Answered step by step

Verified Expert Solution

Question

1 Approved Answer

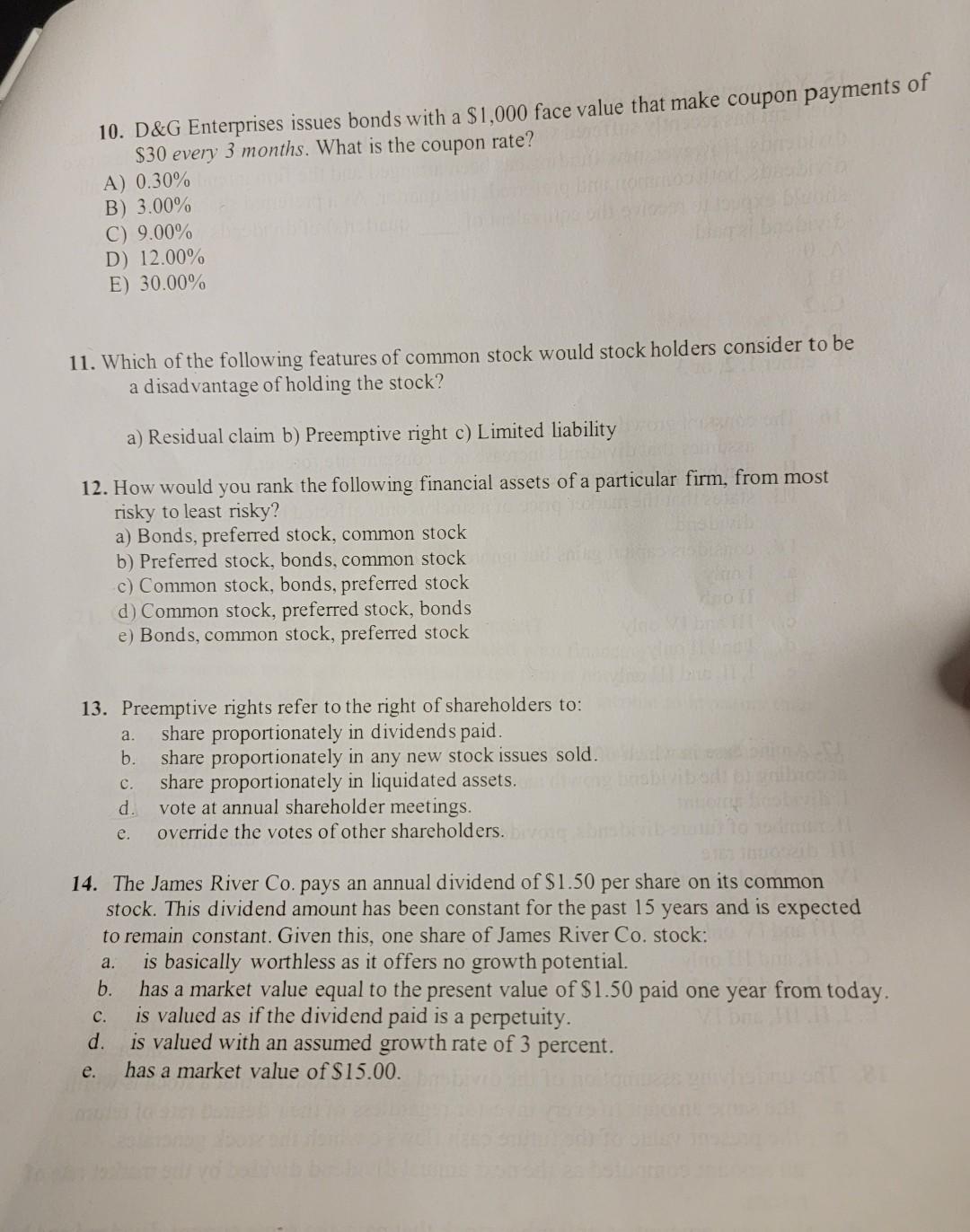

10. D&G Enterprises issues bonds with a $1,000 face value that make coupon payments of $30 every 3 months. What is the coupon rate? A)

10. D\&G Enterprises issues bonds with a $1,000 face value that make coupon payments of $30 every 3 months. What is the coupon rate? A) 0.30% B) 3.00% C) 9.00% D) 12.00% E) 30.00% 11. Which of the following features of common stock would stock holders consider to be a disad vantage of holding the stock? a) Residual claim b) Preemptive right c) Limited liability 12. How would you rank the following financial assets of a particular firm, from most risky to least risky? a) Bonds, preferred stock, common stock b) Preferred stock, bonds, common stock c) Common stock, bonds, preferred stock d) Common stock, preferred stock, bonds e) Bonds, common stock, preferred stock 13. Preemptive rights refer to the right of shareholders to: a. share proportionately in dividends paid. b. share proportionately in any new stock issues sold. c. share proportionately in liquidated assets. d. vote at annual shareholder meetings. e. override the votes of other shareholders. 14. The James River Co. pays an annual dividend of $1.50 per share on its common stock. This dividend amount has been constant for the past 15 years and is expected to remain constant. Given this, one share of James River Co. stock: a. is basically worthless as it offers no growth potential. b. has a market value equal to the present value of $1.50 paid one year from today. c. is valued as if the dividend paid is a perpetuity. d. is valued with an assumed growth rate of 3 percent. e. has a market value of $15.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started