Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4/24/23, 10:54 AM Section 8 $0 $2,000 $5,000 O $7,000 75-20 d. for follow un )493 10! pays (45) Guer judo 10kg bl mor-10411 wat

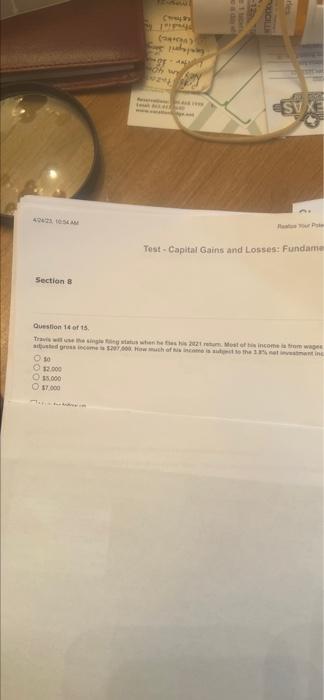

4/24/23, 10:54 AM Section 8 $0 $2,000 $5,000 O $7,000 75-20 d. for follow un )493 10! pays (45) Guer judo 10kg bl mor-10411 wat wy kan wozat Spid $150 Parkway, Pig in Forge, IN ON Reservations: 00.468.1998 Local: 865.453 2640 www.vacation dge.net e a day with e 1 tablett -125, TA XICILLIN Lea Dr. Chatarongs HJ rles "sung pool dossola {p EZ LE/21:01ec 22077 ASN HOVO ESVE Realize Your Pote Question 14 of 15. Travis will use the single filing status when he files his 2021 return. Most of his income is from wages adjusted gross income is $207,000. How much of his income is subject to the 3.8% net investment inc Test Capital Gains and Losses: Fundame

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started