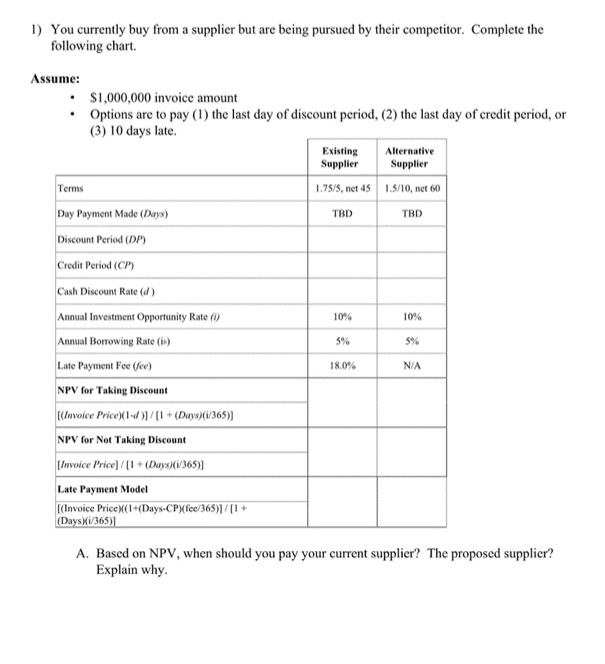

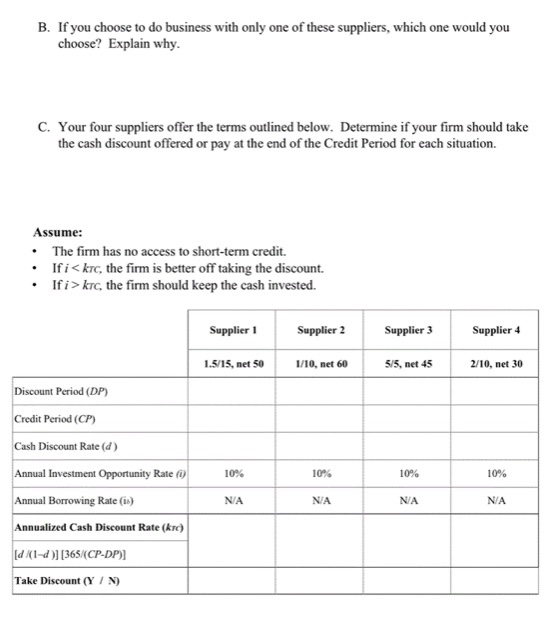

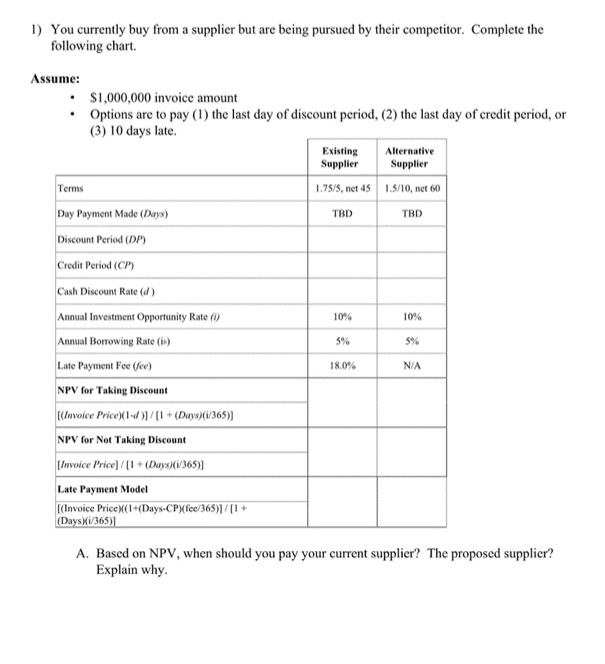

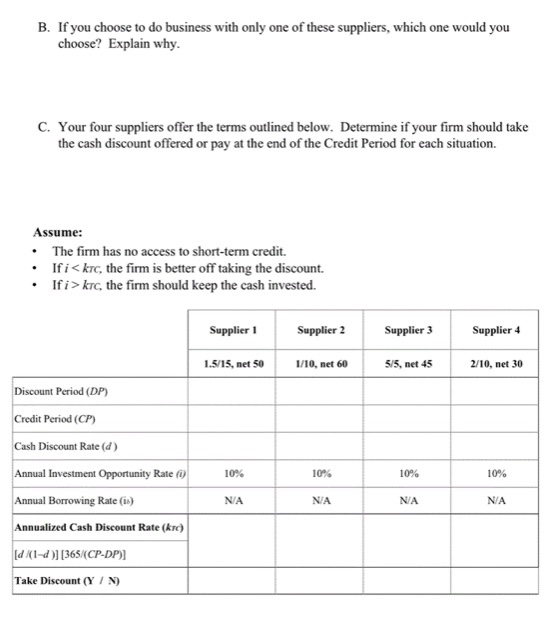

1) You currently buy from a supplier but are being pursued by their competitor. Complete the following chart Assume: $1,000,000 invoice amount Options are to pay (1) the last day of discount period, (2) the last day of credit period, or (3) 10 days late. Existing Alternative Supplier Supplier Terms 1.75/5, net 45 1.5/10, net 60 Day Payment Made (Days) TBD TBD Discount Period (DP) Credit Period (CP) Cash Discount Rate (d) Annual Investment Opportunity Rate () 10% Annual Borrowing Rate (1) 5% 5% Late Payment Fee (fee) 18.0% N/A NPV for Taking Discount (Invoice Price)(1-2)/(1+ (Days)(1/365)] NPV for Not Taking Discount [Invoice Price]/[1 + (Days)(365) Late Payment Model [(Invoice Price)(1+(Days-CP) fec/365)]/[1 + (Days)(1/365) 10% A. Based on NPV, when should you pay your current supplier? The proposed supplier? Explain why. B. If you choose to do business with only one of these suppliers, which one would you choose? Explain why. C. Your four suppliers offer the terms outlined below. Determine if your firm should take the cash discount offered or pay at the end of the Credit Period for each situation. Assume: The firm has no access to short-term credit. Ifi

krc, the firm should keep the cash invested. Supplier Supplier 2 Supplier 3 Supplier 4 1.5/15, net 50 1/10, net 60 5/5, net 45 2/10, net 30 10% 10% 10% 10% Discount Period (DP) Credit Period (CP) Cash Discount Rate (d) Annual Investment Opportunity Rate() Annual Borrowing Rate (1) Annualized Cash Discount Rate (krc) [4 (1-d ][365 (CP-DP)] Take Discount (Y/N) NA NA NA NA 1) You currently buy from a supplier but are being pursued by their competitor. Complete the following chart Assume: $1,000,000 invoice amount Options are to pay (1) the last day of discount period, (2) the last day of credit period, or (3) 10 days late. Existing Alternative Supplier Supplier Terms 1.75/5, net 45 1.5/10, net 60 Day Payment Made (Days) TBD TBD Discount Period (DP) Credit Period (CP) Cash Discount Rate (d) Annual Investment Opportunity Rate () 10% Annual Borrowing Rate (1) 5% 5% Late Payment Fee (fee) 18.0% N/A NPV for Taking Discount (Invoice Price)(1-2)/(1+ (Days)(1/365)] NPV for Not Taking Discount [Invoice Price]/[1 + (Days)(365) Late Payment Model [(Invoice Price)(1+(Days-CP) fec/365)]/[1 + (Days)(1/365) 10% A. Based on NPV, when should you pay your current supplier? The proposed supplier? Explain why. B. If you choose to do business with only one of these suppliers, which one would you choose? Explain why. C. Your four suppliers offer the terms outlined below. Determine if your firm should take the cash discount offered or pay at the end of the Credit Period for each situation. Assume: The firm has no access to short-term credit. Ifi krc, the firm should keep the cash invested. Supplier Supplier 2 Supplier 3 Supplier 4 1.5/15, net 50 1/10, net 60 5/5, net 45 2/10, net 30 10% 10% 10% 10% Discount Period (DP) Credit Period (CP) Cash Discount Rate (d) Annual Investment Opportunity Rate() Annual Borrowing Rate (1) Annualized Cash Discount Rate (krc) [4 (1-d ][365 (CP-DP)] Take Discount (Y/N) NA NA NA NA