Answered step by step

Verified Expert Solution

Question

1 Approved Answer

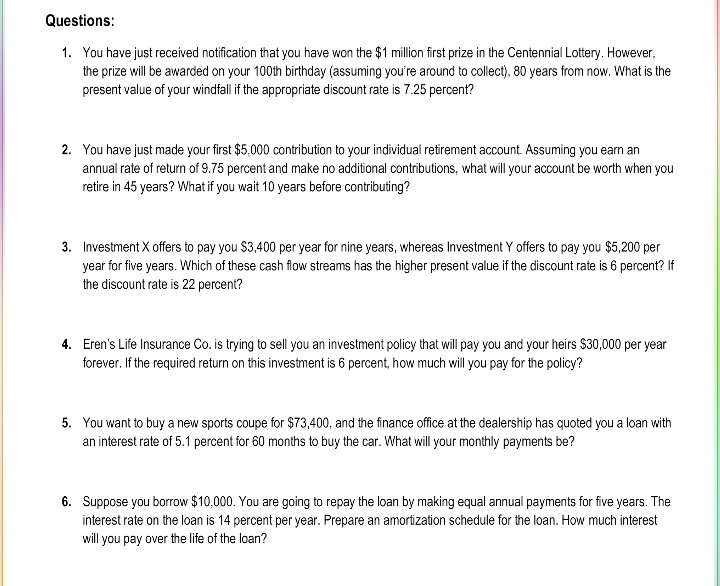

Questions: 1. You have just received notification that you have won the $1 million first prize in the Centennial Lottery. However, the prize will be

Questions: 1. You have just received notification that you have won the $1 million first prize in the Centennial Lottery. However, the prize will be awarded on your 100th birthday (assuming you're around to collect), 80 years from now. What is the present value of your windfall if the appropriate discount rate is 7.25 percent? 2. You have just made your first $5.000 contribution to your individual retirement account. Assuming you earn an annual rate of return of 9.75 percent and make no additional contributions, what will your account be worth when you retire in 45 years? What if you wait 10 years before contributing? 3. Investment X offers to pay you $3,400 per year for nine years, whereas Investment Y offers to pay you $5,200 per year for five years. Which of these cash flow streams has the higher present value if the discount rate is 6 percent? If the discount rate is 22 percent? 4. Eren's Life Insurance Co. is trying to sell you an investment policy that will pay you and your heirs $30,000 per year forever. If the required return on this investment is 6 percent, how much will you pay for the policy? 5. You want to buy a new sports coupe for $73,400, and the finance office at the dealership has quoted you a loan with an interest rate of 5.1 percent for 60 months to buy the car. What will your monthly payments be? 6. Suppose you borrow $10.000. You are going to repay the loan by making equal annual payments for five years. The interest rate on the loan is 14 percent per year. Prepare an amortization schedule for the loan. How much interest will you pay over the life of the loan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started