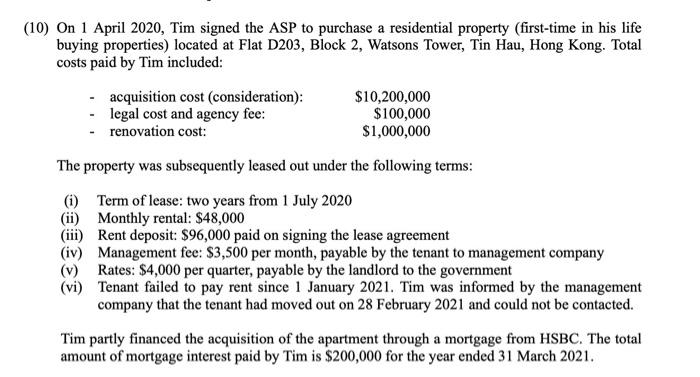

(10) On 1 April 2020, Tim signed the ASP to purchase a residential property (first-time in his life buying properties) located at Flat D203, Block 2, Watsons Tower, Tin Hau, Hong Kong. Total costs paid by Tim included: acquisition cost (consideration): $10,200,000 legal cost and agency fee: $100,000 - renovation cost: $1,000,000 The property was subsequently leased out under the following terms: (1) Term of lease: two years from 1 July 2020 (ii) Monthly rental: $48,000 (iii) Rent deposit: $96,000 paid on signing the lease agreement (iv) Management fee: $3,500 per month, payable by the tenant to management company (v) Rates: $4,000 per quarter, payable by the landlord to the government (vi) Tenant failed to pay rent since 1 January 2021. Tim was informed by the management company that the tenant had moved out on 28 February 2021 and could not be contacted. Tim partly financed the acquisition of the apartment through a mortgage from HSBC. The total amount of mortgage interest paid by Tim is $200,000 for the year ended 31 March 2021. (iv) Stamp Duty Payable by Tim on the ASP, with respect to the acquisition o property by Tim. (10) On 1 April 2020, Tim signed the ASP to purchase a residential property (first-time in his life buying properties) located at Flat D203, Block 2, Watsons Tower, Tin Hau, Hong Kong. Total costs paid by Tim included: acquisition cost (consideration): $10,200,000 legal cost and agency fee: $100,000 - renovation cost: $1,000,000 The property was subsequently leased out under the following terms: (1) Term of lease: two years from 1 July 2020 (ii) Monthly rental: $48,000 (iii) Rent deposit: $96,000 paid on signing the lease agreement (iv) Management fee: $3,500 per month, payable by the tenant to management company (v) Rates: $4,000 per quarter, payable by the landlord to the government (vi) Tenant failed to pay rent since 1 January 2021. Tim was informed by the management company that the tenant had moved out on 28 February 2021 and could not be contacted. Tim partly financed the acquisition of the apartment through a mortgage from HSBC. The total amount of mortgage interest paid by Tim is $200,000 for the year ended 31 March 2021. (iv) Stamp Duty Payable by Tim on the ASP, with respect to the acquisition o property by Tim