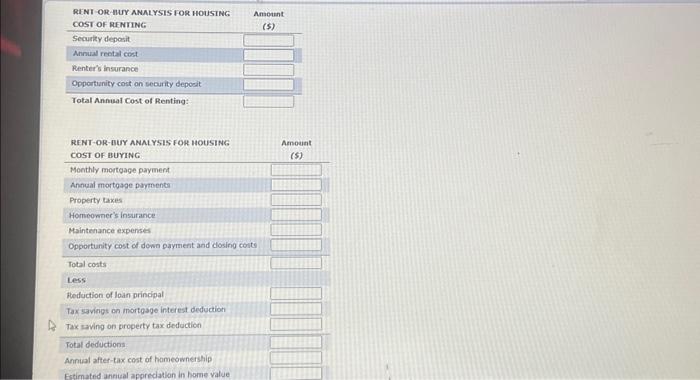

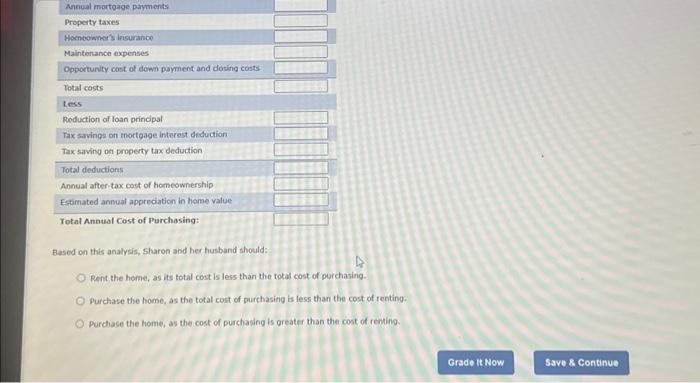

10. Kent versirs buy analvsis - Part ? Which is better: to rent or to bury? The Jechlon of whether to rent or buy housing is a personal decision that is based en both vour Mestvle and your finances: While most firandial experts argue that the finandal aspect of the decision is important, is is also important not to base your rent on tur decision solely on the numbers. Your personal needs and housing market conditions are important. However, it is stitl necessary to perform the financiat analysis, sharon and her husband are trying to decide whether to rent er to purchase a new row house. Ater lobilog for several months, therive nartewed their choice down to one particular house, and the bulder is waling to lease er sell-depending upon the preference of the burer. To perform a rent-or bur anylais, shureo and her hustand have collected the fallowno information: - If they rent, the builder will require monthly rental porments of $1,100 and a securitr deposit equal to two months of tent. - Since ther want to he protected spainst the possible loss of thei possessions, ther will purchase a renters' policy of 1200 even ser montios, while a more comprehensive homeowrers' podicy will cost o.5\% of the homes value per rear. home s down payment and closing costs alse incur an opporturity cost. term of 30 years, and monkthr payments if $743. The dosing costs associated with the house s mortgage wil be $3,500. respectively. - Vour ordinary income is taxed at the rate of 28% and vouli bet wing to itemize your tax deductices in the event that your purchase your new home. Based on this analysis, sharon and her husband should: Rent the home, as its total cost is less than the total cost of purchasing. Purchase the home, as the totat cost of purchasing ls fess than the cost of renting. Purchase the home, as the cost of purchasing is greater than the cost of renting. RINT OR-HUY ANALYSIS FOR HOUSING Amount COST OF RENTINE: (s) security depesit. (s) Annual reotal cost. Renter's insurance Oppertunity cost on security depoet Total Annual Cost of Renting: RENT-OR-DUY ANALYSIS FOR NOUSINS Amount cost OF BurinG. (s) Monthly mortgage parment Annual mortosoe parmenta Property taxes Homeowner's insurance Maintenance expenses Opportunity cost of down payment and closing costs Total costs Less: fleduction of Ioan principal Tax savings on inortgage interest deduction Tax saving on property tax deduction Total deductions Annial after-tax cost of hameownership Fstimated uneual appreciation in home value