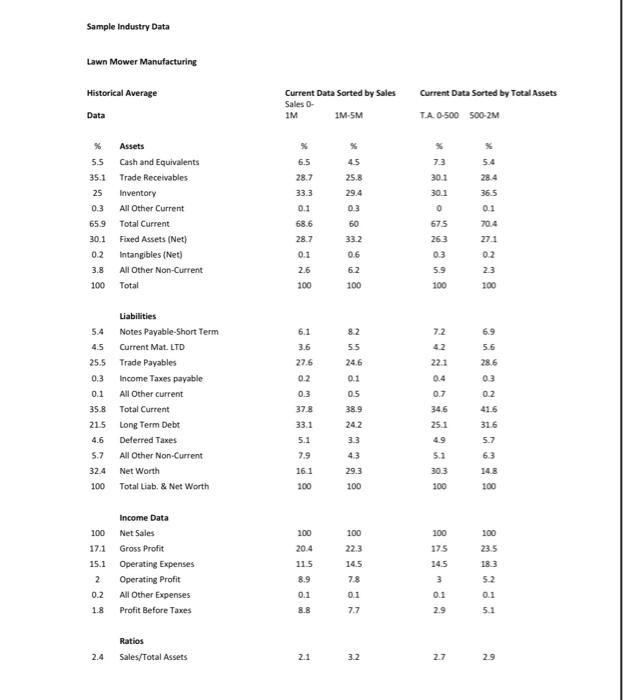

1. You wish to start a firm that will manufacture Lawn Mowers. You have classified your firm as being in the Lawn Mower Manufacturing Business. You have obtained the Risk Management Associates (RMA) Industry Financial Statement Information on the following pages. Using the RMA industry financial information and your sales estimate of $2,000,000 per year, as we did in class, estimate the financial statements of your firm. 2. You wish to start a firm that will manufacture Lawn Mowers. You have classified your firm as being in the Lawn Mower Manufacturing Business. You have obtained the Robert Morris and Associates (RMA) Industry Financial Statement Information on the following pages. Using the RMA industry financial information and your plan to invest $150,000 from your own pocket into the business, as we did in class, estimate the financial statements of your firm. Sample Industry Data Lawn Mower Manufacturing Historical Average Current Data Sorted by Sales Sales - IM IM-SM Current Data Sorted by Total Assets T.A.0-500 500-2M Data 45 5.4 28.4 36.5 0.1 % Assets 5.5 Cash and Equivalents 35.1 Trade Receivables 25 Inventory All Other Current 65.9 Total Current 30.1 Fixed Assets (Net) Intangibles (Net) 3.8 All Other Non-Current 100 Total 25.8 29.4 03 60 03 % 6.5 28.7 33.3 0.1 68.6 28.7 0.1 2.6 100 7.3 30.1 30.1 0 675 263 03 5.9 100 704 27.1 33.2 0.2 0.6 6.2 100 02 23 100 6.1 3.6 27.6 0.2 6.9 5.6 28.6 0.3 03 0.1 03 Liabilities 5.4 Notes Payable-Short Term 4.5 Current Mat. LTD 25.5 Trade Payables Income Taxes payable All Other current 35.8 Total Current 215 Long Term Debt Deferred Taxes 5.7 All Other Non-Current 324 Net Worth 100 Total Liab & Net Worth 37.8 33.1 8.2 5.5 24.6 0.1 05 38.9 24.2 33 43 29.3 100 7.2 4.2 22.1 0.4 0.7 345 25.1 49 5.1 303 100 4.6 5.1 0.2 41.6 316 5.7 63 148 100 7.9 161 100 100 17.1 Income Data 100 Net Sales Gross Profit 15.1 Operating Expenses 2 Operating Profit 0.2 All Other Expenses 1.8 Profit Before Taxes 100 175 145 23.5 100 20.4 115 8.9 0.1 8.8 100 223 14.5 78 0.1 7.7 3 0.1 18.3 5.2 0.1 2.9 5.1 Ratios Sales/Total Assets 2.4 2.1 3.2 27 29 1. You wish to start a firm that will manufacture Lawn Mowers. You have classified your firm as being in the Lawn Mower Manufacturing Business. You have obtained the Risk Management Associates (RMA) Industry Financial Statement Information on the following pages. Using the RMA industry financial information and your sales estimate of $2,000,000 per year, as we did in class, estimate the financial statements of your firm. 2. You wish to start a firm that will manufacture Lawn Mowers. You have classified your firm as being in the Lawn Mower Manufacturing Business. You have obtained the Robert Morris and Associates (RMA) Industry Financial Statement Information on the following pages. Using the RMA industry financial information and your plan to invest $150,000 from your own pocket into the business, as we did in class, estimate the financial statements of your firm. Sample Industry Data Lawn Mower Manufacturing Historical Average Current Data Sorted by Sales Sales - IM IM-SM Current Data Sorted by Total Assets T.A.0-500 500-2M Data 45 5.4 28.4 36.5 0.1 % Assets 5.5 Cash and Equivalents 35.1 Trade Receivables 25 Inventory All Other Current 65.9 Total Current 30.1 Fixed Assets (Net) Intangibles (Net) 3.8 All Other Non-Current 100 Total 25.8 29.4 03 60 03 % 6.5 28.7 33.3 0.1 68.6 28.7 0.1 2.6 100 7.3 30.1 30.1 0 675 263 03 5.9 100 704 27.1 33.2 0.2 0.6 6.2 100 02 23 100 6.1 3.6 27.6 0.2 6.9 5.6 28.6 0.3 03 0.1 03 Liabilities 5.4 Notes Payable-Short Term 4.5 Current Mat. LTD 25.5 Trade Payables Income Taxes payable All Other current 35.8 Total Current 215 Long Term Debt Deferred Taxes 5.7 All Other Non-Current 324 Net Worth 100 Total Liab & Net Worth 37.8 33.1 8.2 5.5 24.6 0.1 05 38.9 24.2 33 43 29.3 100 7.2 4.2 22.1 0.4 0.7 345 25.1 49 5.1 303 100 4.6 5.1 0.2 41.6 316 5.7 63 148 100 7.9 161 100 100 17.1 Income Data 100 Net Sales Gross Profit 15.1 Operating Expenses 2 Operating Profit 0.2 All Other Expenses 1.8 Profit Before Taxes 100 175 145 23.5 100 20.4 115 8.9 0.1 8.8 100 223 14.5 78 0.1 7.7 3 0.1 18.3 5.2 0.1 2.9 5.1 Ratios Sales/Total Assets 2.4 2.1 3.2 27 29