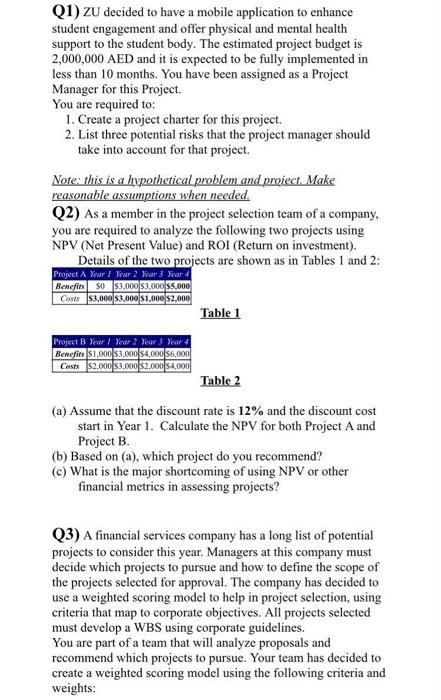

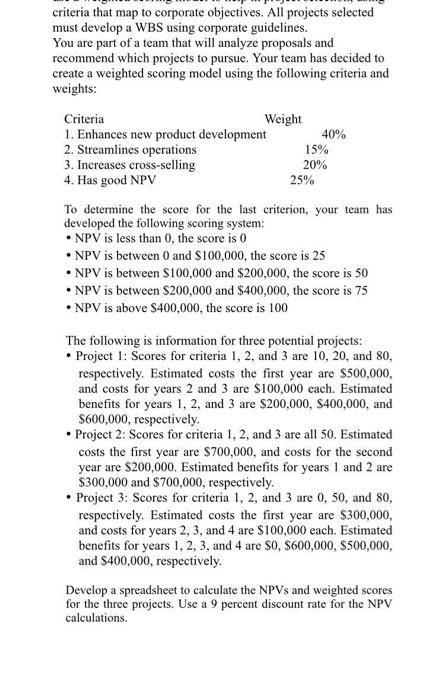

(1) Zu decided to have a mobile application to enhance student engagement and offer physical and mental health support to the student body. The estimated project budget is 2,000,000 AED and it is expected to be fully implemented in less than 10 months. You have been assigned as a Project Manager for this project. You are required to: 1. Create a project charter for this project. 2. List three potential risks that the project manager should take into account for that project. Note: this is a hypothetical problem and project. Make reasonable assumptions when needed. Q2) As a member in the project selection team of a company, you are required to analyze the following two projects using NPV (Net Present Value) and ROI (Return on investment). Details of the two projects are shown as in Tables 1 and 2: Project A Year Year 2 Year 3 Year 4 Benefits S0 53.000 53.000 55.000 Costs $3,000 $3,000 $1,000 $2,000 Table 1 Project B Year / Year 2 Year 3 Year 4 Benefits 51.000 53.000 54.000 56.000 Costs $2,000 $3,000 $2,000 $4,000 Table 2 (a) Assume that the discount rate is 12% and the discount cost start in Year 1. Calculate the NPV for both Project A and Project B. (b) Based on (a), which project do you recommend? (c) What is the major shortcoming of using NPV or other financial metrics in assessing projects? (3) A financial services company has a long list of potential projects to consider this year. Managers at this company must decide which projects to pursue and how to define the scope of the projects selected for approval. The company has decided to use a weighted scoring model to help in project selection, using criteria that map to corporate objectives. All projects selected must develop a WBS using corporate guidelines. You are part of a team that will analyze proposals and recommend which projects to pursue. Your team has decided to create a weighted scoring model using the following criteria and weights: criteria that map to corporate objectives. All projects selected must develop a WBS using corporate guidelines. You are part of a team that will analyze proposals and recommend which projects to pursue. Your team has decided to create a weighted scoring model using the following criteria and weights: Criteria Weight 1. Enhances new product development 40% 2. Streamlines operations 15% 3. Increases cross-selling 20% 4. Has good NPV 25% To determine the score for the last criterion, your team has developed the following scoring system: NPV is less than 0, the score is 0 NPV is between 0 and $100,000, the score is 25 NPV is between $100,000 and $200,000, the score is 50 NPV is between $200,000 and $400,000, the score is 75 NPV is above $400,000, the score is 100 The following is information for three potential projects: Project 1: Scores for criteria 1, 2, and 3 are 10, 20, and 80, respectively. Estimated costs the first year are $500,000, and costs for years 2 and 3 are $100,000 cach. Estimated benefits for years 1, 2, and 3 are $200,000, $400,000, and $600,000, respectively. Project 2: Scores for criteria 1, 2, and 3 are all 50. Estimated costs the first year are $700,000, and costs for the second year are $200,000. Estimated benefits for years 1 and 2 are $300,000 and $700,000, respectively. Project 3: Scores for criteria 1, 2, and 3 are 0, 50, and 80, respectively. Estimated costs the first year are $300,000, and costs for years 2, 3, and 4 are $100,000 each. Estimated benefits for years 1, 2, 3, and 4 are 50, S600,000, $500,000, and $400,000, respectively. Develop a spreadsheet to calculate the NPVs and weighted scores for the three projects. Use a 9 percent discount rate for the NPV calculations. (1) Zu decided to have a mobile application to enhance student engagement and offer physical and mental health support to the student body. The estimated project budget is 2,000,000 AED and it is expected to be fully implemented in less than 10 months. You have been assigned as a Project Manager for this project. You are required to: 1. Create a project charter for this project. 2. List three potential risks that the project manager should take into account for that project. Note: this is a hypothetical problem and project. Make reasonable assumptions when needed. Q2) As a member in the project selection team of a company, you are required to analyze the following two projects using NPV (Net Present Value) and ROI (Return on investment). Details of the two projects are shown as in Tables 1 and 2: Project A Year Year 2 Year 3 Year 4 Benefits S0 53.000 53.000 55.000 Costs $3,000 $3,000 $1,000 $2,000 Table 1 Project B Year / Year 2 Year 3 Year 4 Benefits 51.000 53.000 54.000 56.000 Costs $2,000 $3,000 $2,000 $4,000 Table 2 (a) Assume that the discount rate is 12% and the discount cost start in Year 1. Calculate the NPV for both Project A and Project B. (b) Based on (a), which project do you recommend? (c) What is the major shortcoming of using NPV or other financial metrics in assessing projects? (3) A financial services company has a long list of potential projects to consider this year. Managers at this company must decide which projects to pursue and how to define the scope of the projects selected for approval. The company has decided to use a weighted scoring model to help in project selection, using criteria that map to corporate objectives. All projects selected must develop a WBS using corporate guidelines. You are part of a team that will analyze proposals and recommend which projects to pursue. Your team has decided to create a weighted scoring model using the following criteria and weights: criteria that map to corporate objectives. All projects selected must develop a WBS using corporate guidelines. You are part of a team that will analyze proposals and recommend which projects to pursue. Your team has decided to create a weighted scoring model using the following criteria and weights: Criteria Weight 1. Enhances new product development 40% 2. Streamlines operations 15% 3. Increases cross-selling 20% 4. Has good NPV 25% To determine the score for the last criterion, your team has developed the following scoring system: NPV is less than 0, the score is 0 NPV is between 0 and $100,000, the score is 25 NPV is between $100,000 and $200,000, the score is 50 NPV is between $200,000 and $400,000, the score is 75 NPV is above $400,000, the score is 100 The following is information for three potential projects: Project 1: Scores for criteria 1, 2, and 3 are 10, 20, and 80, respectively. Estimated costs the first year are $500,000, and costs for years 2 and 3 are $100,000 cach. Estimated benefits for years 1, 2, and 3 are $200,000, $400,000, and $600,000, respectively. Project 2: Scores for criteria 1, 2, and 3 are all 50. Estimated costs the first year are $700,000, and costs for the second year are $200,000. Estimated benefits for years 1 and 2 are $300,000 and $700,000, respectively. Project 3: Scores for criteria 1, 2, and 3 are 0, 50, and 80, respectively. Estimated costs the first year are $300,000, and costs for years 2, 3, and 4 are $100,000 each. Estimated benefits for years 1, 2, 3, and 4 are 50, S600,000, $500,000, and $400,000, respectively. Develop a spreadsheet to calculate the NPVs and weighted scores for the three projects. Use a 9 percent discount rate for the NPV calculations