Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Why do firms pay dividends? What, in general, are the advantages and disadvantages of paying cash dividends (1 point)? 2. Suppose FPL will

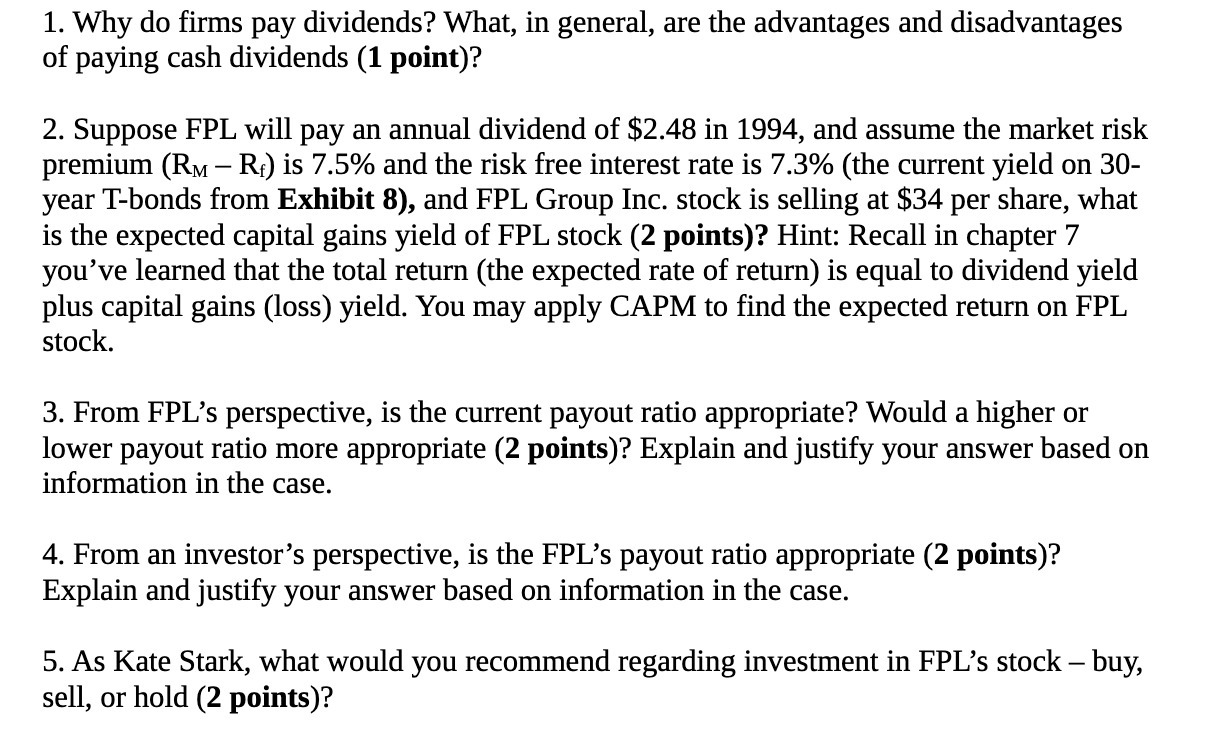

1. Why do firms pay dividends? What, in general, are the advantages and disadvantages of paying cash dividends (1 point)? 2. Suppose FPL will pay an annual dividend of $2.48 in 1994, and assume the market risk premium (RMR) is 7.5% and the risk free interest rate is 7.3% (the current yield on 30- year T-bonds from Exhibit 8), and FPL Group Inc. stock is selling at $34 per share, what is the expected capital gains yield of FPL stock (2 points)? Hint: Recall in chapter 7 you've learned that the total return (the expected rate of return) is equal to dividend yield plus capital gains (loss) yield. You may apply CAPM to find the expected return on FPL stock. 3. From FPL's perspective, is the current payout ratio appropriate? Would a higher or lower payout ratio more appropriate (2 points)? Explain and justify your answer based on information in the case. 4. From an investor's perspective, is the FPL's payout ratio appropriate (2 points)? Explain and justify your answer based on information in the case. 5. As Kate Stark, what would you recommend regarding investment in FPL's stock buy, sell, or hold (2 points)?

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Why do firms pay dividends Advantages and disadvantages of paying cash dividends Firms pay dividends for several reasons To reward and return value to shareholders To signal financial health and con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started