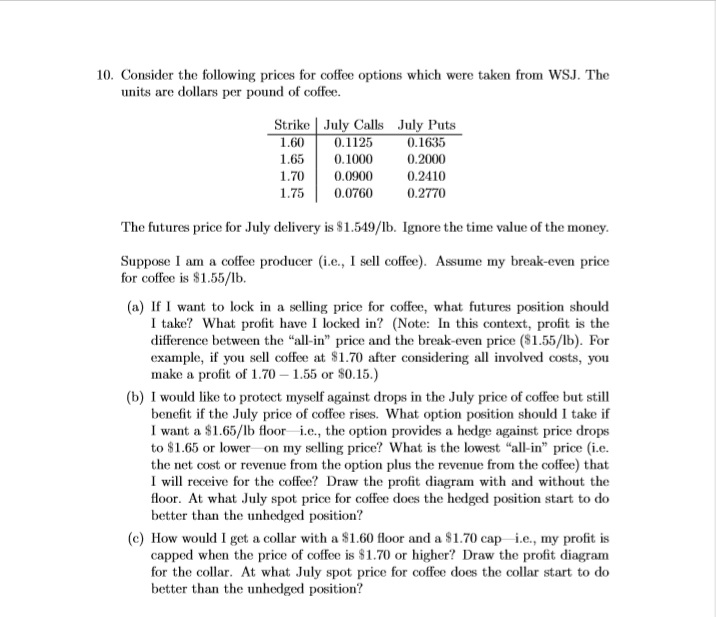

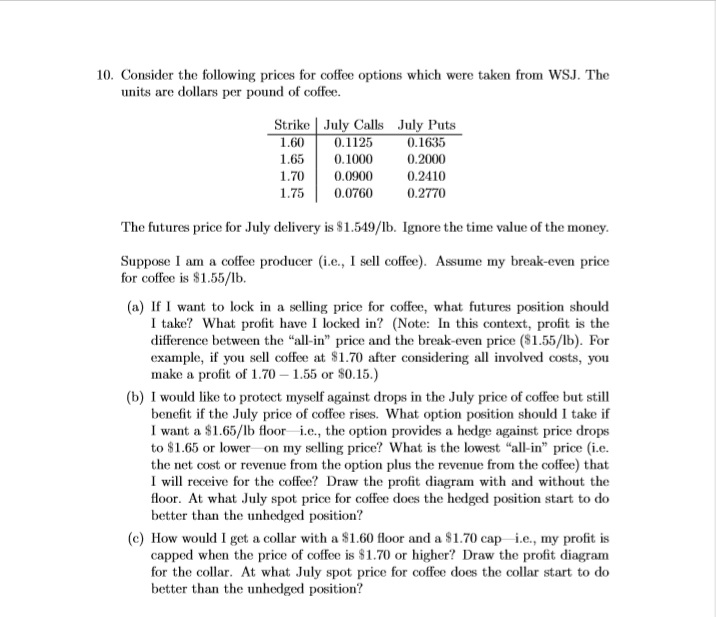

10. Consider the following prices for coffee options which were taken from WSJ. The units are dollars per pound of coffee. Strike July Calls 1.60 0.1125 1.65 0.1000 1.700 .0900 1.75 0.0760 July Puts 0.1635 0.2000 0.2410 0.2770 The futures price for July delivery is $1.549/lb. Ignore the time value of the money. Suppose I am a coffee producer i.e., I sell coffee). Assume my break-even price for coffee is $1.55/Ib. (a) If I want to lock in a selling price for coffee, what futures position should I take? What profit have I locked in? (Note: In this context, profit is the difference between the "all-in" price and the break-even price ($1.55/1b). For example, if you sell coffee at $1.70 after considering all involved costs, you make a profit of 1.70 - 1.55 or $0.15.) (b) I would like to protect myself against drops in the July price of coffee but still benefit if the July price of coffee rises. What option position should I take if I want a $1.65/Ib floor i.e., the option provides a hedge against price drops to $1.65 or lower on my selling price? What is the lowest "all-in" price (i.e. the net cost or revenue from the option plus the revenue from the coffee) that I will receive for the coffee? Draw the profit diagram with and without the floor. At what July spot price for coffee does the hedged position start to do better than the unhedged position? (c) How would I get a collar with a $1.60 floor and a $1.70 cap i.e., my profit is capped when the price of coffee is $1.70 or higher? Draw the profit diagram for the collar. At what July spot price for coffee does the collar start to do better than the unhedged position? 10. Consider the following prices for coffee options which were taken from WSJ. The units are dollars per pound of coffee. Strike July Calls 1.60 0.1125 1.65 0.1000 1.700 .0900 1.75 0.0760 July Puts 0.1635 0.2000 0.2410 0.2770 The futures price for July delivery is $1.549/lb. Ignore the time value of the money. Suppose I am a coffee producer i.e., I sell coffee). Assume my break-even price for coffee is $1.55/Ib. (a) If I want to lock in a selling price for coffee, what futures position should I take? What profit have I locked in? (Note: In this context, profit is the difference between the "all-in" price and the break-even price ($1.55/1b). For example, if you sell coffee at $1.70 after considering all involved costs, you make a profit of 1.70 - 1.55 or $0.15.) (b) I would like to protect myself against drops in the July price of coffee but still benefit if the July price of coffee rises. What option position should I take if I want a $1.65/Ib floor i.e., the option provides a hedge against price drops to $1.65 or lower on my selling price? What is the lowest "all-in" price (i.e. the net cost or revenue from the option plus the revenue from the coffee) that I will receive for the coffee? Draw the profit diagram with and without the floor. At what July spot price for coffee does the hedged position start to do better than the unhedged position? (c) How would I get a collar with a $1.60 floor and a $1.70 cap i.e., my profit is capped when the price of coffee is $1.70 or higher? Draw the profit diagram for the collar. At what July spot price for coffee does the collar start to do better than the unhedged position