Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) XYZ Company, doing merchandising business, started their business on January 1, 2019. The following were the transactions in 2019: Jan 1 - Issued capital

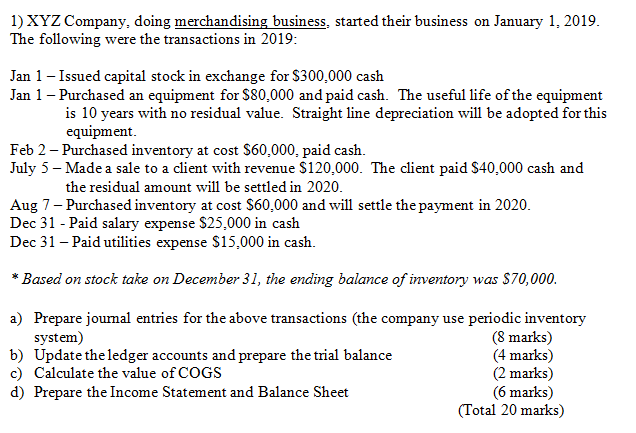

1) XYZ Company, doing merchandising business, started their business on January 1, 2019. The following were the transactions in 2019: Jan 1 - Issued capital stock in exchange for $300,000 cash Jan 1 - Purchased an equipment for $80.000 and paid cash. The useful life of the equipment is 10 years with no residual value. Straight line depreciation will be adopted for this equipment. Feb 2 - Purchased inventory at cost $60,000. paid cash. July 5 - Made a sale to a client with revenue $120.000. The client paid $40.000 cash and the residual amount will be settled in 2020. Aug 7 - Purchased inventory at cost $60,000 and will settle the payment in 2020. Dec 31 - Paid salary expense $25,000 in cash Dec 31 - Paid utilities expense $15,000 in cash. * Based on stock take on December 31, the ending balance of inventory was $70,000. a) Prepare joumal entries for the above transactions (the company use periodic inventory system) (8 marks) b) Update the ledger accounts and prepare the trial balance (4 marks) c) Calculate the value of COGS (2 marks) d) Prepare the Income Statement and Balance Sheet (6 marks) (Total 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started