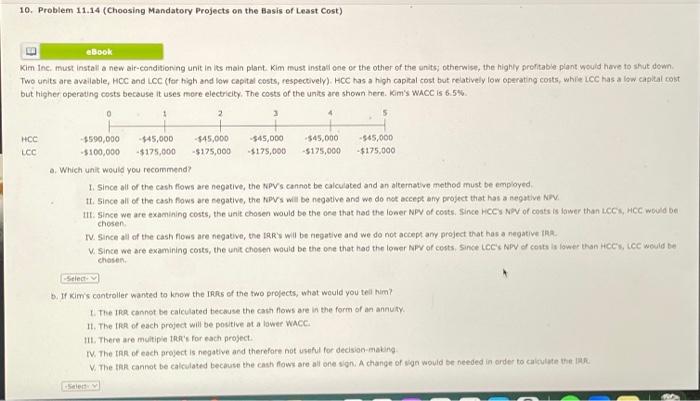

10. Problem 11.14 (Choosing Mandatory Projects on the Easis of Least Cost) eBook Kim Inc, must install a new eir-conditioning unit in its main plant. Kim must instast ooe or the other of the units; otherwise, the highly profitable plant would have to shut down. Two units are available, HCC and LCC (for high and low capital costs, respectively). HCC has a high capital cost but reatively low operating conts, whie LCC has a low caplat coist but higher operavng costs because it uses more electricity. The costs of the units are shown here. Kim's WACC is 6.5N. a. Which unit would you recommend? 1. Since alf of the cash fows art negative, the fovs cannot be calculated and an alternatvo mothod must be employed tt. Since alf of the cash fows are negative, the fDVrs will be negative and wo do not accept any project that has a regative Nov. chosen. F. Since all of the Cash flows are negative, the tRR's wil be negative and we do not accept any project that has a negative tian. chasen. b. If Kim's controller wanted to know the IRrs of the two profects, what would you tell him? t. The tRe cannot be calculated tecisuse the cash fows are in the form of an annuty. If. The tre of esch project will be positive at a lawer WhCC: IIL. There are multiple 1Ra's for each project. W. The IRR of each project is negative and therefore not useful for decision-making c. If the WACC rose to 13% would this affect your recommendation? 1. When the WACC increases to 13%, the NPV of costs are now lower for LCC than HCC 11. When the WACC increases to 13%, the NPV of costs are now lower for HCC than LCC. III. When the WACC increases to 13%, the IRR for LCC is greater than the IRg for HCC, LCC would be chosen. TV, When the WACC increases to 13%, the IRR for HCC is greater than the IRR for LCC, HCC would be chosen. W. Since all of the cash fows are negative, the NPV's will be negative and we do not accept any project that has a negative NPV. Why do you think this result occurred? 1. The reason is that when you discount at a higher rote you are making negative CFs smaller and this lowers the NPN 1t. The reason is that when you discount at a higher rate you are moking negative CFs smaller thus improving the NPV IIt. The reason is that when you discount at a higher rate you are making negative CFs hlgher thus improving the IRR. IV. The reason is that when you discount at a higher rate you are making negative CFs higher thus improving the APW V. The reason is that when you discount at a higher rate you are making negative CFs higher and this lowers the hev