouped at the end of the project. The annual operating cash flow is $345,000 and the discount rate is 18 percent. What is the project's net present value if the tax rate is 34 percent? A. $403,618.02 B. $414,141.41 C. $446,047.36 D. $478,122.21