Answered step by step

Verified Expert Solution

Question

1 Approved Answer

10. Using trusts to transfer assets Trusts are used to transfer assets from an estate. The contractual nature of a trust probating its assets upon

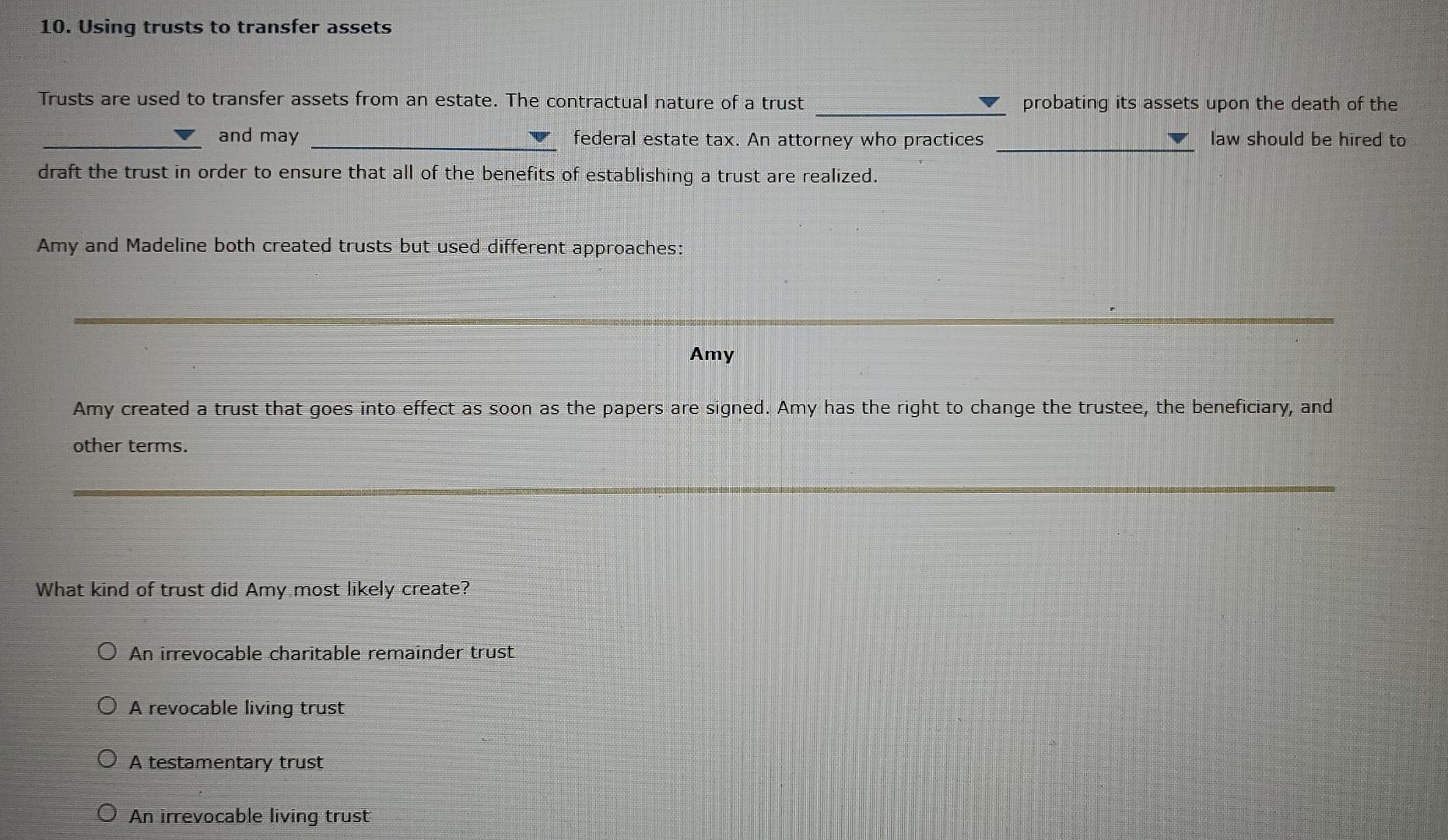

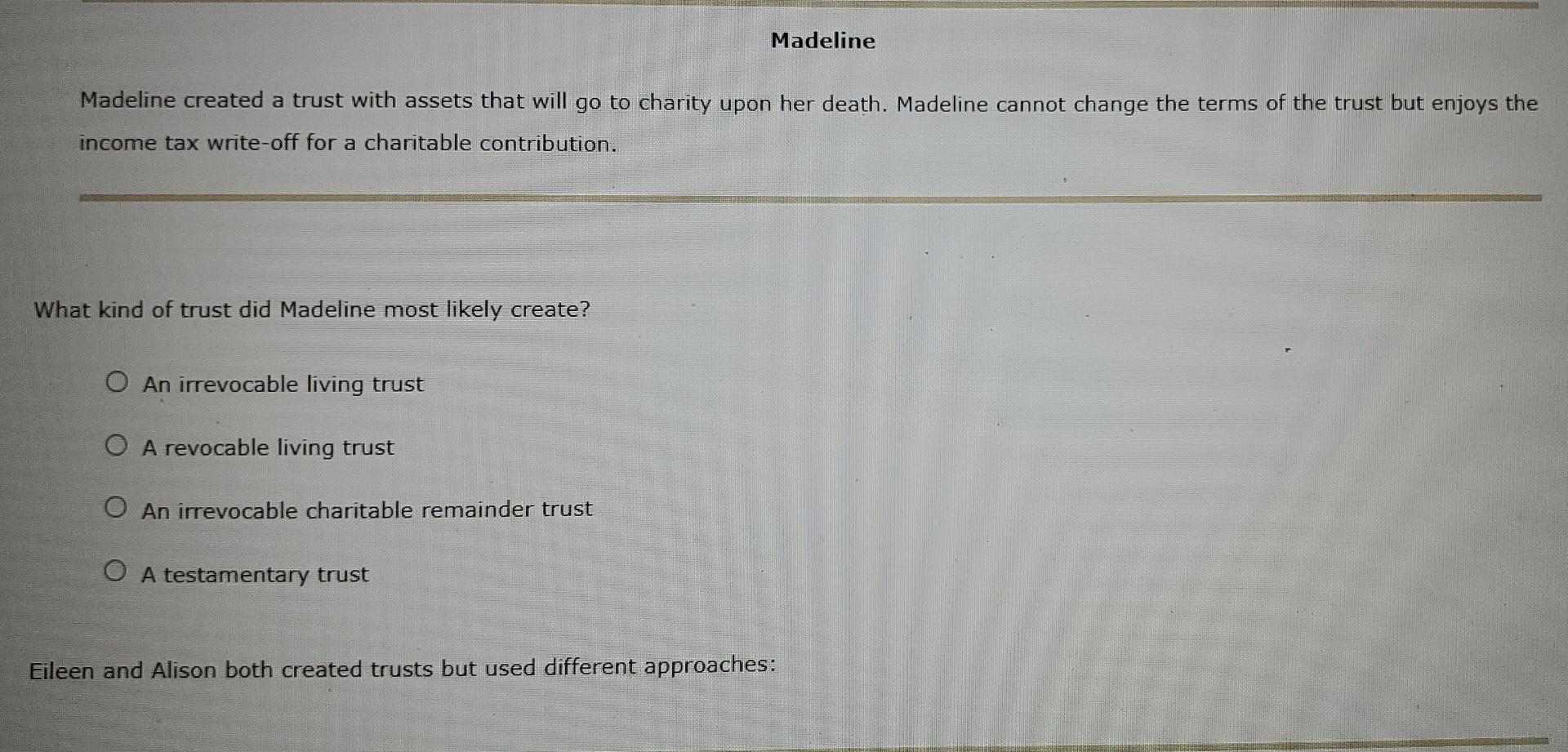

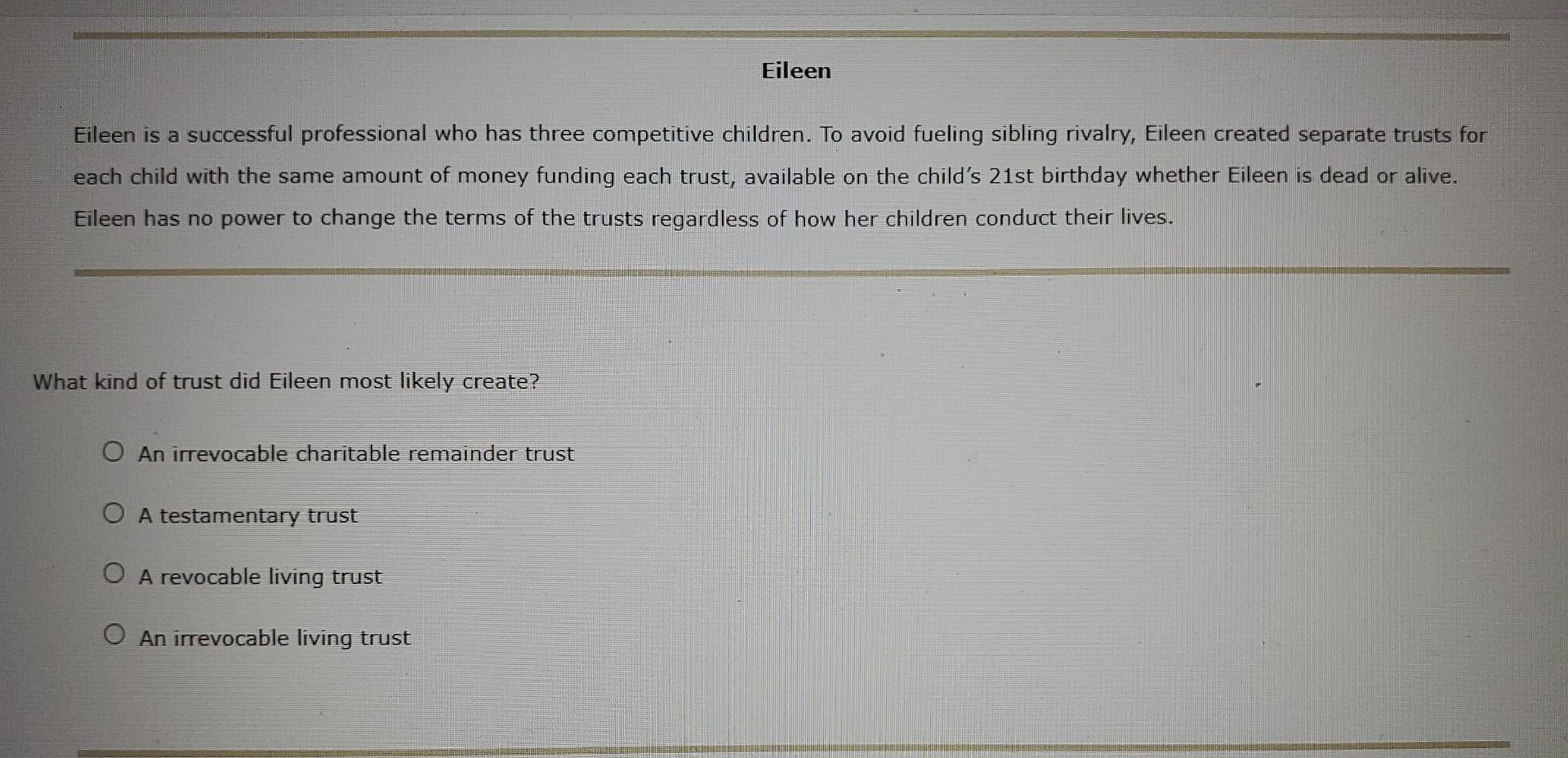

10. Using trusts to transfer assets Trusts are used to transfer assets from an estate. The contractual nature of a trust probating its assets upon the death of the and may federal estate tax. An attorney who practices law should be hired to draft the trust in order to ensure that all of the benefits of establishing a trust are realized. Amy and Madeline both created trusts but used different approaches: Amy Amy created a trust that goes into effect as soon as the papers are signed. Amy has the right to change the trustee, the beneficiary, and other terms. What kind of trust did Amy most likely create? An irrevocable charitable remainder trust O A revocable living trust O A testamentary trust O An irrevocable living trust Madeline Madeline created a trust with assets that will go to charity upon her death. Madeline cannot change the terms of the trust but enjoys the income tax write-off for a charitable contribution. What kind of trust did Madeline most likely create? O An irrevocable living trust O A revocable living trust O An irrevocable charitable remainder trust O A testamentary trust Eileen and Alison both created trusts but used different approaches: Eileen Eileen is a successful professional who has three competitive children. To avoid fueling sibling rivalry, Eileen created separate trusts for each child with the same amount of money funding each trust, available on the child's 21st birthday whether Eileen is dead or alive. Eileen has no power to change the terms of the trusts regardless of how her children conduct their lives. What kind of trust did Eileen most likely create? O An irrevocable charitable remainder trust O A testamentary trust O A revocable living trust O An irrevocable living trust Alison Alison and her husband just retired. They intend to travel frequently and enjoy their retirement without counting their pennies like they had to for many years. They created trusts for their minor grandchildren to be funded with any money left over, but not until after they die. What kind of trust did Alison most likely create? O An irrevocable living trust O A revocable living trust O A testamentary trust O An irrevocable charitable remainder trust A Can

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started