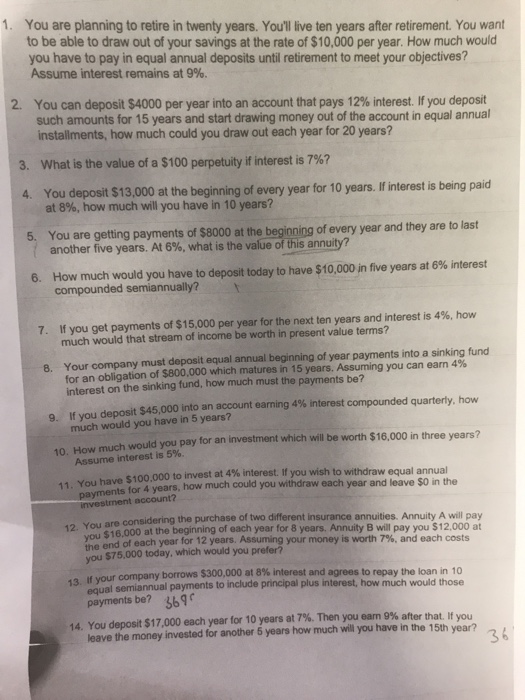

1. You are planning to retire in twenty years. Youll live ten years after retirement. You want to be able to draw out of your savings at the rate of $10,000 per year. How much would you have to pay in equal annual deposits until retirement to meet your objectives? Assume interest remains at 9%. 2. You can deposit $4000 per year into an account that pays 12% interest. If you deposit such amounts for 15 years and start drawing money out of the account in equal annual installments, how much could you draw out each year for 20 years? 3, what is the value of a $100 perpetuity if interest is 7%? 4 You deposit $13,00 at the beginning of every year for 10 years. Ifinterest is being paid You are getting payments of $8000 at the beginning of every year and they are to last another five years. At 6%, what is the value ofthisannuty? 6, How much would you have to deposit today to have $10,000 in five years at 6% interest 7. If you get payments of $15,000 per year for the next ten years and interest is 4%, how much would that stream of income be worth in present value terms? 8. Your company must deposit equal annual beginning of year payments into a sinking fund for an obligation of $800,000 which matures in 15 years. Assuming you can earn 4% 9. If you deposit $45,000 into an account earning 4% interest compounded quarterly, how 10. How much would you pay for an investment which will be worth $16,000 in three vears? interest on the sinking fund, how much must the payments be? much would you have in 5 years? Assume interest is 5%. You have $100,000 to invest at 4% interest if you wish to withdraw equal annual how much could you withdraw each year and leave $0 in the payments for 4 years, inves considering the purchase of two different insurance annuities. Annuity A will pay 12. You are $16,000 at the beginning of each year for 8 years. Annuity B will pay you $12,000 at the en of each year for 12 years. Assuming your money is worth 7%, and each costs you $75,000 today, which would you prefer? If your company borrows payments be? 369 leave the money invested for another 5 years how much will you have in the 15th year? S300.000 at 8% interet and agrees to repay the loan in 10 13. equal semiannual payments to include principal plus interest, how much would those 14. You deposit $17,000 each year for 10 years at 7%. Then you earn 9% after that. If you