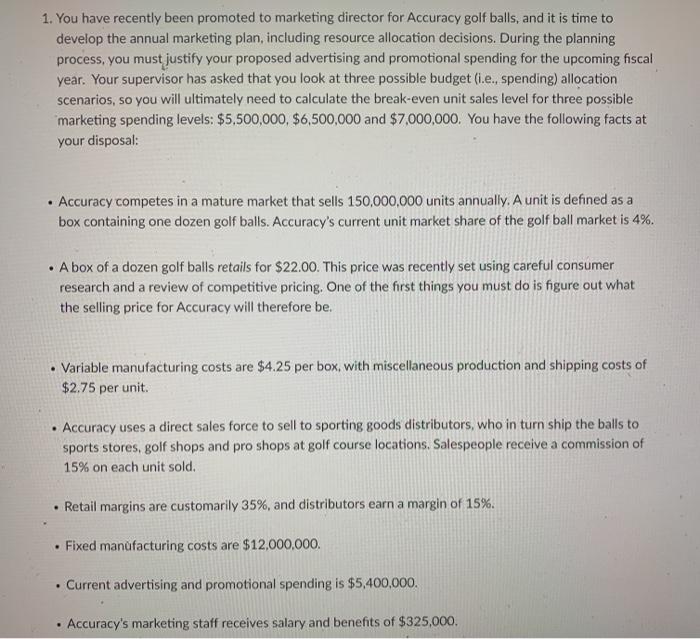

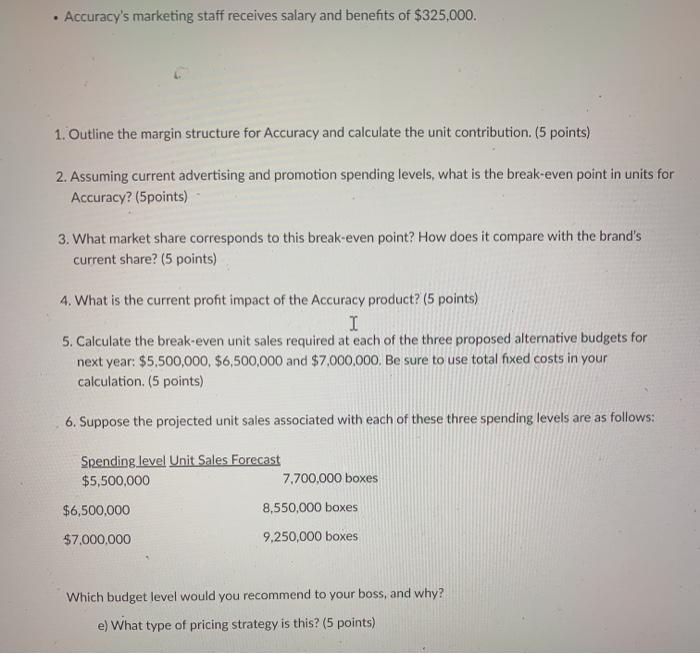

1. You have recently been promoted to marketing director for Accuracy golf balls, and it is time to develop the annual marketing plan, including resource allocation decisions. During the planning process, you must justify your proposed advertising and promotional spending for the upcoming fiscal year. Your supervisor has asked that you look at three possible budget (i.e., spending) allocation scenarios, so you will ultimately need to calculate the break-even unit sales level for three possible marketing spending levels: $5,500,000, $6,500,000 and $7,000,000. You have the following facts at your disposal: Accuracy competes in a mature market that sells 150,000,000 units annually. A unit is defined as a box containing one dozen golf balls. Accuracy's current unit market share of the golf ball market is 4%. . A box of a dozen golf balls retails for $22.00. This price was recently set using careful consumer research and a review of competitive pricing. One of the first things you must do is figure out what the selling price for Accuracy will therefore be. Variable manufacturing costs are $4.25 per box, with miscellaneous production and shipping costs of $2.75 per unit. Accuracy uses a direct sales force to sell to sporting goods distributors, who in turn ship the balls to sports stores, golf shops and pro shops at golf course locations. Salespeople receive a commission of 15% on each unit sold . Retail margins are customarily 35%, and distributors earn a margin of 15%. . Fixed manufacturing costs are $12,000,000 . Current advertising and promotional spending is $5,400,000. . Accuracy's marketing staff receives salary and benefits of $325,000. 1. You have recently been promoted to marketing director for Accuracy golf balls, and it is time to develop the annual marketing plan, including resource allocation decisions. During the planning process, you must justify your proposed advertising and promotional spending for the upcoming fiscal year. Your supervisor has asked that you look at three possible budget (i.e., spending) allocation scenarios, so you will ultimately need to calculate the break-even unit sales level for three possible marketing spending levels: $5,500,000, $6,500,000 and $7,000,000. You have the following facts at your disposal: Accuracy competes in a mature market that sells 150,000,000 units annually. A unit is defined as a box containing one dozen golf balls. Accuracy's current unit market share of the golf ball market is 4%. . A box of a dozen golf balls retails for $22.00. This price was recently set using careful consumer research and a review of competitive pricing. One of the first things you must do is figure out what the selling price for Accuracy will therefore be. Variable manufacturing costs are $4.25 per box, with miscellaneous production and shipping costs of $2.75 per unit. Accuracy uses a direct sales force to sell to sporting goods distributors, who in turn ship the balls to sports stores, golf shops and pro shops at golf course locations. Salespeople receive a commission of 15% on each unit sold . Retail margins are customarily 35%, and distributors earn a margin of 15%. . Fixed manufacturing costs are $12,000,000 . Current advertising and promotional spending is $5,400,000. . Accuracy's marketing staff receives salary and benefits of $325,000