Answered step by step

Verified Expert Solution

Question

1 Approved Answer

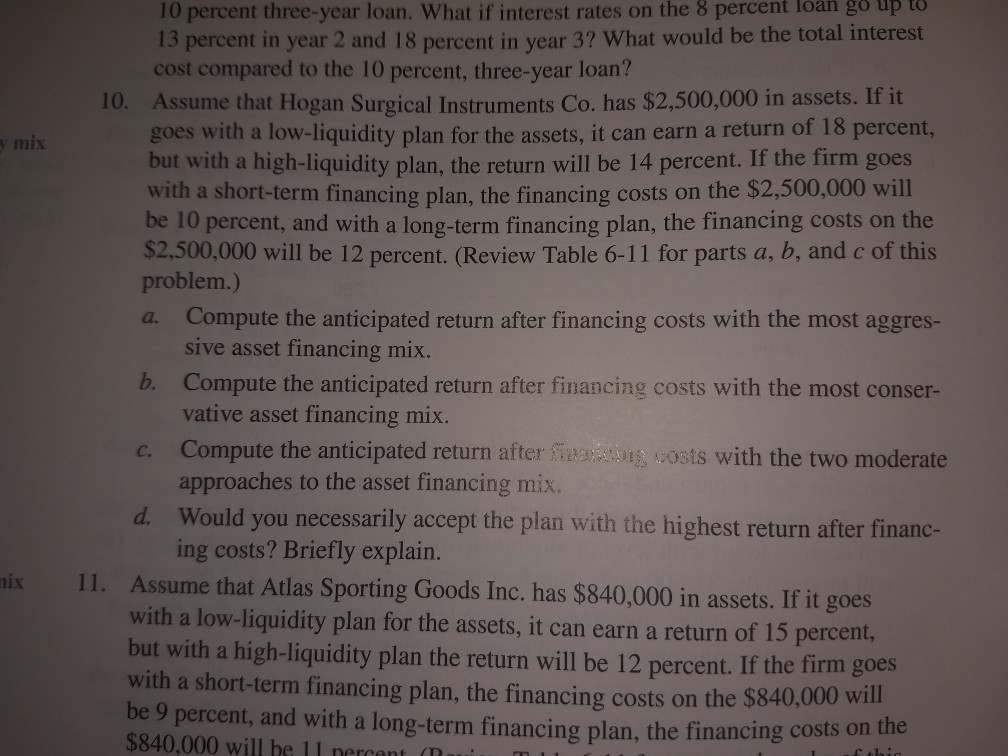

10 10 percent three-year loan. What if interest rates on the 8 percent loan go 13 percent in year 2 and 18 percent in year

10

10 percent three-year loan. What if interest rates on the 8 percent loan go 13 percent in year 2 and 18 percent in year 3? What would be the total interest cost compared to the 10 percent, three-year loan? Assume that Hogan Surgical Instruments Co. has $2,500,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 18 percent, but with a high-liquidity plan, the return will be 14 percent. If the firm goes with a short-term financing plan, the financing costs on the $2,500,000 wil be 10 percent, and with a long-term financing plan, the financing costs on the $2,500,000 will be 12 percent. (Review Table 6-11 for parts a, b, and c of this problem.) up to 10. mix a. Compute the anticipated return after financing costs with the most aggres- sive asset financing mix. Compute the anticipated return after financing costs with the most conser- vative asset financing mix. b. c. Compute the anticipated return after wosts with the two moderate approaches to the asset financing mix. Would you necessarily accept the plan with the highest return after financ- ing costs? Briefly explain. d. Assume that Atlas Sporting Goods Inc. has $840,000 in assets. If it goes with a low-liquidity plan for the assets, it can earn a return of 15 percent, but with a high-liquidity plan the return will be 12 percent. If the firm goes with a short-term financing plan, the financing costs on the $840 be 9 percent, and with a long-term financing plan, the financing costs $840,000 will be ll nercent. cpa ix 11. 000 wilStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started