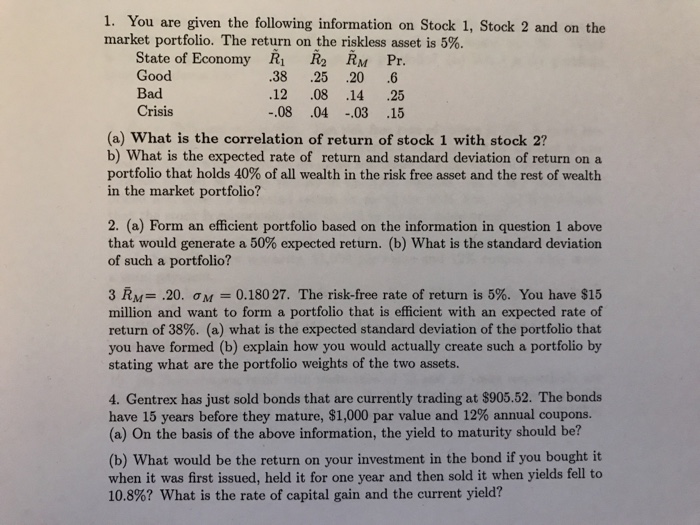

1. You are given the following information on Stock 1, Stock 2 and on the market portfolio. The return on the riskless asset is 5%. State of Economy Ri R2 RM Pr. Good Bad Crisis 38 .25 .20 .6 .12 .08 .14 .25 .08 .04 .03 .15 (a) What is the correlation of return of stock 1 with stock 2? b) What is the expected rate of return and standard deviation of return on a portfolio that holds 40% of all wealth in the risk free asset and the rest of wealth in the market portfolio? 2. (a) Form an efficient portfolio based on the information in question 1 above that would generate a 50% expected return. (b) what is the standard deviation of such a portfolio? 3 RM= .20. M = 0.18027. The risk-free rate of return is 5%. You have $15 million and want to form a portfolio that is efficient with an expected rate of return of 38%. (a) what is the expected standard deviation of the portfolio that you have formed (b) explain how you would actually create such a portfolio by stating what are the portfolio weights of the two assets. 4. Gentrex has just sold bonds that are currently trading at $905.52. The bonds have 15 years before they mature, $1,000 par value and 12% annual coupons. (a) On the basis of the above information, the yield to maturity should be? (b) What would be the return on your investment in the bond if you bought it when it was first issued, held it for one year and then sold it when yields fell to 10.8%? what is the rate of capital gain and the current yield? 1. You are given the following information on Stock 1, Stock 2 and on the market portfolio. The return on the riskless asset is 5%. State of Economy Ri R2 RM Pr. Good Bad Crisis 38 .25 .20 .6 .12 .08 .14 .25 .08 .04 .03 .15 (a) What is the correlation of return of stock 1 with stock 2? b) What is the expected rate of return and standard deviation of return on a portfolio that holds 40% of all wealth in the risk free asset and the rest of wealth in the market portfolio? 2. (a) Form an efficient portfolio based on the information in question 1 above that would generate a 50% expected return. (b) what is the standard deviation of such a portfolio? 3 RM= .20. M = 0.18027. The risk-free rate of return is 5%. You have $15 million and want to form a portfolio that is efficient with an expected rate of return of 38%. (a) what is the expected standard deviation of the portfolio that you have formed (b) explain how you would actually create such a portfolio by stating what are the portfolio weights of the two assets. 4. Gentrex has just sold bonds that are currently trading at $905.52. The bonds have 15 years before they mature, $1,000 par value and 12% annual coupons. (a) On the basis of the above information, the yield to maturity should be? (b) What would be the return on your investment in the bond if you bought it when it was first issued, held it for one year and then sold it when yields fell to 10.8%? what is the rate of capital gain and the current yield