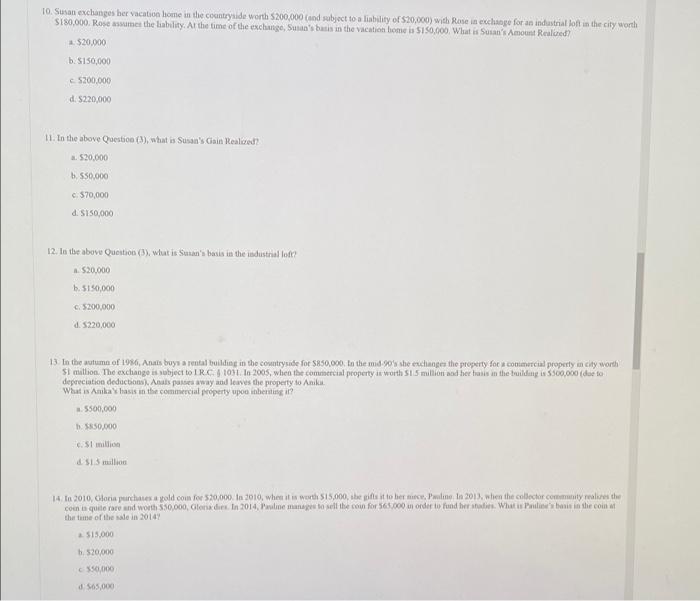

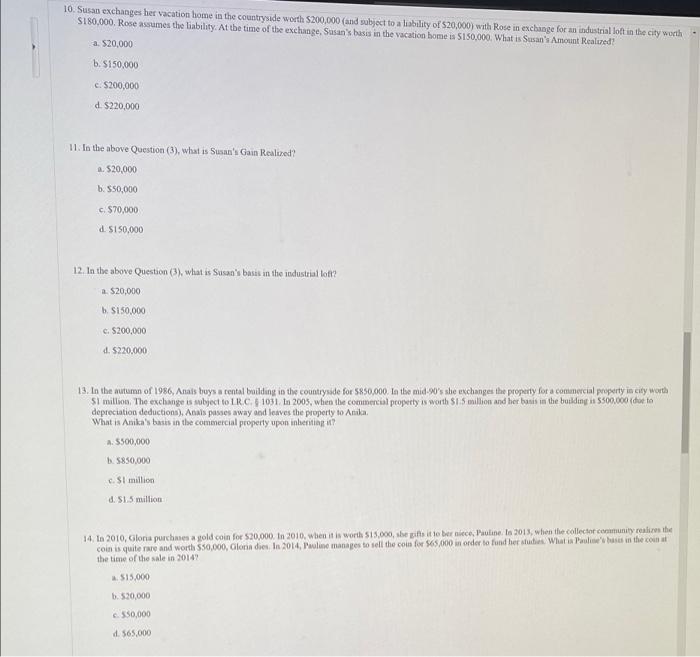

10. Susan exchanges her vacation home in the countryside worth $200,000 (and subject to a liability of $20,000) with Rose in exchange for an industrial fort in the city worth S180,000. Rose asmes the liability. At the time of the exchange, Susan's basis in the Vacation home is $150.000. What is Susan's Amount Realed $20.000 b 5150,000 5200,000 d. $220,000 11. In the above Question (3), what is Susan's Gain Realized . $20,000 b. 550.000 c570,000 d. SI50,000 12. In the above Question (3), wlutis Suan's basis in the industrial of? $20,000 b. 5150,000 c. $200,000 d. 5220,000 13 In the autumn of 1936, Anats buys a rental building in the countryside for $850,000, to the mid 90' she exchange the property for a conmurcial property in city worth Si million. The exchange is subject to IRC 410. In 2005, when the commercial property is worth $1.5 millionaod her hans in the building is 3500.000 (due to depreciation deductions). Anals purses way and leaves the property to Anik What is Ankahasis in the commercial property upon inbertingi? 5500,000 1 850,000 c. Si milli 15 million 14. In 2010, Gloria purchases a yold.com for $20,000 to 2010, when it is worth $15,000, the positio berce, wolime In 2013, when the collector.commity as the con is quite are and worth 550.000, Glend. In 2014, Pline ma to sell the coin for 565.000 in order to fund bei What is tans in the com the time of these in 2014 515.000 - 520,000 550.000 0 505,000 10. Susan exchanges her vacation home in the countryside worth $200,000 (and subject to a liability of 520,000) with Rose in exchange for an industrial lot in the city worth S180,000. Rose assumes the liability. At the time of the exchange, Susan's basis in the vacation home is 5150,000. What is Susan's Amount Realized! a $20,000 b. $150,000 c. $200,000 d. $220,000 11. In the above Question (3), what is Susan's Gain Realuned! a. 520,000 b. 550.000 c. $70,000 d. $150,000 12. In the above Question (3), what is Susan's basis in the industrial lott? 2. $20,000 b. $150,000 c. $200,000 d. $220.000 13. In the autumn of 1986, Anais buys a cental building in the countryside for 5850,000. In the mid 90's she exchanges the property for a comunercial property in citly worth S1 million. The exchange is subject to LRC 1031. In 2005, when the commercial property is worth $15 million and her bonis m the building a 5500,000 (due to depreciation deduction), Anais passes away and leaves the property to Anda What is Anika's basis in the commercial property upon inbeiting? a. 5500,000 15850,000 c. Si million d. S1.5 million 14. In 2010, Glona purchases a gold coin for $20,000. In 2010, when it is worth $15.000, she is the berniece, telo 2013, when the collector community realize the coin is quite rare and worth 550.000, Gloria dos In 2014, Proline manages to sell the comfor $65.000 in order to find her. What is bases in the count the time of the sale in 2014 $15.000 b. 520,000 550.000 d. 565.000 10. Susan exchanges her vacation home in the countryside worth $200,000 (and subject to a liability of $20,000) with Rose in exchange for an industrial fort in the city worth S180,000. Rose asmes the liability. At the time of the exchange, Susan's basis in the Vacation home is $150.000. What is Susan's Amount Realed $20.000 b 5150,000 5200,000 d. $220,000 11. In the above Question (3), what is Susan's Gain Realized . $20,000 b. 550.000 c570,000 d. SI50,000 12. In the above Question (3), wlutis Suan's basis in the industrial of? $20,000 b. 5150,000 c. $200,000 d. 5220,000 13 In the autumn of 1936, Anats buys a rental building in the countryside for $850,000, to the mid 90' she exchange the property for a conmurcial property in city worth Si million. The exchange is subject to IRC 410. In 2005, when the commercial property is worth $1.5 millionaod her hans in the building is 3500.000 (due to depreciation deductions). Anals purses way and leaves the property to Anik What is Ankahasis in the commercial property upon inbertingi? 5500,000 1 850,000 c. Si milli 15 million 14. In 2010, Gloria purchases a yold.com for $20,000 to 2010, when it is worth $15,000, the positio berce, wolime In 2013, when the collector.commity as the con is quite are and worth 550.000, Glend. In 2014, Pline ma to sell the coin for 565.000 in order to fund bei What is tans in the com the time of these in 2014 515.000 - 520,000 550.000 0 505,000 10. Susan exchanges her vacation home in the countryside worth $200,000 (and subject to a liability of 520,000) with Rose in exchange for an industrial lot in the city worth S180,000. Rose assumes the liability. At the time of the exchange, Susan's basis in the vacation home is 5150,000. What is Susan's Amount Realized! a $20,000 b. $150,000 c. $200,000 d. $220,000 11. In the above Question (3), what is Susan's Gain Realuned! a. 520,000 b. 550.000 c. $70,000 d. $150,000 12. In the above Question (3), what is Susan's basis in the industrial lott? 2. $20,000 b. $150,000 c. $200,000 d. $220.000 13. In the autumn of 1986, Anais buys a cental building in the countryside for 5850,000. In the mid 90's she exchanges the property for a comunercial property in citly worth S1 million. The exchange is subject to LRC 1031. In 2005, when the commercial property is worth $15 million and her bonis m the building a 5500,000 (due to depreciation deduction), Anais passes away and leaves the property to Anda What is Anika's basis in the commercial property upon inbeiting? a. 5500,000 15850,000 c. Si million d. S1.5 million 14. In 2010, Glona purchases a gold coin for $20,000. In 2010, when it is worth $15.000, she is the berniece, telo 2013, when the collector community realize the coin is quite rare and worth 550.000, Gloria dos In 2014, Proline manages to sell the comfor $65.000 in order to find her. What is bases in the count the time of the sale in 2014 $15.000 b. 520,000 550.000 d. 565.000