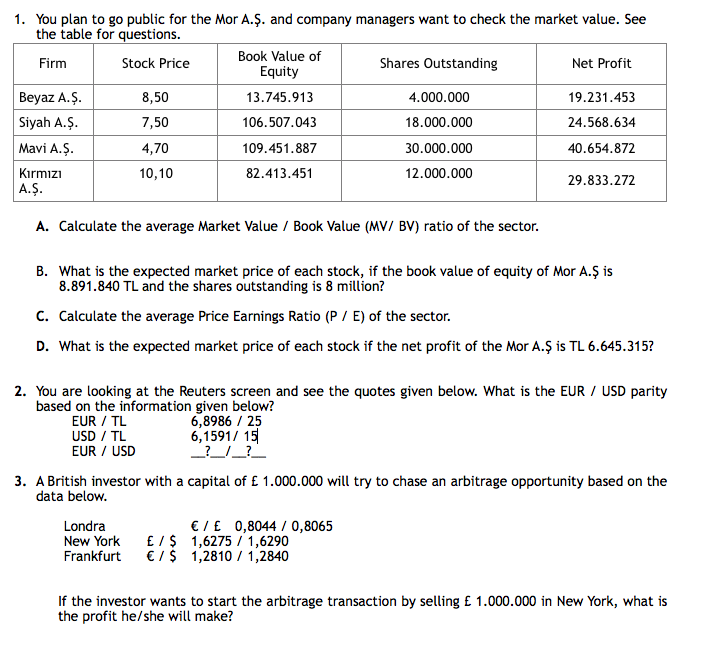

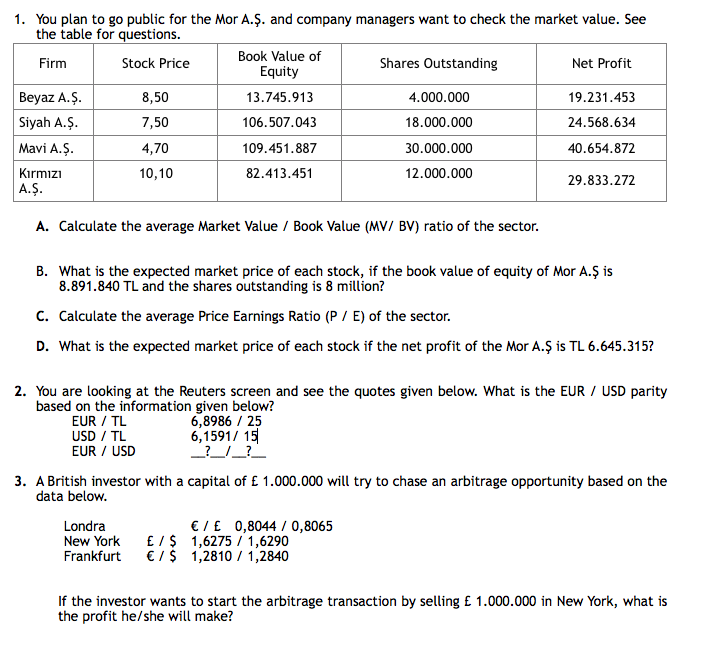

1. You plan to go public for the Mor A.. and company managers want to check the market value. See the table for questions. Firm Stock Price Book Value of Shares Outstanding Net Profit Equity Beyaz A.. 8,50 13.745.913 4.000.000 19.231.453 Siyah A.. 7,50 106.507.043 18.000.000 24.568.634 Mavi A.. 4,70 109.451.887 30.000.000 40.654.872 Krmz 10,10 82.413.451 12.000.000 29.833.272 A.. A. Calculate the average Market Value / Book Value (MV/ BV) ratio of the sector. B. What is the expected market price of each stock, if the book value of equity of Mor A. is 8.891.840 TL and the shares outstanding is 8 million? C. Calculate the average Price Earnings Ratio (P/E) of the sector. D. What is the expected market price of each stock if the net profit of the Mor A. is TL 6.645.315? 2. You are looking at the Reuters screen and see the quotes given below. What is the EUR / USD parity based on the information given below? EUR / TL 6,8986 / 25 USD / TL 6,1591/ 15 EUR / USD _2_1_? 3. A British investor with a capital of 1.000.000 will try to chase an arbitrage opportunity based on the data below. Londra New York Frankfurt / 0,8044 / 0,8065 / $ 1,6275 / 1,6290 / $ 1,2810 / 1,2840 If the investor wants to start the arbitrage transaction by selling 1.000.000 in New York, what is the profit he/she will make? 1. You plan to go public for the Mor A.. and company managers want to check the market value. See the table for questions. Firm Stock Price Book Value of Shares Outstanding Net Profit Equity Beyaz A.. 8,50 13.745.913 4.000.000 19.231.453 Siyah A.. 7,50 106.507.043 18.000.000 24.568.634 Mavi A.. 4,70 109.451.887 30.000.000 40.654.872 Krmz 10,10 82.413.451 12.000.000 29.833.272 A.. A. Calculate the average Market Value / Book Value (MV/ BV) ratio of the sector. B. What is the expected market price of each stock, if the book value of equity of Mor A. is 8.891.840 TL and the shares outstanding is 8 million? C. Calculate the average Price Earnings Ratio (P/E) of the sector. D. What is the expected market price of each stock if the net profit of the Mor A. is TL 6.645.315? 2. You are looking at the Reuters screen and see the quotes given below. What is the EUR / USD parity based on the information given below? EUR / TL 6,8986 / 25 USD / TL 6,1591/ 15 EUR / USD _2_1_? 3. A British investor with a capital of 1.000.000 will try to chase an arbitrage opportunity based on the data below. Londra New York Frankfurt / 0,8044 / 0,8065 / $ 1,6275 / 1,6290 / $ 1,2810 / 1,2840 If the investor wants to start the arbitrage transaction by selling 1.000.000 in New York, what is the profit he/she will make