Answered step by step

Verified Expert Solution

Question

1 Approved Answer

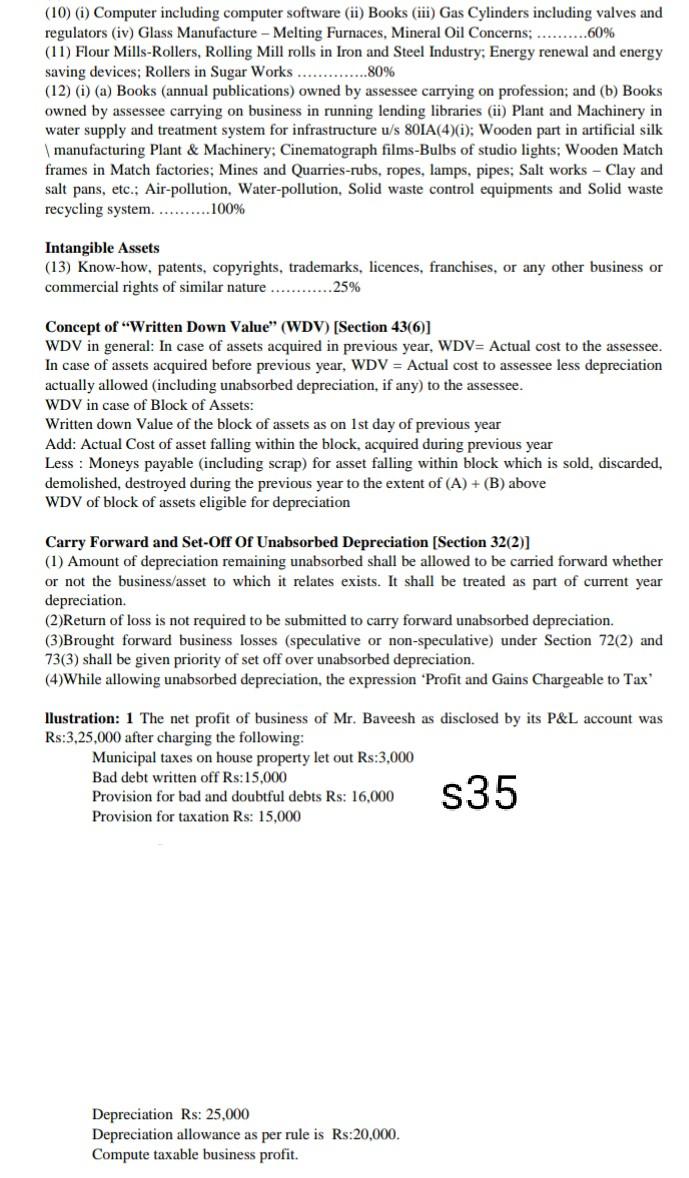

(10) (i) Computer including computer software (ii) Books (iii) Gas Cylinders including valves and regulators (iv) Glass Manufacture - Melting Furnaces, Mineral Oil Concerns; ..........60%

(10) (i) Computer including computer software (ii) Books (iii) Gas Cylinders including valves and regulators (iv) Glass Manufacture - Melting Furnaces, Mineral Oil Concerns; ..........60% (11) Flour Mills-Rollers, Rolling Mill rolls in Iron and Steel Industry: Energy renewal and energy saving devices; Rollers in Sugar Works ..............80% (12) (i) (a) Books (annual publications) owned by assessee carrying on profession; and (b) Books owned by assessee carrying on business in running lending libraries (ii) Plant and Machinery in water supply and treatment system for infrastructure u/s 801A(4)(i): Wooden part in artificial silk manufacturing Plant & Machinery: Cinematograph films-Bulbs of studio lights: Wooden Match frames in Match factories; Mines and Quarries-rubs, ropes, lamps, pipes; Salt works - Clay and salt pans, etc.; Air-pollution, Water-pollution, Solid waste control equipments and Solid waste recycling system. .......... 100% Intangible Assets (13) Know-how, patents, copyrights, trademarks, licences, franchises, or any other business or commercial rights of similar nature 25% Concept of "Written Down Value (WDV) [Section 43(6)] WDV in general: In case of assets acquired in previous year, WDV= Actual cost to the assessee. In case of assets acquired before previous year, WDV = Actual cost to assessee less depreciation actually allowed (including unabsorbed depreciation, if any) to the assessee. WDV in case of Block of Assets: Written down Value of the block of assets as on 1st day of previous year Add: Actual Cost of asset falling within the block, acquired during previous year Less : Moneys payable (including scrap) for asset falling within block which is sold, discarded demolished, destroyed during the previous year to the extent of (A) + (B) above WDV of block of assets eligible for depreciation Carry Forward and Set-Off Of Unabsorbed Depreciation (Section 32(2)] (1) Amount of depreciation remaining unabsorbed shall be allowed to be carried forward whether or not the business/asset to which it relates exists. It shall be treated as part of current year depreciation. (2)Return of loss is not required to be submitted to carry forward unabsorbed depreciation. (3)Brought forward business losses (speculative or non-speculative) under Section 72(2) and 73(3) shall be given priority of set off over unabsorbed depreciation. (4)While allowing unabsorbed depreciation, the expression Profit and Gains Chargeable to Tax llustration: 1 The net profit of business of Mr. Baveesh as disclosed by its P&L account was Rs:3,25,000 after charging the following: Municipal taxes on house property let out Rs:3,000 Bad debt written off Rs:15,000 Provision for bad and doubtful debts Rs: 16,000 Provision for taxation Rs: 15,000 s35 Depreciation Rs: 25,000 Depreciation allowance as per rule is Rs:20,000. Compute taxable business profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started