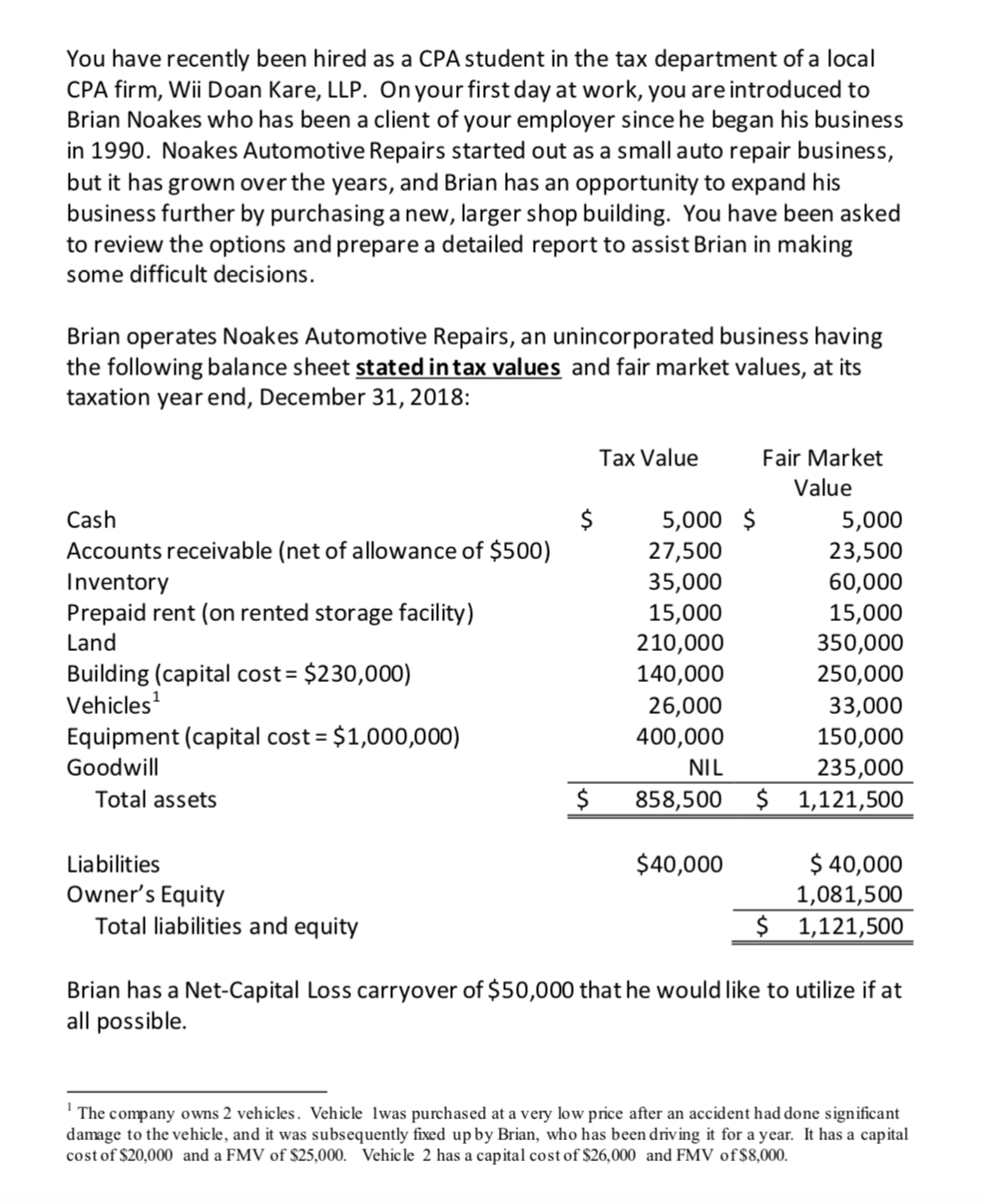

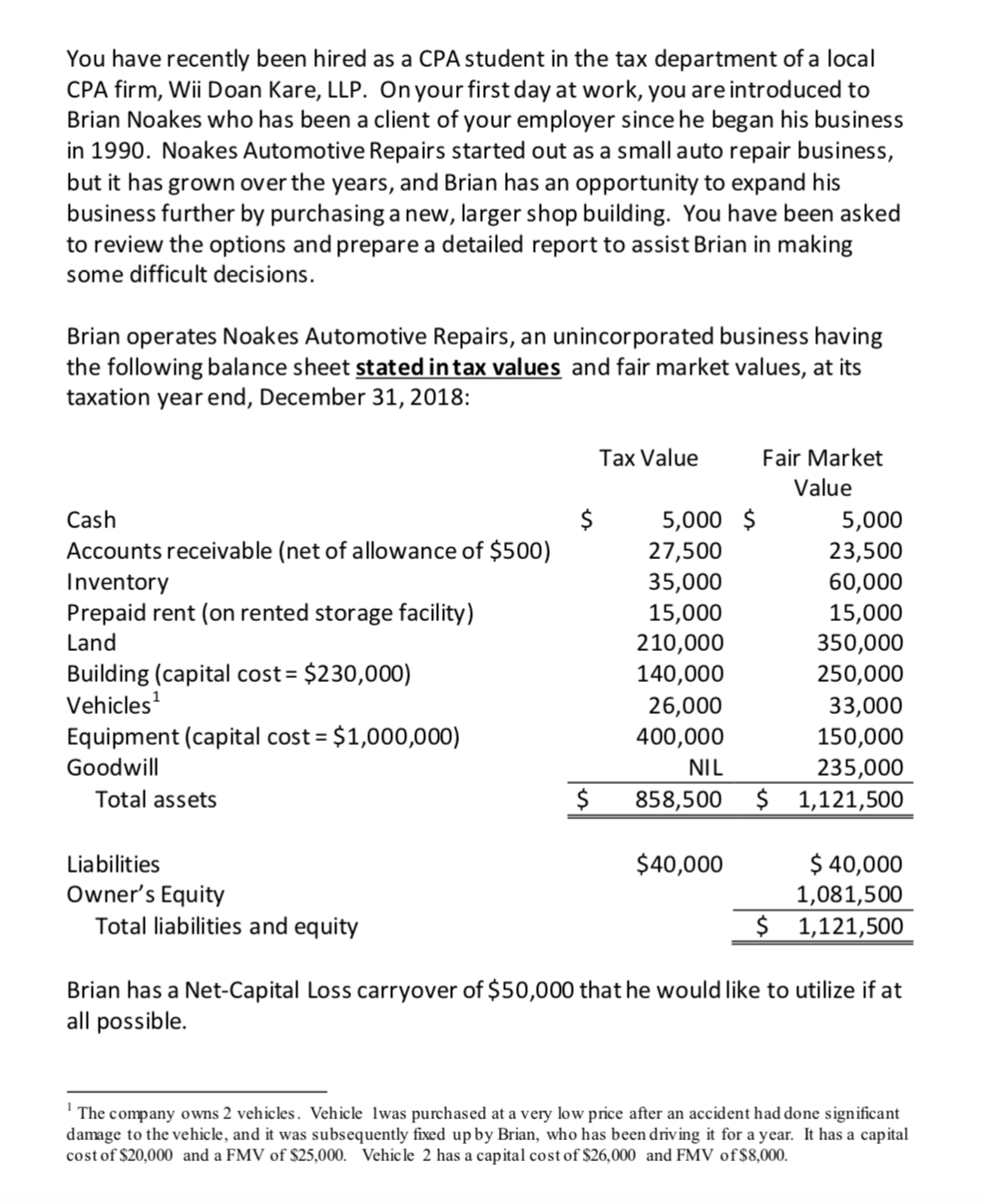

You have recently been hired as a CPA student in the tax department of a local CPA firm, Wii Doan Kare, LLP. On your first day at work, you are introduced to Brian Noakes who has been a client of your employer since he began his business in 1990. Noakes Automotive Repairs started out as a small auto repair business, but it has grown over the years, and Brian has an opportunity to expand his business further by purchasing a new, larger shop building. You have been asked to review the options and prepare a detailed report to assist Brian in making some difficult decisions. Brian operates Noakes Automotive Repairs, an unincorporated business having the following balance sheet stated in tax values and fair market values, at its taxation year end, December 31, 2018: Tax Value Cash Accounts receivable (net of allowance of $500) Inventory Prepaid rent (on rented storage facility) Land Building (capital cost = $230,000) Vehicles Equipment (capital cost = $1,000,000) Goodwill Total assets 5,000 27,500 35,000 15,000 210,000 140,000 26,000 400,000 NIL 858,500 Fair Market Value $ 5,000 23,500 60,000 15,000 350,000 250,000 33,000 150,000 235,000 $ 1,121,500 $40,000 Liabilities Owner's Equity Total liabilities and equity $ 40,000 1,081,500 1,121,500 $ Brian has a Net-Capital Loss carryover of $50,000 that he would like to utilize if at all possible. The company owns 2 vehicles. Vehicle lwas purchased at a very low price after an accident had done significant damage to the vehicle, and it was subsequently fixed up by Brian, who has been driving it for a year. It has a capital cost of $20,000 and a FMV of $25,000. Vehicle 2 has a capital cost of $26,000 and FMV of $8,000. Brian (age 50) has a wife, Connie (age 49) and a son, Shawn. Shawn is 17 and has demonstrated an interest in automotive repairs. Connie does the bookkeeping and manages the office for the business. She receives an annual salary from the business of $50,000, which is considered to be reasonable for the work she does. Shawn works in the shop on a part time basis, and earned $10,000 in 2018. It is expected that he could earn $20,000 in 2019, and that this level of pay would be consistent for Shawn for the next several years as he completes his education. Brian is one of four siblings. His parents own a local Honda dealership that each of the siblings had worked in while attending technical college. Recently Brian's parents completed an estate freeze transaction under ITA 86. As a result, Brian holds 25% of the common shares of this dealership. His father owns 100% of the non-voting preferred shares in the dealership with a value of $4 million. Brian expects that he will receive an annual dividend of $50,000 as a result of his shareholdings. The dealership is quite profitable, and has an annual active business income of $300,000. Brian is considering incorporating his business as Noakes Automotive Inc. He predicts that once the new premises are purchased the business will earn net income before salaries to the family members of approximately $225,000. For the next five years, the family will need all of the funds from the business in order to cover personal costs plus the dividend income mentioned in the preceding paragraph, however after five years, the mortgage on the family home will be paid off, and they would be able to leave about $50,000 in the business each year. Once the business is incorporated, Brian will sell his current land, building and equipment at FMV and then he will purchase the new facility in an industrial area close to one of his largest clients. The new property will cost $450,000 with $150,000 allocated to the land, and the balance to the building. New equipment will cost $150,000. Brian wonders if the shares he owns in the family Honda dealership would create any tax issues for his planned new corporation? He wonders if he should own these shares personally or if there would be a benefit of transferring them to his new corporation? Brian was at a local meeting of the Rotary Club last month and sat with some other small business owners. One of them explained to Brian that when they incorporated, they were able to bring in some of their family members as shareholders, and that it didn't cost the family members a significant amount, just a few dollars. Brian doesn't understand how this could be possible, because he feels his business is worth a considerable amount. He wouldn't mind having Connie as a partner in the business, particularly if there are tax savings to be had, and he feels that Shawn could become a partner in about 10 years. He would like to know how this could be considered in the planning that you are doing for him. The friend also told Brian that because of an expansion in the rules which used to be called Kiddie Tax, somehow these rules had an impact on the splitting of dividends from their corporation with adult family members now. Brian has asked you to look into this, and let him know if there's anything that will be affected in his new corporation by these rules, and if it has any applicability to his shares in the Honda dealership corporation. Brian, Connie and Shawn have no sources of income except those that are mentioned here. Brian lives in a province where the corporate tax rate on income eligible for the small business deduction is 2.5%, and on other income, the rate is 11%. The provincial dividend tax credit on non-eligible dividends is 6/18 of the gross up, and it is 4/11 of the gross up on eligible dividends. The provincial tax rate for individuals in Brian's province is a flat rate of 12%. Brian has specifically asked you to complete a detailed report written with full sentences in language that could be understood by a non-accountant. Brian is leaving tomorrow for a month to climb Mount McGinley in British Columbia, and he will be unavailable for questions. If there is any information you feel is missing, he suggests that you make a reasonable assumption, and explain your assumption in your report to him. Your report must contain at least the following: 1) A discussion of the tax related advantages and disadvantages of incorporation, including an analysis of the possible tax savings or cost associated with incorporating the business income now, or in the future. In this discussion, please also discuss whether or not there may be TOSI issues with Brian's plans relating to other family members' shares. 2) An explanation of any non-tax risks and benefits that could be experienced as a result of incorporating. 3) Your recommendation with respect to Brian's shares in the family car dealership, including potential TOSI issues. 4) A description of how family members could be brought into the new corporation, and any pitfalls that must be avoided: a. If Connie is brought into the business now b. If Shawn is brought into the business in 10 years. 5) A determination of which assets should not or cannot be transferred to a corporation under ITA 85. State the reasons why these assets cannot or should not be transferred under the rollover. If another section of the Act should be utilized for a particular asset, explain the benefits of doing so. If these assets are required in the corporation, how will Brian complete the transfer? 6) Calculate the transfer prices for the assets to be transferred under ITA 85 and the consideration to be received. If the transfer price results in income being triggered, calculate the amount that Brian will have to include in his income as a result of the transfer. The corporation will assume the liabilities of the proprietorship. Brian wants to make sure you complete this transfer in the most tax efficient way possible. He does not want any non-share consideration in excess of the liabilities the corporation will assume. He would also like any amount of debt that the corporation issues to be rounded to the nearest $100. 7) Calculate the ACB and PUC of the shares received by Brian in the transfer. 8) Compute the taxable capital gain on a subsequent sale of the common shares at $500,000. 9) Compute the tax consequences of redemption of the preferred shares by the corporation at $500,000. You have recently been hired as a CPA student in the tax department of a local CPA firm, Wii Doan Kare, LLP. On your first day at work, you are introduced to Brian Noakes who has been a client of your employer since he began his business in 1990. Noakes Automotive Repairs started out as a small auto repair business, but it has grown over the years, and Brian has an opportunity to expand his business further by purchasing a new, larger shop building. You have been asked to review the options and prepare a detailed report to assist Brian in making some difficult decisions. Brian operates Noakes Automotive Repairs, an unincorporated business having the following balance sheet stated in tax values and fair market values, at its taxation year end, December 31, 2018: Tax Value Cash Accounts receivable (net of allowance of $500) Inventory Prepaid rent (on rented storage facility) Land Building (capital cost = $230,000) Vehicles Equipment (capital cost = $1,000,000) Goodwill Total assets 5,000 27,500 35,000 15,000 210,000 140,000 26,000 400,000 NIL 858,500 Fair Market Value $ 5,000 23,500 60,000 15,000 350,000 250,000 33,000 150,000 235,000 $ 1,121,500 $40,000 Liabilities Owner's Equity Total liabilities and equity $ 40,000 1,081,500 1,121,500 $ Brian has a Net-Capital Loss carryover of $50,000 that he would like to utilize if at all possible. The company owns 2 vehicles. Vehicle lwas purchased at a very low price after an accident had done significant damage to the vehicle, and it was subsequently fixed up by Brian, who has been driving it for a year. It has a capital cost of $20,000 and a FMV of $25,000. Vehicle 2 has a capital cost of $26,000 and FMV of $8,000. Brian (age 50) has a wife, Connie (age 49) and a son, Shawn. Shawn is 17 and has demonstrated an interest in automotive repairs. Connie does the bookkeeping and manages the office for the business. She receives an annual salary from the business of $50,000, which is considered to be reasonable for the work she does. Shawn works in the shop on a part time basis, and earned $10,000 in 2018. It is expected that he could earn $20,000 in 2019, and that this level of pay would be consistent for Shawn for the next several years as he completes his education. Brian is one of four siblings. His parents own a local Honda dealership that each of the siblings had worked in while attending technical college. Recently Brian's parents completed an estate freeze transaction under ITA 86. As a result, Brian holds 25% of the common shares of this dealership. His father owns 100% of the non-voting preferred shares in the dealership with a value of $4 million. Brian expects that he will receive an annual dividend of $50,000 as a result of his shareholdings. The dealership is quite profitable, and has an annual active business income of $300,000. Brian is considering incorporating his business as Noakes Automotive Inc. He predicts that once the new premises are purchased the business will earn net income before salaries to the family members of approximately $225,000. For the next five years, the family will need all of the funds from the business in order to cover personal costs plus the dividend income mentioned in the preceding paragraph, however after five years, the mortgage on the family home will be paid off, and they would be able to leave about $50,000 in the business each year. Once the business is incorporated, Brian will sell his current land, building and equipment at FMV and then he will purchase the new facility in an industrial area close to one of his largest clients. The new property will cost $450,000 with $150,000 allocated to the land, and the balance to the building. New equipment will cost $150,000. Brian wonders if the shares he owns in the family Honda dealership would create any tax issues for his planned new corporation? He wonders if he should own these shares personally or if there would be a benefit of transferring them to his new corporation? Brian was at a local meeting of the Rotary Club last month and sat with some other small business owners. One of them explained to Brian that when they incorporated, they were able to bring in some of their family members as shareholders, and that it didn't cost the family members a significant amount, just a few dollars. Brian doesn't understand how this could be possible, because he feels his business is worth a considerable amount. He wouldn't mind having Connie as a partner in the business, particularly if there are tax savings to be had, and he feels that Shawn could become a partner in about 10 years. He would like to know how this could be considered in the planning that you are doing for him. The friend also told Brian that because of an expansion in the rules which used to be called Kiddie Tax, somehow these rules had an impact on the splitting of dividends from their corporation with adult family members now. Brian has asked you to look into this, and let him know if there's anything that will be affected in his new corporation by these rules, and if it has any applicability to his shares in the Honda dealership corporation. Brian, Connie and Shawn have no sources of income except those that are mentioned here. Brian lives in a province where the corporate tax rate on income eligible for the small business deduction is 2.5%, and on other income, the rate is 11%. The provincial dividend tax credit on non-eligible dividends is 6/18 of the gross up, and it is 4/11 of the gross up on eligible dividends. The provincial tax rate for individuals in Brian's province is a flat rate of 12%. Brian has specifically asked you to complete a detailed report written with full sentences in language that could be understood by a non-accountant. Brian is leaving tomorrow for a month to climb Mount McGinley in British Columbia, and he will be unavailable for questions. If there is any information you feel is missing, he suggests that you make a reasonable assumption, and explain your assumption in your report to him. Your report must contain at least the following: 1) A discussion of the tax related advantages and disadvantages of incorporation, including an analysis of the possible tax savings or cost associated with incorporating the business income now, or in the future. In this discussion, please also discuss whether or not there may be TOSI issues with Brian's plans relating to other family members' shares. 2) An explanation of any non-tax risks and benefits that could be experienced as a result of incorporating. 3) Your recommendation with respect to Brian's shares in the family car dealership, including potential TOSI issues. 4) A description of how family members could be brought into the new corporation, and any pitfalls that must be avoided: a. If Connie is brought into the business now b. If Shawn is brought into the business in 10 years. 5) A determination of which assets should not or cannot be transferred to a corporation under ITA 85. State the reasons why these assets cannot or should not be transferred under the rollover. If another section of the Act should be utilized for a particular asset, explain the benefits of doing so. If these assets are required in the corporation, how will Brian complete the transfer? 6) Calculate the transfer prices for the assets to be transferred under ITA 85 and the consideration to be received. If the transfer price results in income being triggered, calculate the amount that Brian will have to include in his income as a result of the transfer. The corporation will assume the liabilities of the proprietorship. Brian wants to make sure you complete this transfer in the most tax efficient way possible. He does not want any non-share consideration in excess of the liabilities the corporation will assume. He would also like any amount of debt that the corporation issues to be rounded to the nearest $100. 7) Calculate the ACB and PUC of the shares received by Brian in the transfer. 8) Compute the taxable capital gain on a subsequent sale of the common shares at $500,000. 9) Compute the tax consequences of redemption of the preferred shares by the corporation at $500,000