Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Zoey Miller earned gross wages of $70,000 from Dell Corp. Her 2022 Form W-2 shows that $7,000 has been withheld from her paycheck

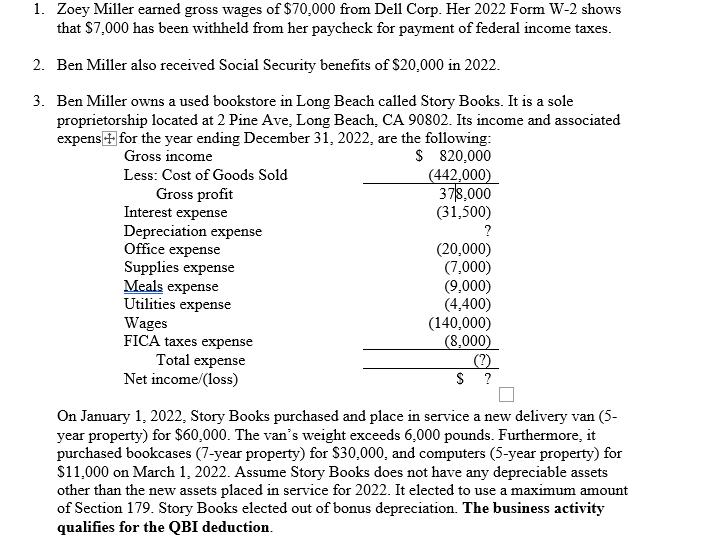

1. Zoey Miller earned gross wages of $70,000 from Dell Corp. Her 2022 Form W-2 shows that $7,000 has been withheld from her paycheck for payment of federal income taxes. 2. Ben Miller also received Social Security benefits of $20,000 in 2022. 3. Ben Miller owns a used bookstore in Long Beach called Story Books. It is a sole proprietorship located at 2 Pine Ave, Long Beach, CA 90802. Its income and associated expens for the year ending December 31, 2022, are the following: $ 820,000 Gross income Less: Cost of Goods Sold Gross profit Interest expense Depreciation expense Office expense Supplies expense Meals expense Utilities expense Wages FICA taxes expense Total expense Net income/(loss) (442,000) 37/8.000 (31,500) ? (20,000) (7,000) (9,000) (4,400) (140,000) (8,000) $? On January 1, 2022, Story Books purchased and place in service a new delivery van (5- year property) for $60,000. The van's weight exceeds 6,000 pounds. Furthermore, it purchased bookcases (7-year property) for $30,000, and computers (5-year property) for $11,000 on March 1, 2022. Assume Story Books does not have any depreciable assets other than the new assets placed in service for 2022. It elected to use a maximum amount of Section 179. Story Books elected out of bonus depreciation. The business activity qualifies for the QBI deduction.

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started