Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10 12. Using the sample of January 1990 through November 2022, what is the likelihood of losing more than 20% of your money in one

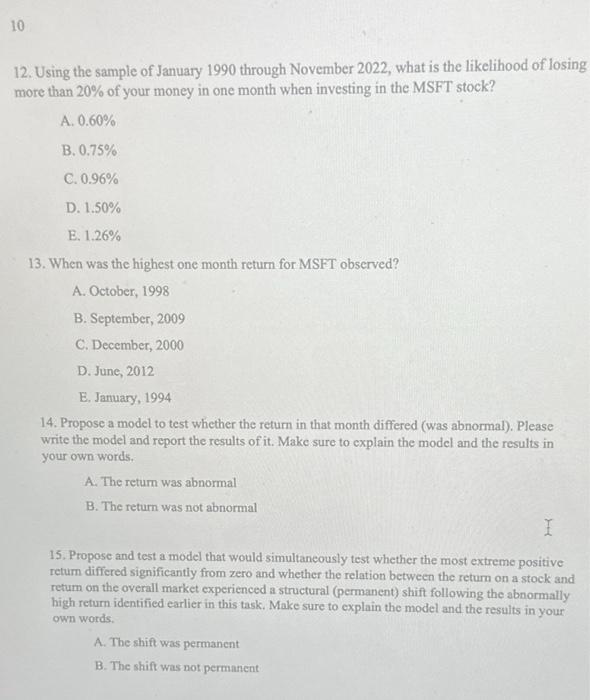

10 12. Using the sample of January 1990 through November 2022, what is the likelihood of losing more than 20% of your money in one month when investing in the MSFT stock? A. 0.60% B. 0.75% C. 0.96% D. 1.50% E. 1.26% 13. When was the highest one month return for MSFT observed? A. October, 1998 B. September, 2009 C. December, 2000 D. June, 2012 E. January, 1994 14. Propose a model to test whether the return in that month differed (was abnormal). Please write the model and report the results of it. Make sure to explain the model and the results in your own words. A. The return was abnormal B. The return was not abnormal I 15. Propose and test a model that would simultaneously test whether the most extreme positive return differed significantly from zero and whether the relation between the return on a stock and return on the overall market experienced a structural (permanent) shift following the abnormally high return identified earlier in this task. Make sure to explain the model and the results in your own words. A. The shift was permanent B. The shift was not permanent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started