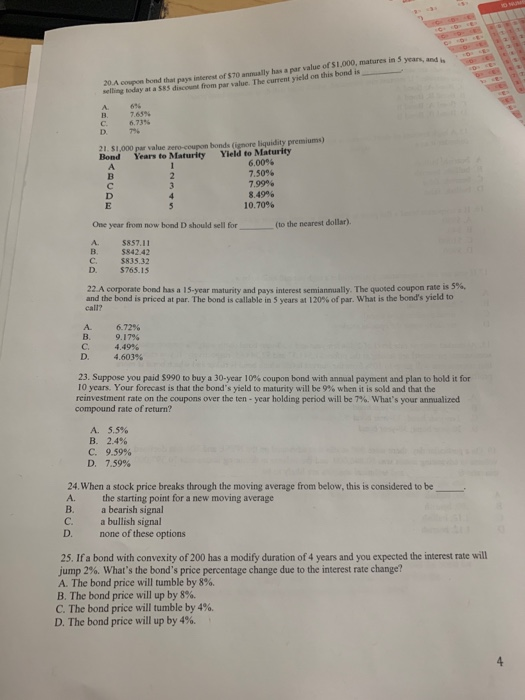

- 10. A coupon bond that pays interest of 570 annually has a par value of 51.000, matures in 5 years selling today at a 585 discount from par value. The current yield on this bond is 6,73% 21. 51.000 par value zero-coupon bonds (nore liquidity premiums) Bond Years to Maturity Yield to Maturity 6.0096 7.5096 7.99% 8.4996 10.70% One year from now hond D should sell for to the nearest dollar). 5857.11 5842.42 5835.32 $765.15 22. A corporate bond has a 15-year maturity and pays interest semiannually. The quoted coupon rate is 56, and the bond is priced at par. The bond is callable in 5 years at 120% of par. What is the bond's yield to call? A B 6.72% 9.1 796 4.49% 4.603% D 23. Suppose you paid $990 to buy a 30-year 10% coupon bond with annual payment and plan to hold it for 10 years. Your forecast is that the bond's yield to maturity will be 9% when it is sold and that the reinvestment rate on the coupons over the ten-year holding period will be 7%. What's your annualized compound rate of return? A. S.5% B. 2.4% C. 9.59% D7.59% 24. When a stock price breaks through the moving average from below, this is considered to be the starting point for a new moving average B. a bearish signal . a bullish signal D. none of these options 25. If a bond with convexity of 200 has a modify duration of 4 years and you expected the interest rate will jump 2%. What's the bond's price percentage change due to the interest rate change! A. The bond price will tumble by 8%. B. The bond price will up by 8%. C. The bond price will tumble by 4%. D. The bond price will up by 4%. - 10. A coupon bond that pays interest of 570 annually has a par value of 51.000, matures in 5 years selling today at a 585 discount from par value. The current yield on this bond is 6,73% 21. 51.000 par value zero-coupon bonds (nore liquidity premiums) Bond Years to Maturity Yield to Maturity 6.0096 7.5096 7.99% 8.4996 10.70% One year from now hond D should sell for to the nearest dollar). 5857.11 5842.42 5835.32 $765.15 22. A corporate bond has a 15-year maturity and pays interest semiannually. The quoted coupon rate is 56, and the bond is priced at par. The bond is callable in 5 years at 120% of par. What is the bond's yield to call? A B 6.72% 9.1 796 4.49% 4.603% D 23. Suppose you paid $990 to buy a 30-year 10% coupon bond with annual payment and plan to hold it for 10 years. Your forecast is that the bond's yield to maturity will be 9% when it is sold and that the reinvestment rate on the coupons over the ten-year holding period will be 7%. What's your annualized compound rate of return? A. S.5% B. 2.4% C. 9.59% D7.59% 24. When a stock price breaks through the moving average from below, this is considered to be the starting point for a new moving average B. a bearish signal . a bullish signal D. none of these options 25. If a bond with convexity of 200 has a modify duration of 4 years and you expected the interest rate will jump 2%. What's the bond's price percentage change due to the interest rate change! A. The bond price will tumble by 8%. B. The bond price will up by 8%. C. The bond price will tumble by 4%. D. The bond price will up by 4%