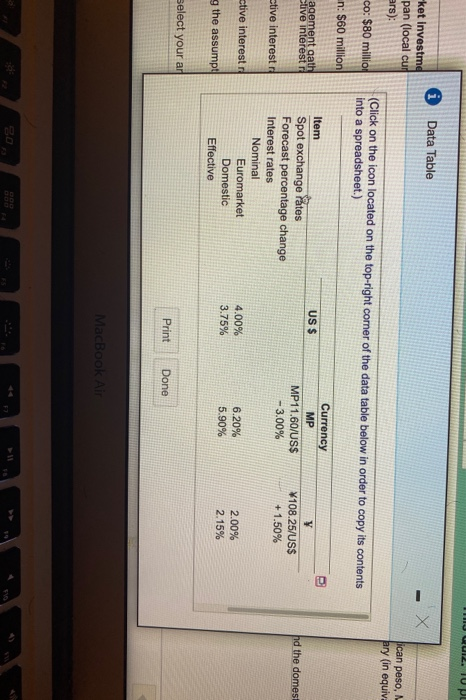

Question: 10 QUI2. IU PL Data Table - ket Investmd pan (local cui ars): ican peso, ary (in equiv: co: $80 million n: $60 million agement

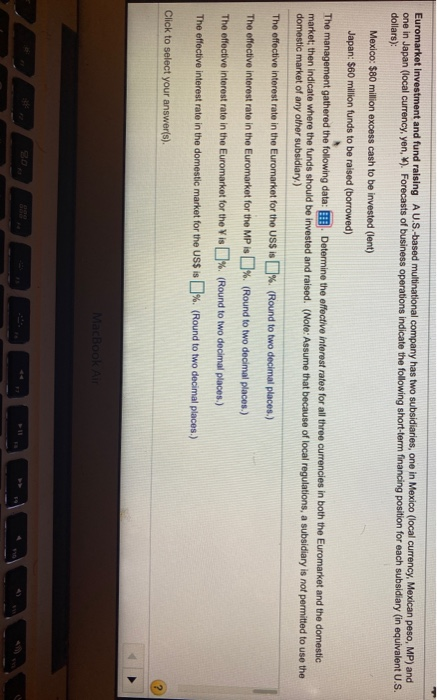

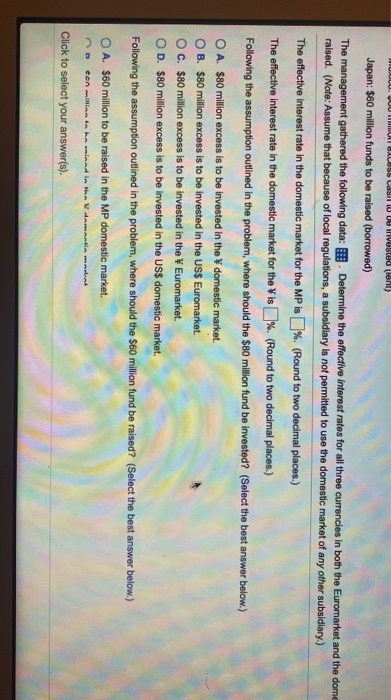

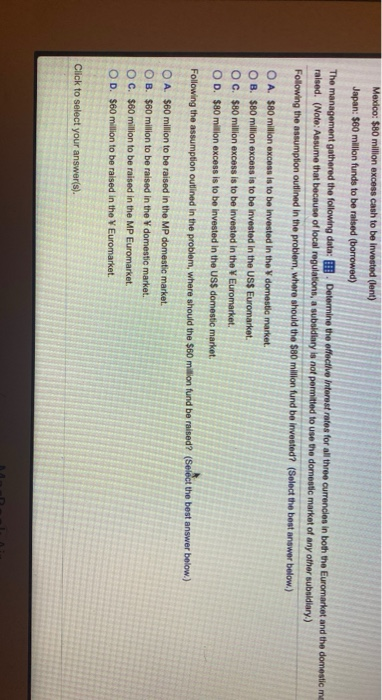

10 QUI2. IU PL Data Table - ket Investmd pan (local cui ars): ican peso, ary (in equiv: co: $80 million n: $60 million agement gath stive interest (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Currency Item US $ MP Y Spot exchange Pates MP11.60/US$ 108.25/US$ Forecast percentage change - 3.00% +1.50% Interest rates Nominal Euromarket 4.00% 6.20% 2.00% Domestic 3.75% 5.90% 2.15% Effective hd the domest stive interest ctive interest g the assump! select your ar Print Done MacBook Air 20 Euromarket investment and fund raising A U.S.-based multinational company has two subsidiaries, one in Mexico (local currency, Mexican peso, MP) and one in Japan (local currency, yen, ). Forecasts of business operations indicate the following short-term financing position for each subsidiary (in equivalent U.S. dollars): Mexico: $80 million excess cash to be invested (lent) Japan: $60 million funds to be raised (borrowed) The management gathered the following data: Determine the effective interest rates for all three currencies in both the Euromarket and the domestic market; then indicate where the funds should be invested and raised. (Note: Assume that because of local regulations, a subsidiary is not permitted to use the domestic market of any other subsidiary) The effective interest rate in the Euromarket for the US$ is 0% (Round to two decimal places.) The effective interest rate in the Euromarket for the MP is %. (Round to two decimal places) The effective interest rate in the Euromarket for the Vis % (Round to two decimal places.) The effective interest rate in the domestic market for the US$ is % (Round to two decimal places.) Click to select your answer(s). ? MacBook Air HULU. QUUM GALOS Las De Invested (lent) Japan: $60 million funds to be raised (borrowed) The management gathered the following data: . Determine the effective interest rates for all three currencies in both the Euromarket and the dome raised. (Note: Assume that because of local regulations, a subsidiary is not permitted to use the domestic market of any other subsidiary.) The effective interest rate in the domestic market for the MP is %. (Round to two decimal places.) The effective interest rate in the domestic market for the Vis %. (Round to two decimal places.) Following the assumption outlined in the problem, where should the $80 million fund be invested? (Select the best answer below.) O A $80 million excess is to be invested in the domestic market. OB. $80 million excess is to be invested in the US$ Euromarket. OC. $80 million excess is to be invested in the Euromarket. OD. $80 million excess is to be invested in the US$ domestic market. Following the assumption outlined in the problem, where should the $60 million fund be raised? (Select the best answer below.) O A. $60 million to be raised in the MP domestic market. een willen da hewand in the Amantiament Click to select your answer(s). Mexico: $80 million excess cash to be invested (lent) Japan: $60 million funds to be raised (borrowed) The management gathered the following data: Determine the effective interest rates for all three currencies in both the Euromarket and the domestic me raised. (Note: Assume that because of local regulations, a subsidiary is not permitted to use the domestic market of any other subeldiary) Following the assumption outlined in the problem, where should the $80 million fund be invested? (Select the best answer below.) O A $80 million excess is to be invested in the domestic market. O B. $80 million excess is to be invested in the US$ Euromarket. OC. $80 million excess is to be invested in the Euromarket. OD $80 milion excess is to be invested in the US$ domestic market. Following the assumption outlined in the problem, where should the $60 million fund be raised? (Select the best answer below) O A $60 million to be raised in the MP domestic market. O B. $60 million to be raised in the domestic market. OC. $60 million to be raised in the MP Euromarket. OD. $60 million to be raised in the Euromarket. Click to select your answer(s). 10 QUI2. IU PL Data Table - ket Investmd pan (local cui ars): ican peso, ary (in equiv: co: $80 million n: $60 million agement gath stive interest (Click on the icon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Currency Item US $ MP Y Spot exchange Pates MP11.60/US$ 108.25/US$ Forecast percentage change - 3.00% +1.50% Interest rates Nominal Euromarket 4.00% 6.20% 2.00% Domestic 3.75% 5.90% 2.15% Effective hd the domest stive interest ctive interest g the assump! select your ar Print Done MacBook Air 20 Euromarket investment and fund raising A U.S.-based multinational company has two subsidiaries, one in Mexico (local currency, Mexican peso, MP) and one in Japan (local currency, yen, ). Forecasts of business operations indicate the following short-term financing position for each subsidiary (in equivalent U.S. dollars): Mexico: $80 million excess cash to be invested (lent) Japan: $60 million funds to be raised (borrowed) The management gathered the following data: Determine the effective interest rates for all three currencies in both the Euromarket and the domestic market; then indicate where the funds should be invested and raised. (Note: Assume that because of local regulations, a subsidiary is not permitted to use the domestic market of any other subsidiary) The effective interest rate in the Euromarket for the US$ is 0% (Round to two decimal places.) The effective interest rate in the Euromarket for the MP is %. (Round to two decimal places) The effective interest rate in the Euromarket for the Vis % (Round to two decimal places.) The effective interest rate in the domestic market for the US$ is % (Round to two decimal places.) Click to select your answer(s). ? MacBook Air HULU. QUUM GALOS Las De Invested (lent) Japan: $60 million funds to be raised (borrowed) The management gathered the following data: . Determine the effective interest rates for all three currencies in both the Euromarket and the dome raised. (Note: Assume that because of local regulations, a subsidiary is not permitted to use the domestic market of any other subsidiary.) The effective interest rate in the domestic market for the MP is %. (Round to two decimal places.) The effective interest rate in the domestic market for the Vis %. (Round to two decimal places.) Following the assumption outlined in the problem, where should the $80 million fund be invested? (Select the best answer below.) O A $80 million excess is to be invested in the domestic market. OB. $80 million excess is to be invested in the US$ Euromarket. OC. $80 million excess is to be invested in the Euromarket. OD. $80 million excess is to be invested in the US$ domestic market. Following the assumption outlined in the problem, where should the $60 million fund be raised? (Select the best answer below.) O A. $60 million to be raised in the MP domestic market. een willen da hewand in the Amantiament Click to select your answer(s). Mexico: $80 million excess cash to be invested (lent) Japan: $60 million funds to be raised (borrowed) The management gathered the following data: Determine the effective interest rates for all three currencies in both the Euromarket and the domestic me raised. (Note: Assume that because of local regulations, a subsidiary is not permitted to use the domestic market of any other subeldiary) Following the assumption outlined in the problem, where should the $80 million fund be invested? (Select the best answer below.) O A $80 million excess is to be invested in the domestic market. O B. $80 million excess is to be invested in the US$ Euromarket. OC. $80 million excess is to be invested in the Euromarket. OD $80 milion excess is to be invested in the US$ domestic market. Following the assumption outlined in the problem, where should the $60 million fund be raised? (Select the best answer below) O A $60 million to be raised in the MP domestic market. O B. $60 million to be raised in the domestic market. OC. $60 million to be raised in the MP Euromarket. OD. $60 million to be raised in the Euromarket. Click to select your answer(s)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts