Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. 11. Bob and Lyn were unrelated partners in the BL Partnership, Bob owning a 70 percent interest and Lyn all the rest. Bob

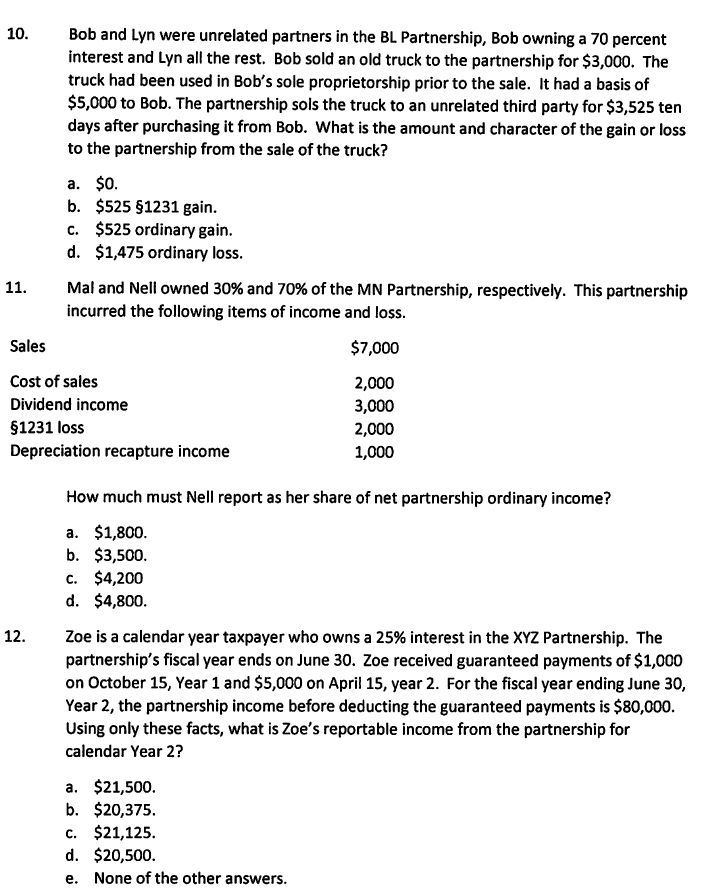

10. 11. Bob and Lyn were unrelated partners in the BL Partnership, Bob owning a 70 percent interest and Lyn all the rest. Bob sold an old truck to the partnership for $3,000. The truck had been used in Bob's sole proprietorship prior to the sale. It had a basis of $5,000 to Bob. The partnership sols the truck to an unrelated third party for $3,525 ten days after purchasing it from Bob. What is the amount and character of the gain or loss to the partnership from the sale of the truck? 12. a. $0. b. $525 1231 gain. c. $525 ordinary gain. d. $1,475 ordinary loss. Mal and Nell owned 30% and 70% of the MN Partnership, respectively. This partnership incurred the following items of income and loss. Sales Cost of sales Dividend income 1231 loss Depreciation recapture income How much must Nell report as her share of net partnership ordinary income? a. $1,800. b. $3,500. C. $4,200 d. $4,800. $7,000 2,000 3,000 2,000 1,000 Zoe is a calendar year taxpayer who owns a 25% interest in the XYZ Partnership. The partnership's fiscal year ends on June 30. Zoe received guaranteed payments of $1,000 on October 15, Year 1 and $5,000 on April 15, year 2. For the fiscal year ending June 30, Year 2, the partnership income before deducting the guaranteed payments is $80,000. Using only these facts, what is Zoe's reportable income from the partnership for calendar Year 2? a. $21,500. b. $20,375. C. $21,125. d. $20,500. e. None of the other answers.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

11 Mal and Nell owned 30 and 70 of the MN Partnership respectively This partnership incurred the fol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started