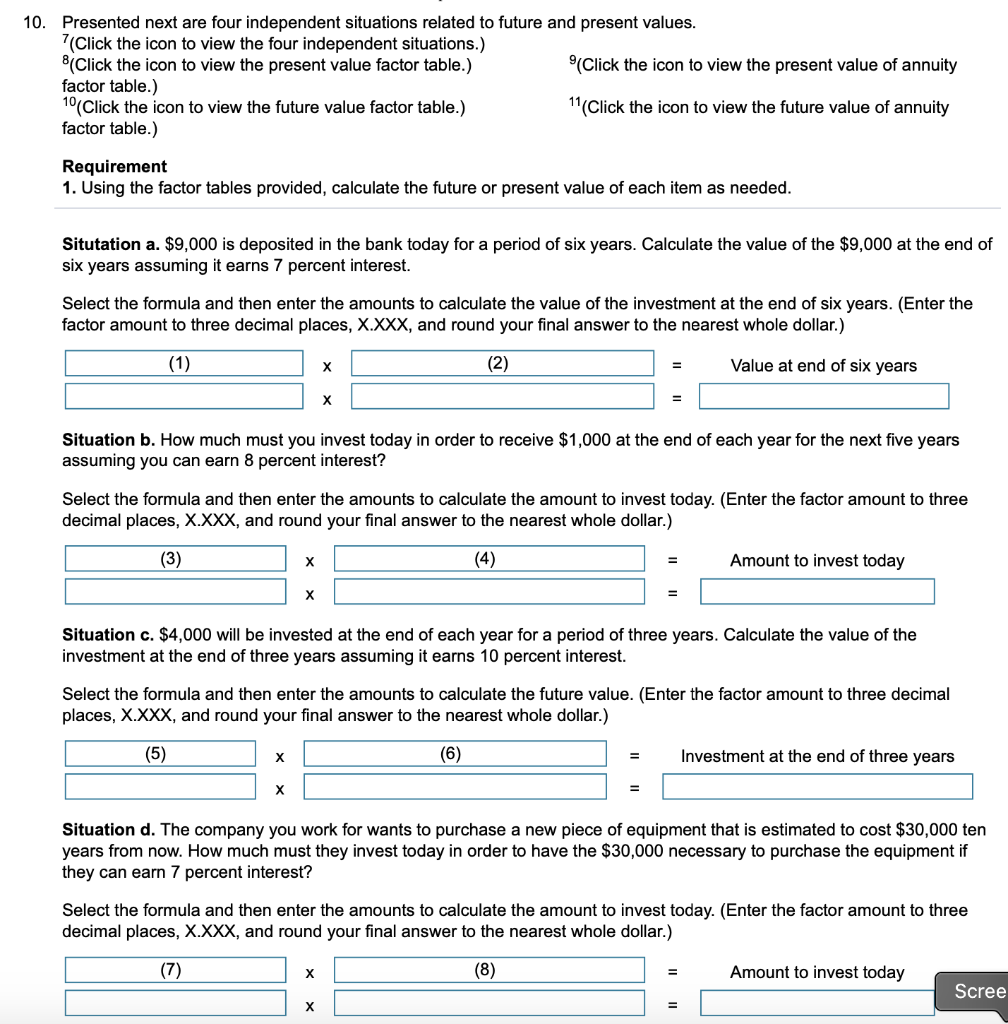

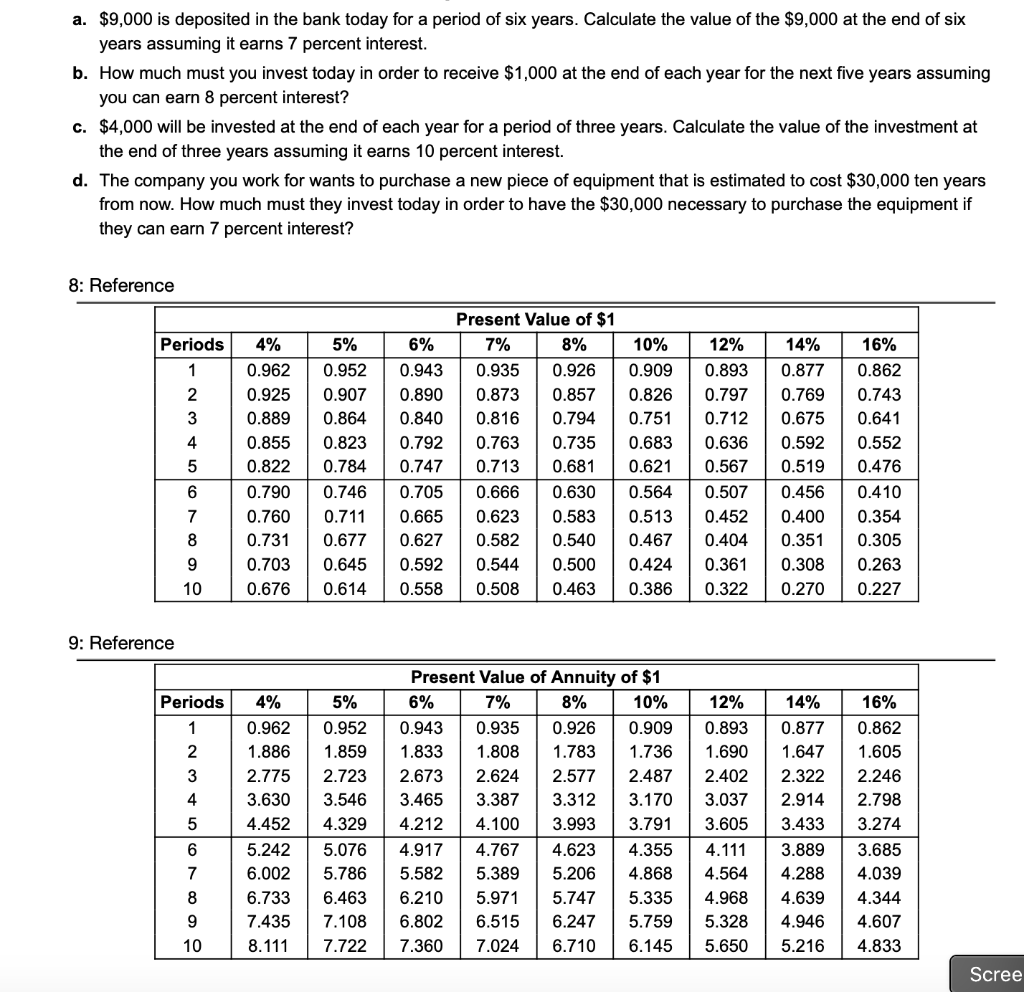

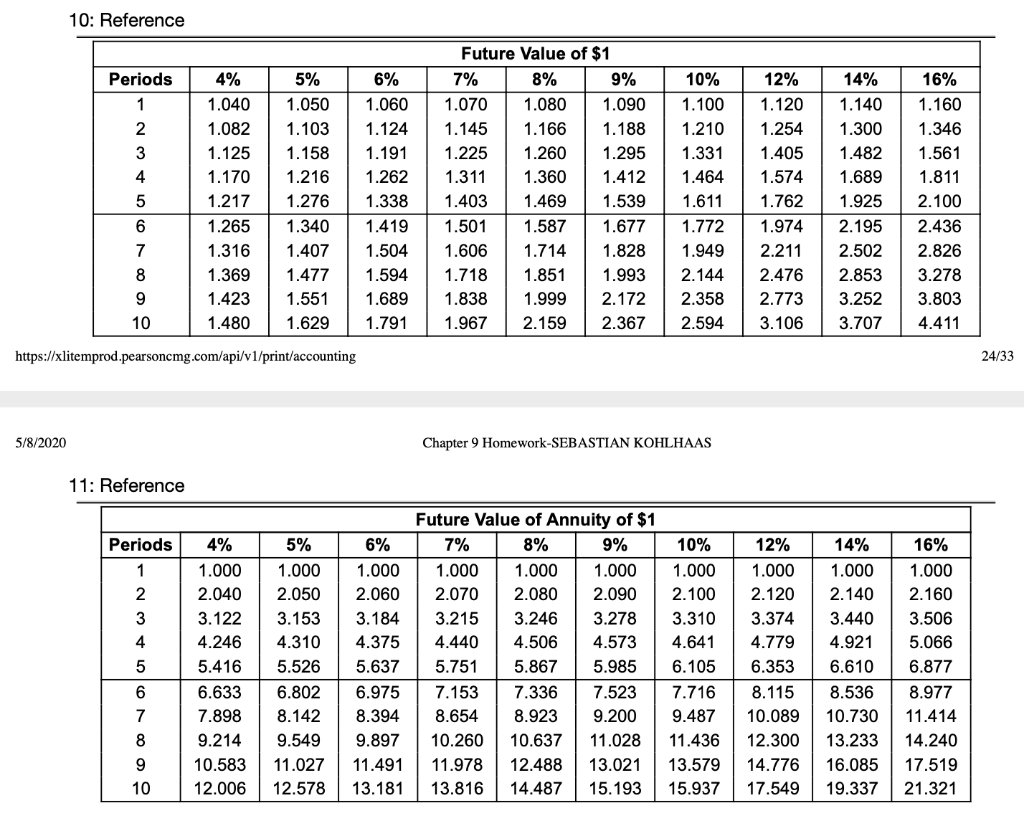

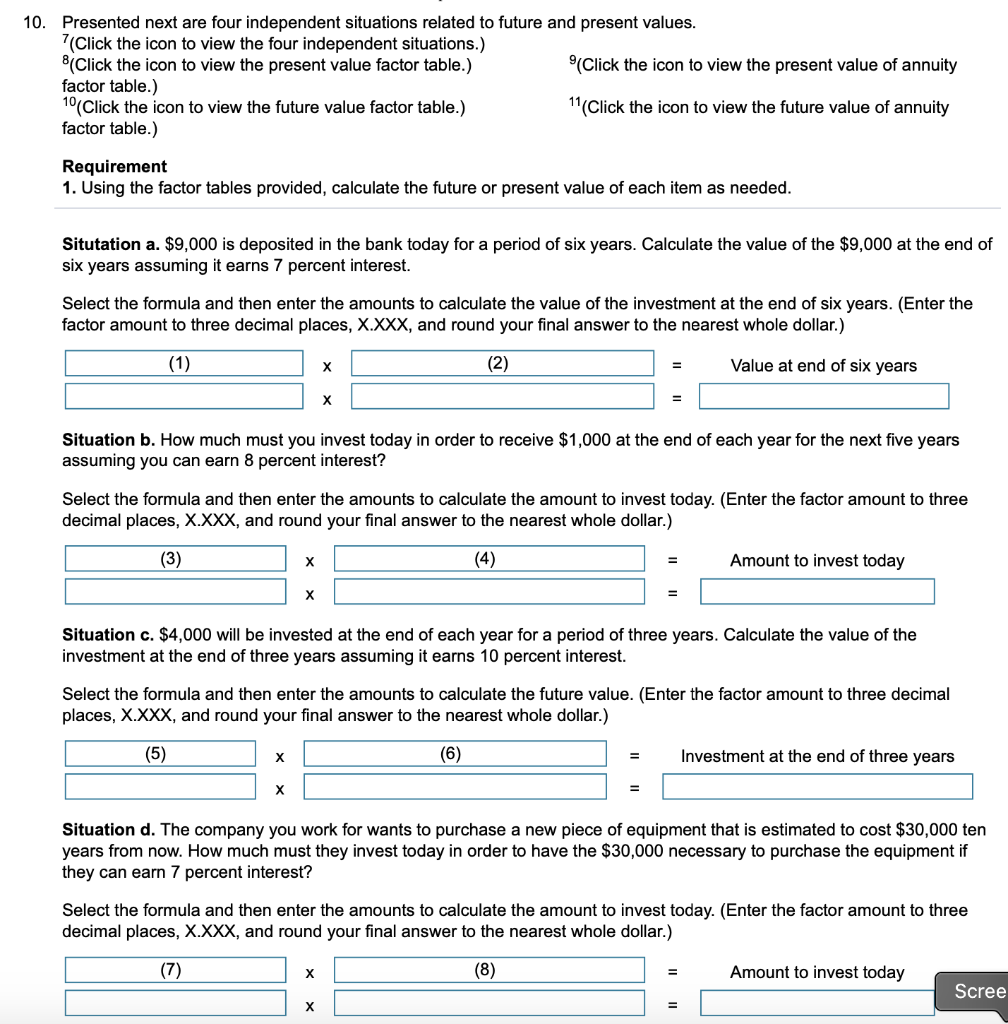

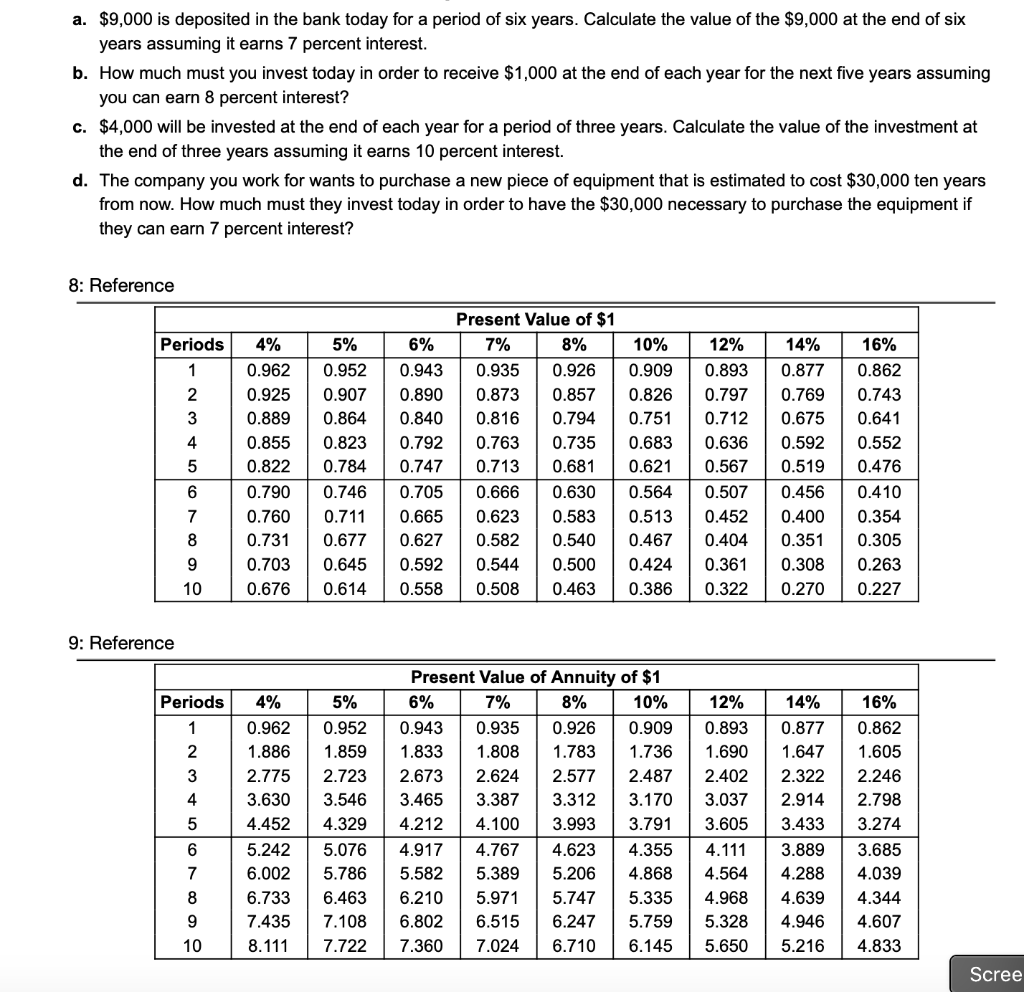

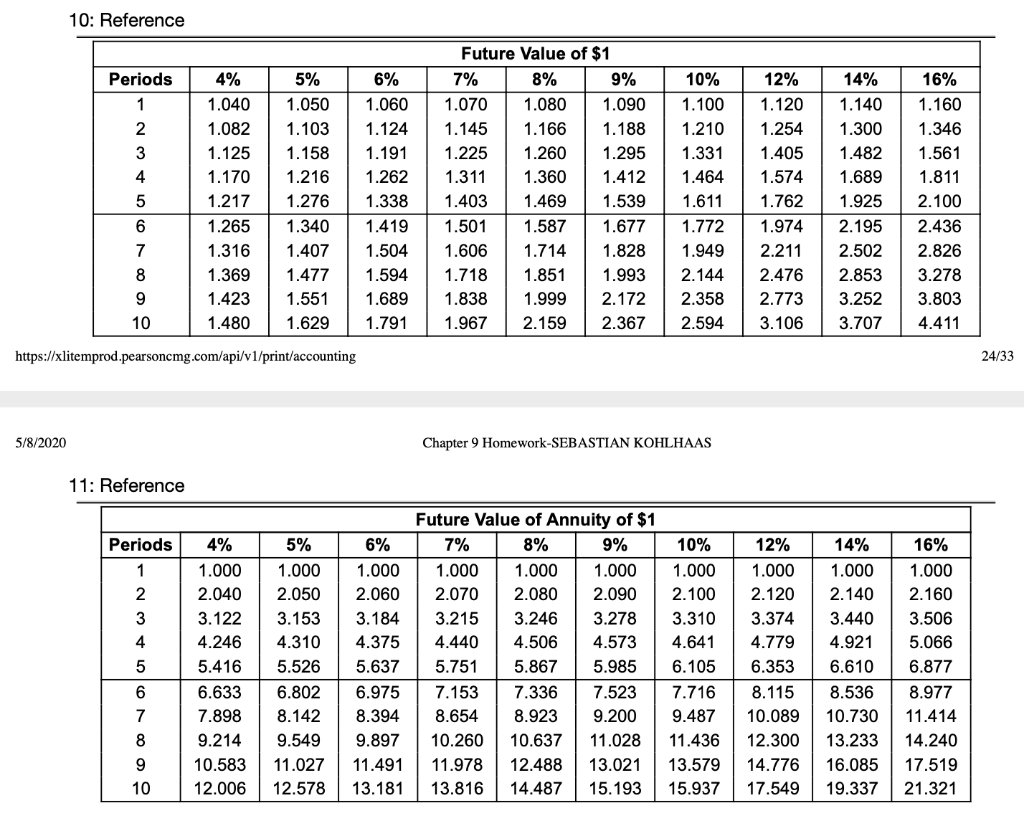

10. Presented next are four independent situations related to future and present values. 7(Click the icon to view the four independent situations.) 8(Click the icon to view the present value factor table.) (Click the icon to view the present value of annuity factor table.) 10 (Click the icon to view the future value factor table.) 11(Click the icon to view the future value of annuity factor table.) Requirement 1. Using the factor tables provided, calculate the future or present value of each item as needed. Situtation a. $9,000 is deposited in the bank today for a period of six years. Calculate the value of the $9,000 at the end of six years assuming it earns 7 percent interest. Select the formula and then enter the amounts to calculate the value of the investment at the end of six years. (Enter the factor amount to three decimal places, X.XXX, and round your final answer to the nearest whole dollar.) (1) X (2) = Value at end of six years Situation b. How much must you invest today in order to receive $1,000 at the end of each year for the next five years assuming you can earn 8 percent interest? Select the formula and then enter the amounts to calculate the amount to invest today. (Enter the factor amount to three decimal places, X.XXX, and round your final answer to the nearest whole dollar.) (3) (4) Amount to invest today Situation c. $4,000 will be invested at the end of each year for a period of three years. Calculate the value of the investment at the end of three years assuming it earns 10 percent interest. Select the formula and then enter the amounts to calculate the future value. (Enter the factor amount to three decimal places, X.XXX, and round your final answer to the nearest whole dollar.) (5) (6) = Investment at the end of three years Situation d. The company you work for wants to purchase a new piece of equipment that is estimated to cost $30.000 ten years from now. How much must they invest today in order to have the $30,000 necessary to purchase the equipment if they can earn 7 percent interest? Select the formula and then enter the amounts to calculate the amount to invest today. (Enter the factor amount to three decimal places, X.XXX, and round your final answer to the nearest whole dollar.) (7) (8) Amount to invest today Scree a. $9,000 is deposited in the bank today for a period of six years. Calculate the value of the $9,000 at the end of six years assuming it earns 7 percent interest. b. How much must you invest today in order to receive $1,000 at the end of each year for the next five years assuming you can earn 8 percent interest? c. $4,000 will be invested at the end of each year for a period of three years. Calculate the value of the investment at the end of three years assuming it earns 10 percent interest. d. The company you work for wants to purchase a new piece of equipment that is estimated to cost $30,000 ten years from now. How much must they invest today in order to have the $30,000 necessary to purchase the equipment if they can earn 7 percent interest? 8: Reference Periods 4% 5% 0.962 0.952 0.925 0.907 0.889 0.864 0.855 0.823 0.822 0.784 0.790 0.746 0.760 0.711 0.731 0.677 0.703 0.645 .6760.614 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 Present Value of $1 7% 8% 0.935 0.926 0.873 0.857 0.816 0.794 0.763 0.735 0.713 0.681 0.666 0.630 0.623 0.583 0.582 0.540 0.544 0.500 0.508 0.463 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 16% 0.862 0.743 0.641 0.552 0.476 0.410 0.354 0.305 0.263 0.227 9 100 9: Reference Periods 4% | 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 OWN- 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 Present Value of Annuity of $1 6% 7% 8% 10% 0.943 0.935 0.926 0.909 1.833 1.808 1.783 1.736 2.673 2.624 2.577 2.487 3.465 3.387 3.312 3.170 4.212 4.100 3.993 3.791 4.917 4.767 4.623 4.355 5.582 5.389 5.206 4.868 6.210 5.971 5.747 5.335 6.515 6.247 5.759 7.360 7.024 6.710 6.145 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 16% 0.862 1.605 2.246 2.798 3.274 3.685 4.039 4.344 4.607 4.833 6.802 Scree 10: Reference Periods Ovo AWN- 4% 1.040 1.082 1.125 1.170 1.217 1.265 1.316 1.369 1.423 1.480 5% 1.050 1.103 1.158 1.216 1.276 1.340 1.407 1.477 1.551 1.629 6% 1.060 1.124 1.191 1.262 1.338 1.419 1.504 1.594 1.689 1.791 Future Value of $1 7% 8% 9% 1.070 1.080 1.090 1.145 1.166 1.188 1.225 1.260 1.295 1.311 1.360 1.412 1.403 1.469 1.539 1.501 1.587 1.677 1.606 1.714 1.828 1.718 1.851 1.993 1.838 11.999 2.172 1.967 2.159 2.367 10% 1.100 1.210 1.331 1.464 1.611 1.772 1.949 2.144 2.358 2.594 12% 1.120 1.254 1.405 1.574 1.762 1.974 2.211 2.476 2.773 3.106 14% 1.140 1.300 1.482 1.689 1.925 2.195 2.502 2.853 3.252 3.707 16% 1.160 1.346 1.561 1.811 2.100 2.436 2.826 3.278 3.803 4.411 https://xlitemprod.pearsoncmg.com/api/v1/print/accounting 24/33 5/8/2020 Chapter 9 Homework-SEBASTIAN KOHLHAAS 11: Reference Periods 4% 1.000 2.040 3.122 4.246 5.416 6.633 7.898 9.214 10.583 12.006 5% 1.000 2.050 3.153 4.310 5.526 6.802 8.142 9.549 11.027 12.578 Future Value of Annuity of $1 6% 7% 8% 9% 1.000 1.000 1.000 11.000 2.060 2.070 2.080 2.090 3.184 3.215 3.246 3.278 4.375 4.440 4.506 4.573 5.637 5.751 5.867 5.985 6.975 7.153 7.336 7.523 8.394 8.654 8.923 9.200 9.897 10.260 10.637 11.028 11.49111.978 12.488 13.021 13.18113.816 14.48715.193 10% 1.000 2.100 3.310 4.641 6.105 7.716 9.487 11.436 13.579 15.937 12% 1.000 2.120 3.374 4.779 6.353 8.115 10.089 14% 16% 1.000 1.000 2.140 2.160 3.440 3.506 4.921 5.066 6.610 6.877 8.5368.977 10.730 11.414 13.23314.240 16.085 17.519 19.337 21.321 14.776 17.549