Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10) On January 1, 20X8, Pierce Corporation acquired 90 percent of Sharp Company's voting stock, at underlying book value. The fair value of the noncontrolling

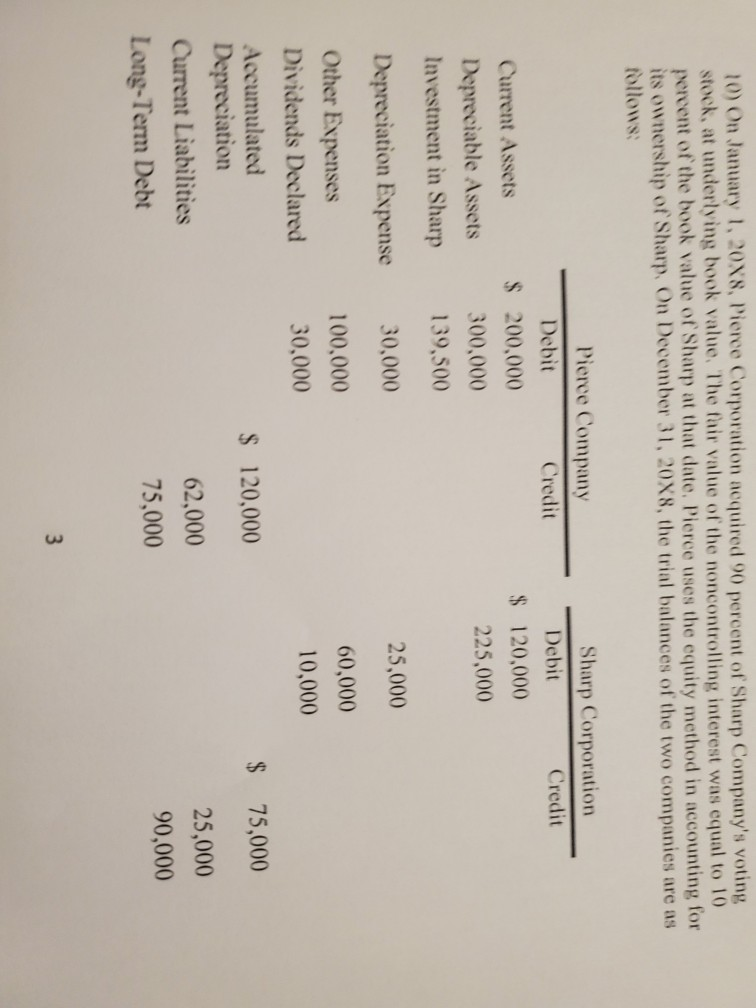

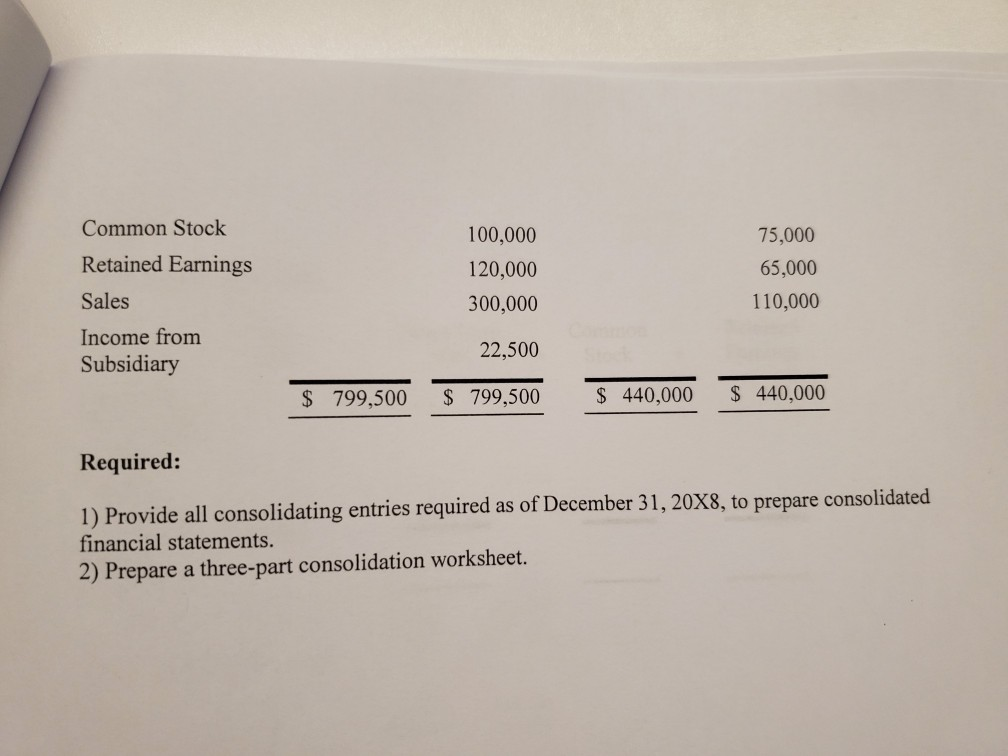

10) On January 1, 20X8, Pierce Corporation acquired 90 percent of Sharp Company's voting stock, at underlying book value. The fair value of the noncontrolling interest was equal to 10 percent of the book value of Sharp at that date. Pierce uses the equity method in accounting for its ownership of Sharp. On December 31, 20X8, the trial balances of the two companies are as follows: Pierce Company Debit Credit $ 200,000 300,000 139,500 Sharp Corporation Debit Credit $ 120,000 225.000 Current Assets Depreciable Assets Investment in Sharp 25,000 Depreciation Expense 30,000 60,000 100,000 30,000 10,000 $ 120,000 $ 75,000 Other Expenses Dividends Declared Accumulated Depreciation Current Liabilities Long-Term Debt 25,000 62,000 75,000 90,000 Common Stock Retained Earnings Sales Income from Subsidiary 100,000 120,000 300,000 75,000 65,000 110,000 22,500 $ 799,500 $ 799,500 $ 440,000 $ 440,000 Required: 1) Provide all consolidating entries required as of December 31, 20X8, to prepare consolidated financial statements. 2) Prepare a three-part consolidation worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started