Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. You own a delayed perpetuity. It pays $200 per year, starting at the end of year five. If the annual interest rate is

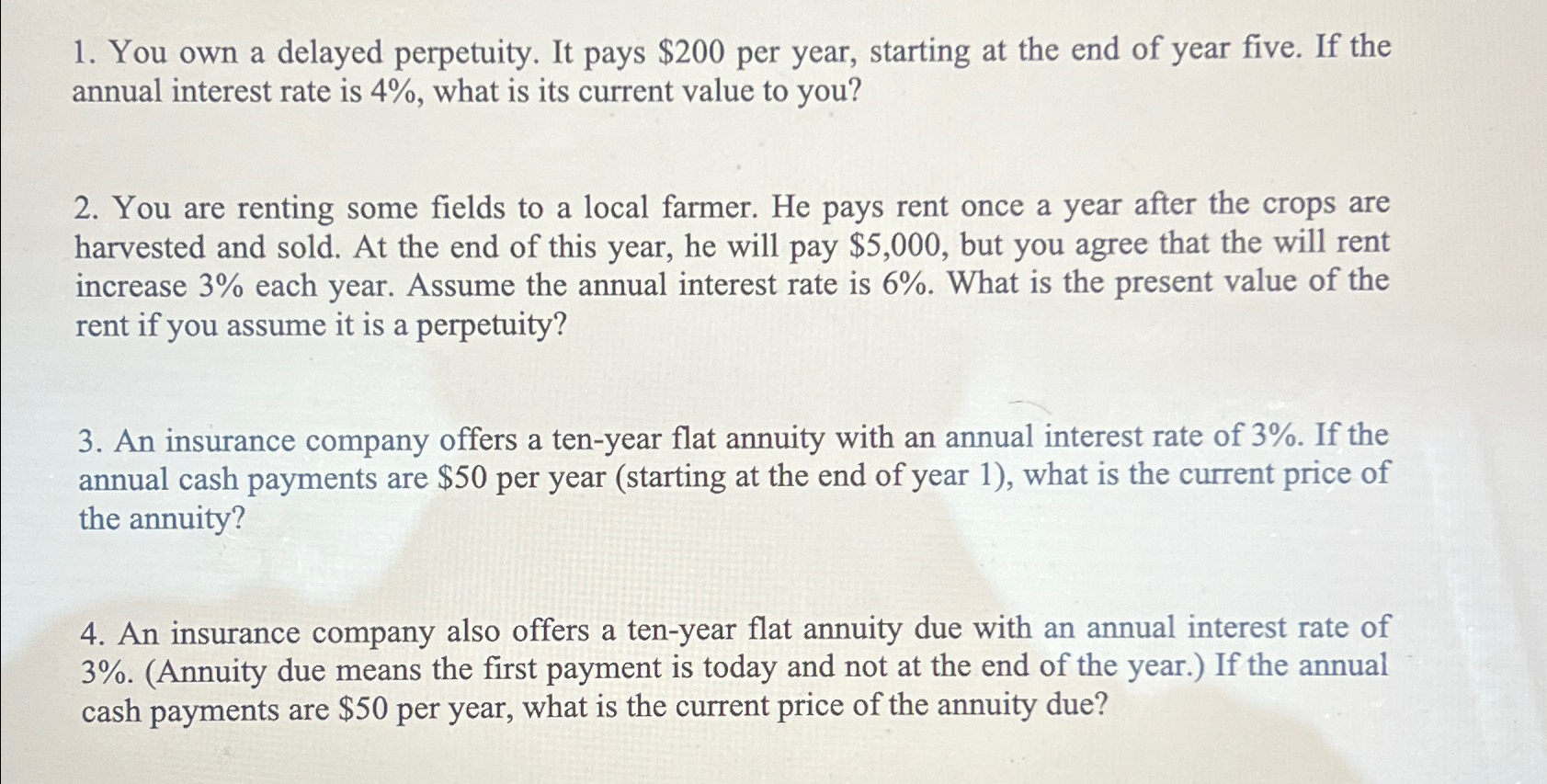

1. You own a delayed perpetuity. It pays $200 per year, starting at the end of year five. If the annual interest rate is 4%, what is its current value to you? 2. You are renting some fields to a local farmer. He pays rent once a year after the crops are harvested and sold. At the end of this year, he will pay $5,000, but you agree that the will rent increase 3% each year. Assume the annual interest rate is 6%. What is the present value of the rent if you assume it is a perpetuity? 3. An insurance company offers a ten-year flat annuity with an annual interest rate of 3%. If the annual cash payments are $50 per year (starting at the end of year 1), what is the current price of the annuity? 4. An insurance company also offers a ten-year flat annuity due with an annual interest rate of 3%. (Annuity due means the first payment is today and not at the end of the year.) If the annual cash payments are $50 per year, what is the current price of the annuity due?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Present Value of a Delayed Perpetuity We can use the formula for the present value of a delay...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started