Answered step by step

Verified Expert Solution

Question

1 Approved Answer

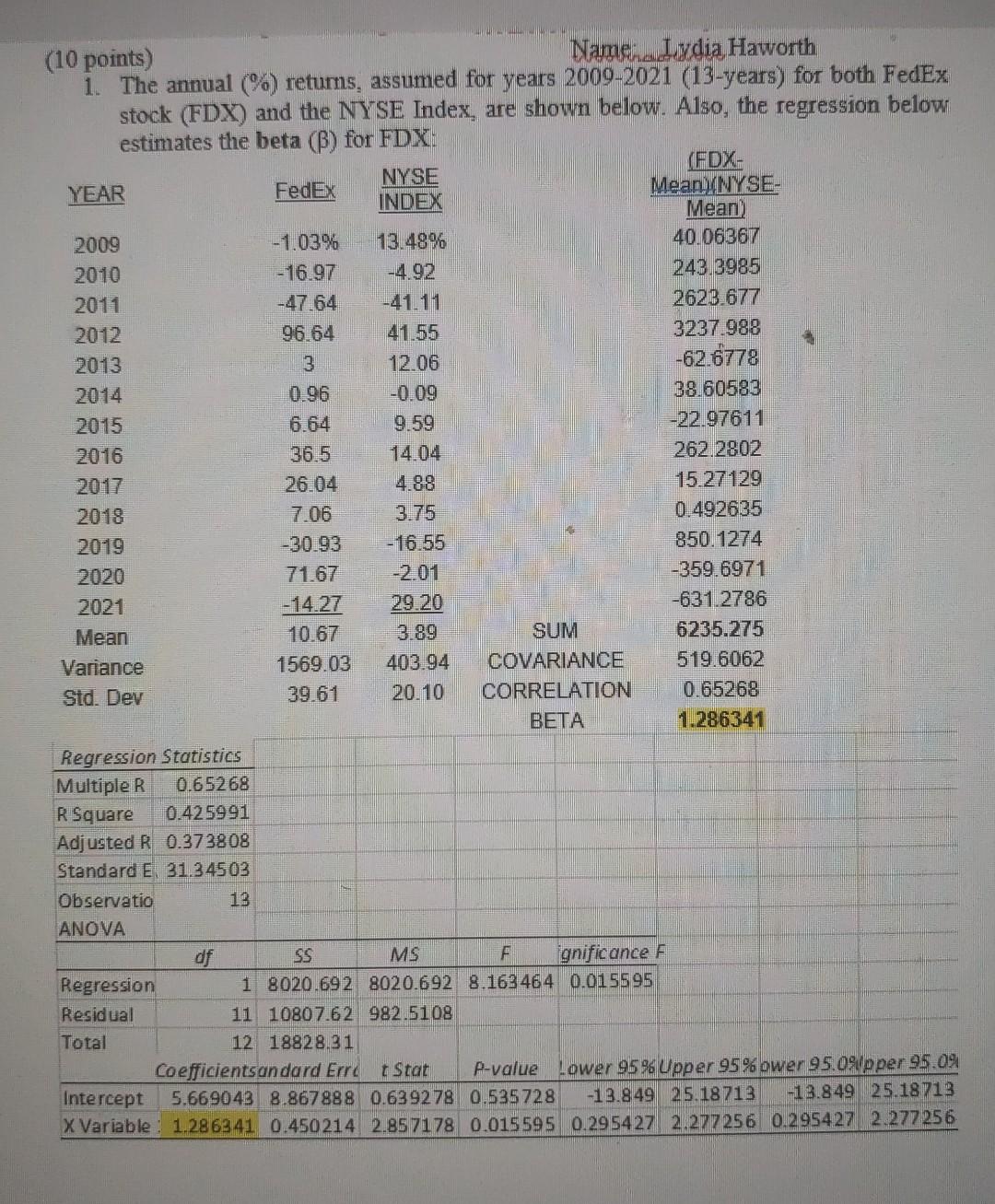

(10 points) Namena Lydia Haworth 1. The annual (%) retums, assumed for years 2009-2021 (13-years) for both FedEx stock (FDX) and the NYSE Index, are

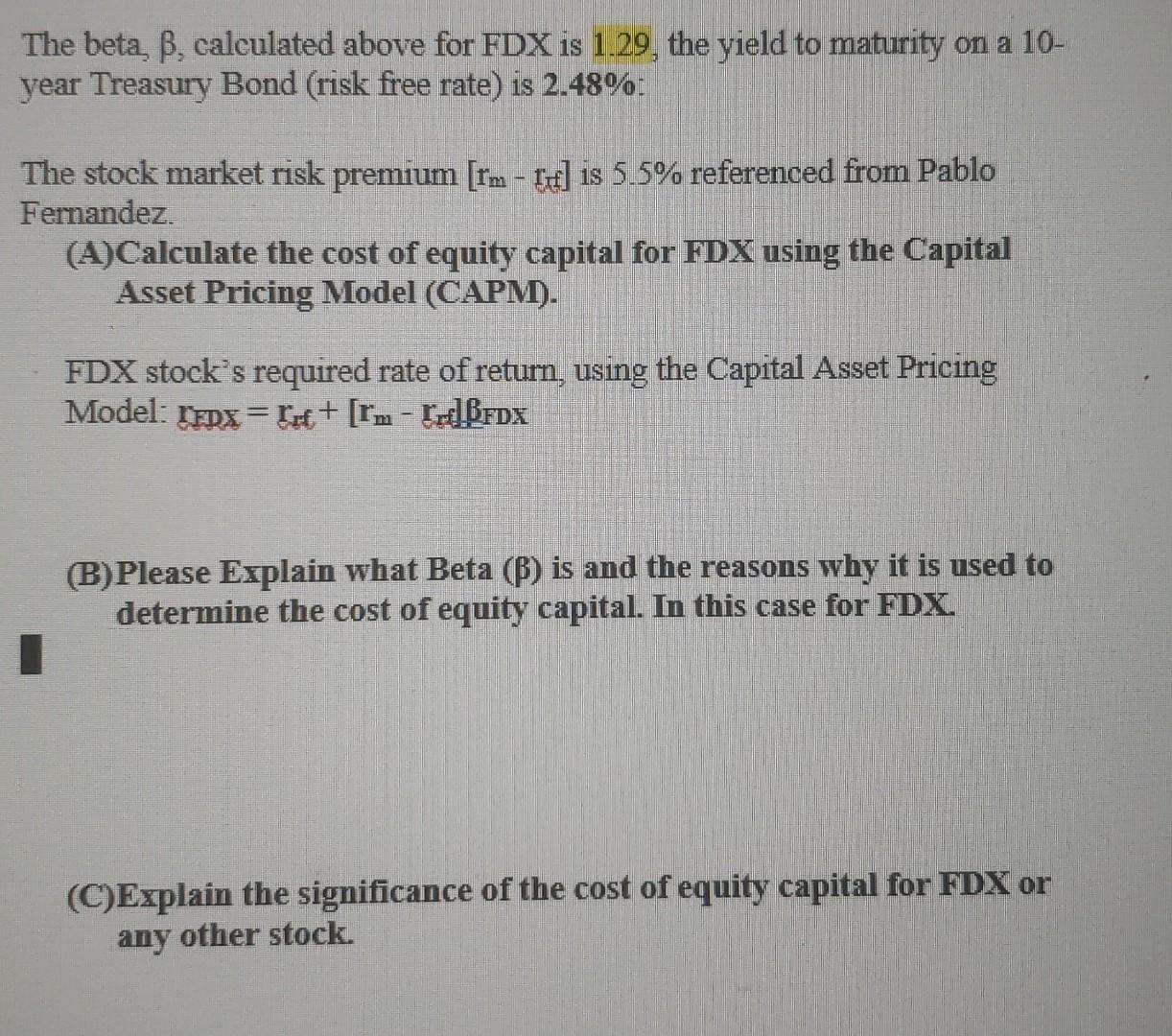

(10 points) Namena Lydia Haworth 1. The annual (%) retums, assumed for years 2009-2021 (13-years) for both FedEx stock (FDX) and the NYSE Index, are shown below. Also, the regression below estimates the beta (6) for FDX: (FDX- NYSE YEAR FedEx Mean NYSE- INDEX Mean) 2009 -1.03% 13.48% 40.06367 2010 -16.97 -4.92 243.3985 2011 -47.64 -41.11 2623.677 2012 96.64 41.55 3237.988 2013 3 12.06 -62.6778 2014 0.96 -0.09 38.60583 2015 6.64 9.59 -22.97611 2016 36.5 14.04 262.2802 2017 26.04 4.88 15.27129 2018 7.06 3.75 0.492635 2019 -30.93 -16.55 850.1274 2020 71.67 -2.01 -359.6971 2021 -14.27 29.20 -631.2786 Mean 10.67 3.89 SUM 6235.275 Variance 1569.03 403.94 COVARIANCE 519.6062 Std. Dev 39.61 20.10 CORRELATION 0.65268 BETA 1.286341 Regression Statistics Multiple R 0.652 68 R Square 0.425991 Adjusted R 0.373808 Standard E. 31.34503 Observatio 13 ANOVA df SS MS ignificance F Regression 1 8020.692 8020.692 8.163 464 0.015595 Residual 11 1080 7.62 982.5108 Total 12 18828.31 Coefficientsandard Erre Stat P-value Lower 95 96 Upper 95% ower 95.0%pper 95.09 Intercept 5.669043 8.867888 0.639278 0.535728 -13.849 25.18713 -13.849 25.18713 X Variable 1.286341 0.450 214 2.85 7178 0.015595 0.295427 2.277256 0.295427 2.277256 The beta, b, calculated above for FDX is 1.29, the yield to maturity on a 10- year Treasury Bond (risk free rate) is 2.48%: The stock market risk premium [Im - rd] is 5.5% referenced from Pablo Fernandez. (A)Calculate the cost of equity capital for FDX using the Capital Asset Pricing Model (CAPM). FDX stock's required rate of return, using the Capital Asset Pricing Model: TEDx = Fz+ [1m - Pd BFDX (B)Please Explain what Beta () is and the reasons why it is used to determine the cost of equity capital. In this case for FDX. (C)Explain the significance of the cost of equity capital for FDX or any other stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started