All multiple choice questions needed.

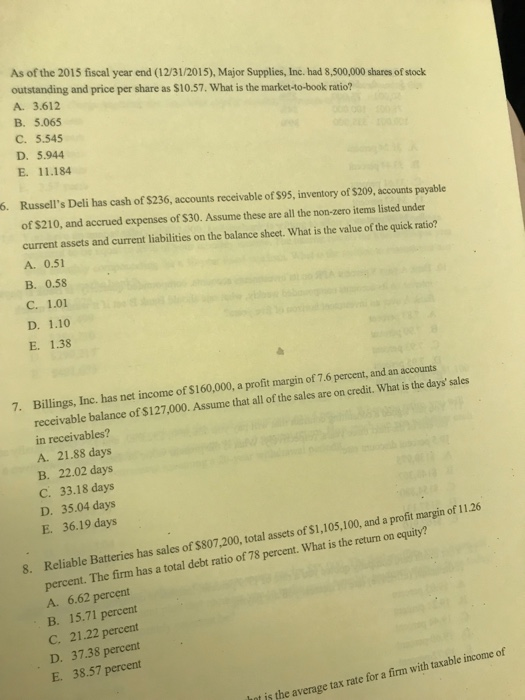

As of the 2015 fiscal year end (12/31/2015), Major Supplies, Inc. had 8,500,000 shares of stock outstanding and price per share as $10.57. What is the market-to-book ratio? A. 3.612 B. 5.065 C. 5.545 D. 5.944 E. 11.184 6. Russell's Deli has cash of $236, accounts receivable of $95, inventory of $209, accounts payable of $210, and accrued expenses of $30. Assume these are all the non-zero items listed under current assets and current liabilities on the balance sheet. What is the value of the quick ratio? A. 0.51 B. 0.58 C, 1.01 D. 1.10 E. 1.38 Billings, Inc. has net income of $160,000, a profit margin of 7.6 percent, and an accounts receivable balance of $127,000. Assume that all of the sales are on credit. What is the days' sales in receivables? A. 21.88 days B. 22.02 days C. 33.18 days D. 35.04 days E. 36.19 days 7. iable Batteries has sales of $807.200, tota percent. The firm has a total debt ratio of 78 percent. What is the A. 6.62 percent B. 15.71 percent C. 21.22 percent D. 37.38 percent E. 38.57 percent 8. Rel e Batteries has sales of $$07,.200, total assets of $1,105,100,and a proft margin of 1126 return on equity? is the average tax rate for a firm with taxable income of As of the 2015 fiscal year end (12/31/2015), Major Supplies, Inc. had 8,500,000 shares of stock outstanding and price per share as $10.57. What is the market-to-book ratio? A. 3.612 B. 5.065 C. 5.545 D. 5.944 E. 11.184 6. Russell's Deli has cash of $236, accounts receivable of $95, inventory of $209, accounts payable of $210, and accrued expenses of $30. Assume these are all the non-zero items listed under current assets and current liabilities on the balance sheet. What is the value of the quick ratio? A. 0.51 B. 0.58 C, 1.01 D. 1.10 E. 1.38 Billings, Inc. has net income of $160,000, a profit margin of 7.6 percent, and an accounts receivable balance of $127,000. Assume that all of the sales are on credit. What is the days' sales in receivables? A. 21.88 days B. 22.02 days C. 33.18 days D. 35.04 days E. 36.19 days 7. iable Batteries has sales of $807.200, tota percent. The firm has a total debt ratio of 78 percent. What is the A. 6.62 percent B. 15.71 percent C. 21.22 percent D. 37.38 percent E. 38.57 percent 8. Rel e Batteries has sales of $$07,.200, total assets of $1,105,100,and a proft margin of 1126 return on equity? is the average tax rate for a firm with taxable income of

All multiple choice questions needed.

All multiple choice questions needed.