Question

1) You believe that next year there is a 25% probability of a recession and 75% probability that the economy will be normal. If your

1) You believe that next year there is a 25% probability of a recession and 75% probability that the economy will be normal. If your stock will yield -11% in a recession and 22% in a normal year, what is the standard deviation of the stock? Round to two decimals.

2) You hold a portfolio composed of 20% security A and 80% security B. If A has an expected return of 10% and B has an expected return of 15%, what is the expected return from your portfolio? Round to two decimals.

3) Suppose you purchased 1,700 shares of Pan Am Airlines at the beginning of the year for $21.55. By the end of the year, the stock price had appreciated to 23.42. At the end of the year, Pan Am paid a dividend of $1.15 per share. Calculate the dividend yield on this investment over the year. Round to two decimals.

4) You bought stock in your favorite online retail company at a price of $70 per share. You recently sold the stock for a price of $78 per share. While holding the stock, you received dividends of $1.50. What was your holding period return? Round to two decimals.

5) If Microsoft stockholders expect either a 24.5% return or a 1.9% return, each with a 50% probability, and Apple Computer shareholders expect a 10.2% return with certainty, what is the expected return from a portfolio comprised of equal amounts of stock from both firms.

6) If the probability of a 20% return is 70% and the probability of a 3% loss is 30%, what is the expected return? a) 10% b) 15% c) 13% d) 17% e) 12%

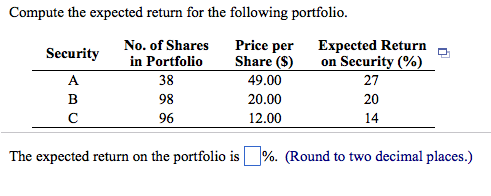

7)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started