Answered step by step

Verified Expert Solution

Question

1 Approved Answer

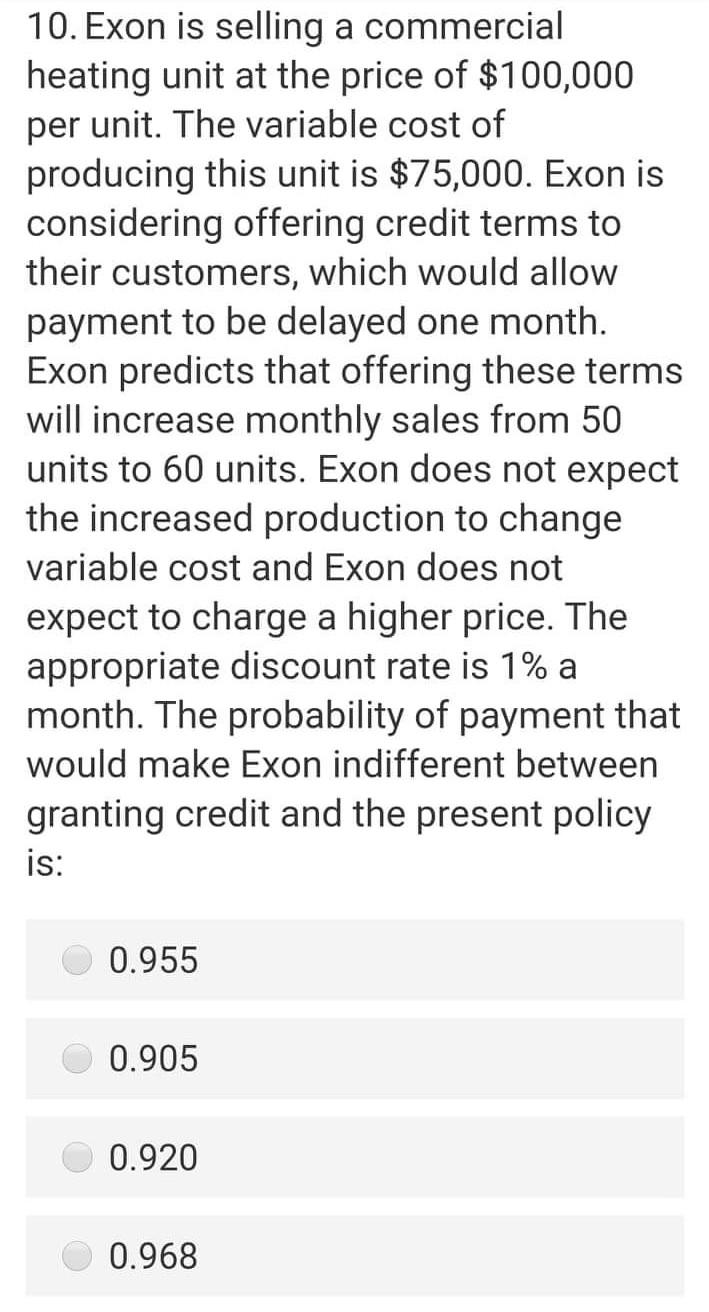

10. Exon is selling a commercial heating unit at the price of $100,000 per unit. The variable cost of producing this unit is $75,000. Exon

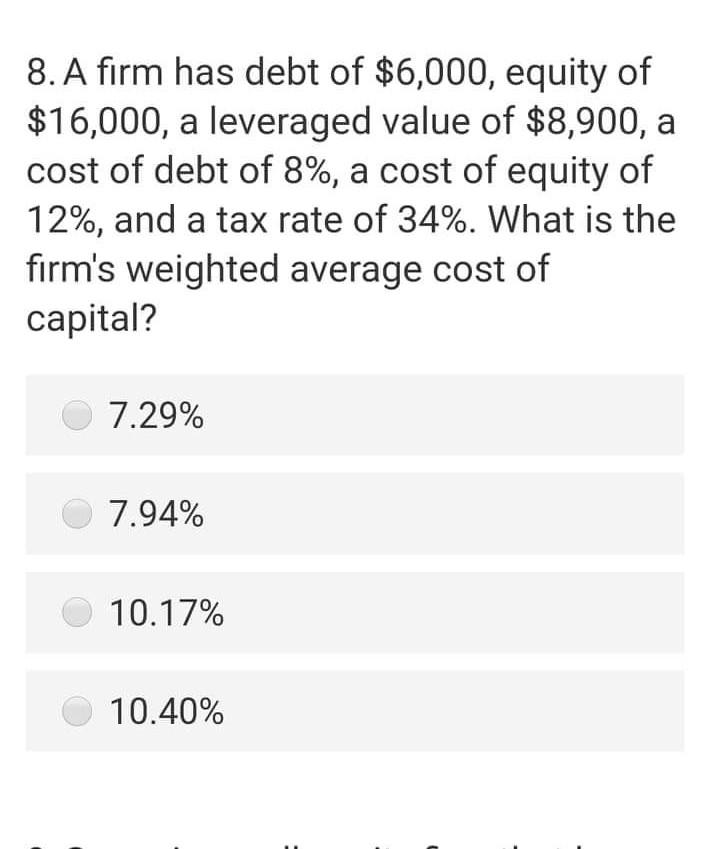

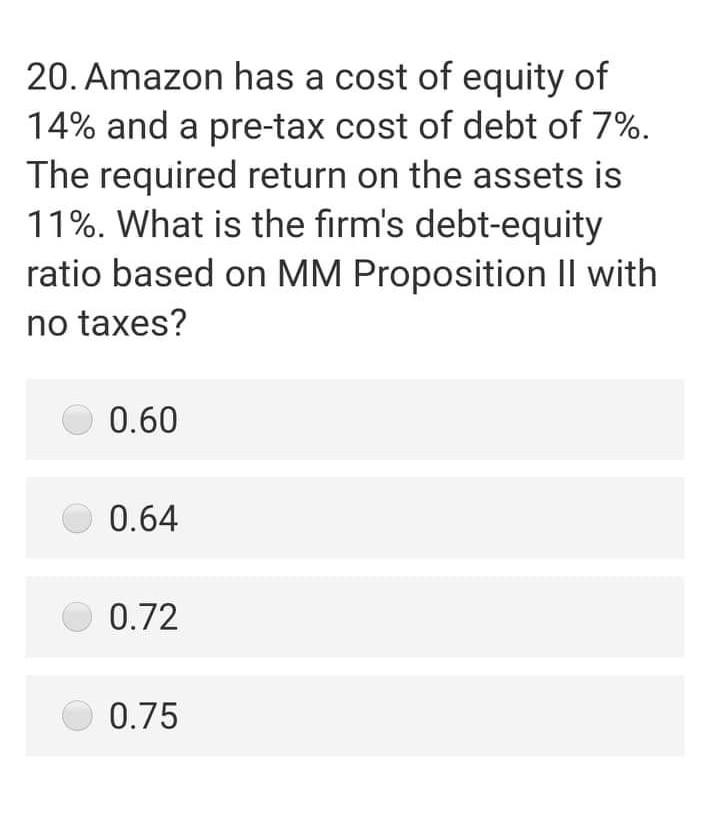

10. Exon is selling a commercial heating unit at the price of $100,000 per unit. The variable cost of producing this unit is $75,000. Exon is considering offering credit terms to their customers, which would allow payment to be delayed one month. Exon predicts that offering these terms will increase monthly sales from 50 units to 60 units. Exon does not expect the increased production to change variable cost and Exon does not expect to charge a higher price. The appropriate discount rate is 1% a month. The probability of payment that would make Exon indifferent between granting credit and the present policy is: 0.955 0.905 0.920 0.968 8. A firm has debt of $6,000, equity of $16,000, a leveraged value of $8,900, a cost of debt of 8%, a cost of equity of 12%, and a tax rate of 34%. What is the firm's weighted average cost of capital? 7.29% 7.94% 10.17% 10.40% 20. Amazon has a cost of equity of 14% and a pre-tax cost of debt of 7%. The required return on the assets is 11%. What is the firm's debt-equity ratio based on MM Proposition II with no taxes? 0.60 0.64 0.72 0.75

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started