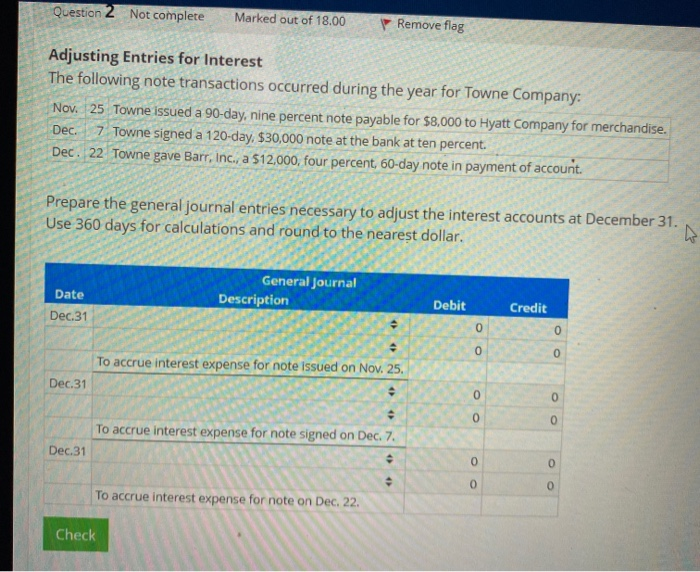

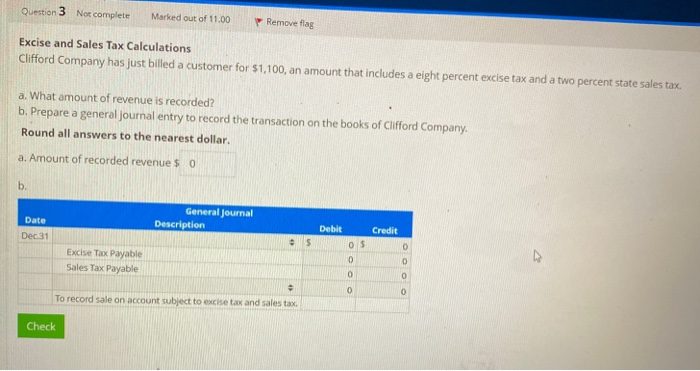

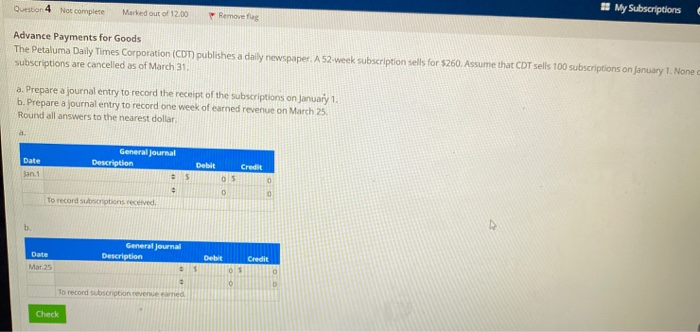

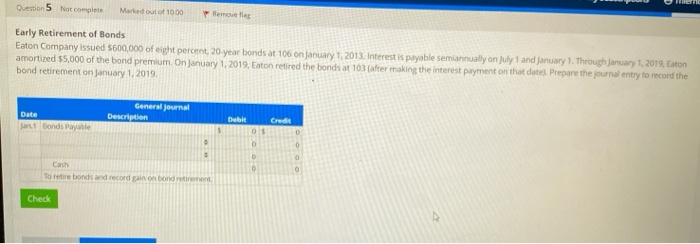

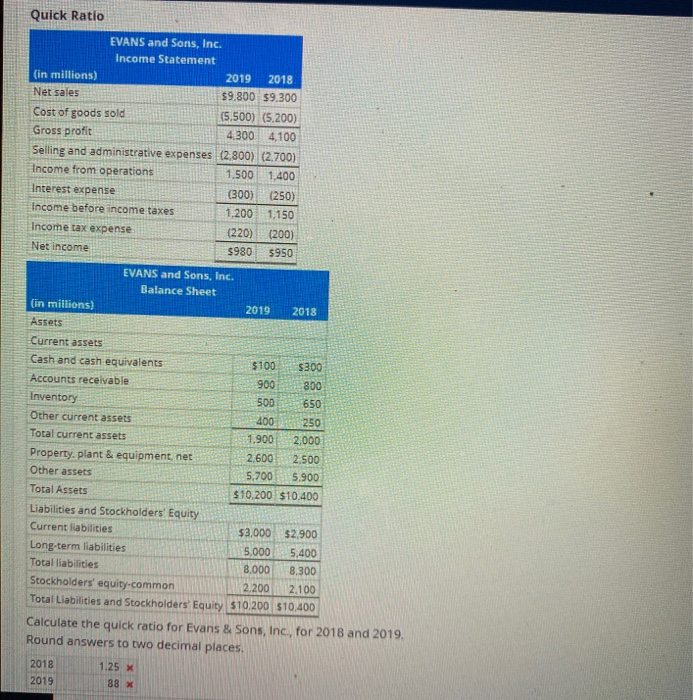

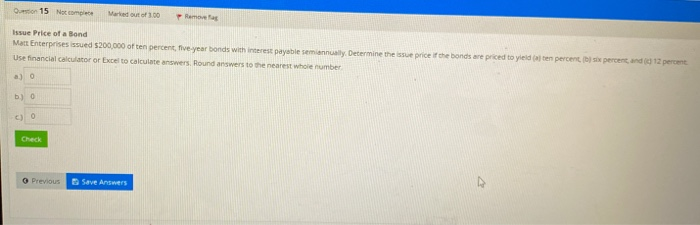

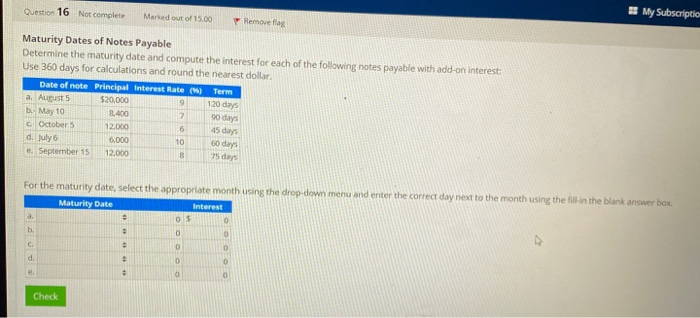

Question 2 Not complete Marked out of 18.00 Remove flag Adjusting Entries for Interest The following note transactions occurred during the year for Towne Company: Nov. 25 Towne issued a 90-day, nine percent note payable for $8,000 to Hyatt Company for merchandise. Dec. 7 Towne signed a 120-day, $30,000 note at the bank at ten percent. Dec. 22 Towne gave Barr, Inc., a $12,000, four percent, 60-day note in payment of account. Prepare the general journal entries necessary to adjust the interest accounts at December 31, Use 360 days for calculations and round to the nearest dollar. General Journal Description Desc Date Dec.31 Debit Credit 0 0 To accrue interest expense for note issued on Nov. 25. ensa 2 Dec.31 0 To accrue interest expense for note signed on Dec. 7. Dec.31 To accrue interest expense for note on Dec. 22. Check Question 3 Nor complete Marked out of 11.00 Remove flag Excise and Sales Tax Calculations Clifford Company has just billed a customer for $1,100, an amount that includes a eight percent excise tax and a two percent state sales tax. a. What amount of revenue is recorded? b. Prepare a general Journal entry to record the transaction on the books of Clifford Company. Round all answers to the nearest dollar. a. Amount of recorded revenue 5 0 Date General Journal Description Debit Credit Dec Excise Tax Payable Sales Tax Payable To record sale on account subject to excise tax and sales tax. Check Question 4 Not complete Marked out of 12.00 Remove flag My Subscriptions Advance Payments for Goods The Petaluma Daily Times Corporation (CDT) publishes a daily newspaper A 52-week subscription sells for $260. Assume that CDT sells 100 subscriptions on January 1. None subscriptions are cancelled as of March 31. a. Prepare a journal entry to record the receipt of the subscriptions on January 1 b. Prepare a journal entry to record one week of earned revenue on March 25 Round all answers to the nearest dollar General Journal Description Debit Credit To record subscriptions received Date General Journal Description To record subscription revenue Check Question 5 Not complete Marked out of 1000 Early Retirement of Bonds Eaton Company issued 5600,000 of eight percent, 20-year bonds at 106 on January 1, 2013. Interest is payable semiannually only 1 and January 1. Throuchanuary 1, 2019. Eaton amortized $5,000 of the bond premium On January 1, 2019. Eaton retired the bonds at 103 after making the interest payment on that datel. Prepare the journal entry to record the bond retirement on January 1, 2019 General Journal Description La Bonds Payetle To retire bonds and record painon bondre Check Quick Ratio EVANS and Sons, Inc. Income Statement (in millions) 2019 2018 Net sales $9.800 $9,300 Cost of goods sold (5.500) (5.200) Gross profit 4.300 4,100 Selling and administrative expenses (2.800) (2.700) Income from operations 1.500 1,400 Interest expense (300) (250) Income before income taxes 1,200 1.150 Income tax expense (220) (200) Net income $980 9950 EVANS and Sons, Inc. Balance Sheet (in millions) 2019 2018 Assets Current assets Cash and cash equivalents $100 $300 Accounts receivable 900 800 Inventory 650 Other current assets 400 250 Total current assets 1,900 2,000 Property.plant & equipment net 2,600 2.500 Other assets 5.700 5.900 Total Assets $10,200 $10.400 Liabilities and Stockholders' Equity Current liabilities $3,000 $2,900 Long-term liabilities 5.000 5.400 Total liabilities 8.000 8.300 Stockholders' equity.common 2.200 2.100 Total Liabilities and Stockholders' Equity $10,200 $10,400 Calculate the quick ratio for Evans & Sons, Inc., for 2018 and 2019. Round answers to two decimal places. 2018 2019 500 to 15 Notcomece are out of 100 m g Issue Price of a Bond Matt Enterprises issued 5200,000 often percent, five year bonds with interest payable semiannually. Determine the issue price of the bonds are priced to yield Use financial Calculator or Excel to calculate answers, Round answers to the nearest whole number a.) ten percent percent and i 12 percent b) 0 Check Previous Save Answers Question 16 Not complete Marked out of 15.00 My Subscriptio 7 Remove flas Maturity Dates of Notes Payable Determine the maturity date and compute the interest for each of the following notes payable with add-on interest: Use 360 days for calculations and round the nearest dollar. Date of note Principal Interest Rate () Term a. August 5 $20.000 20 days be May 10 8,400 90 days October 5 12.000 d. July 6 6,000 September 15 12.000 For the maturity date, select the appropriate month using the drop down menu and enter the correct day next to the month using the fin the blank answer box Maturity Date Interest Check