page 1

page 2

page 3 (Question)

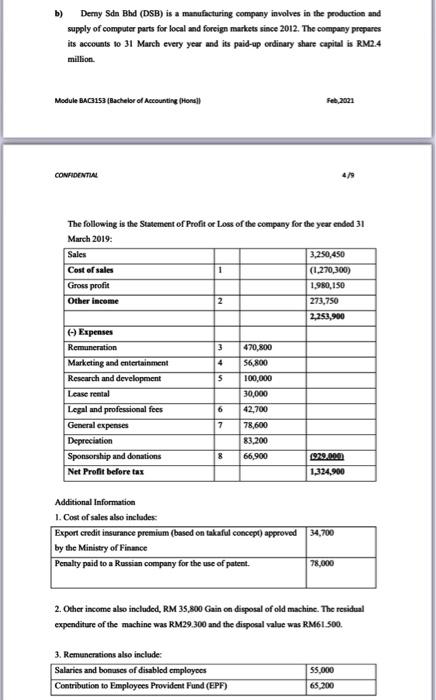

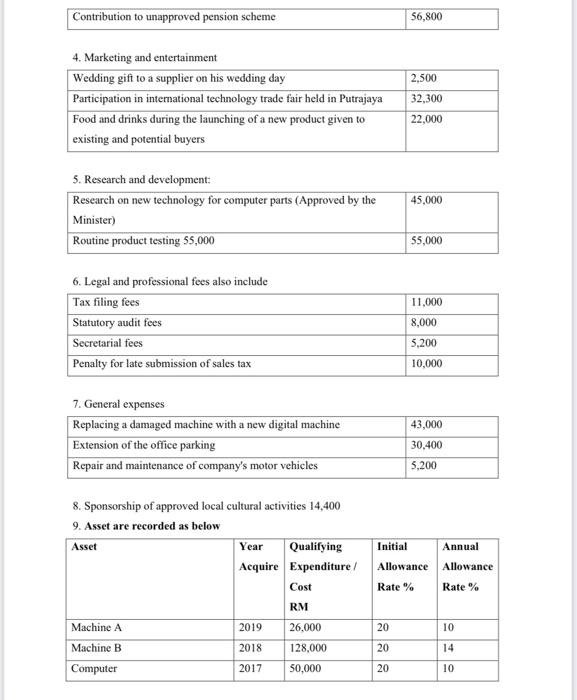

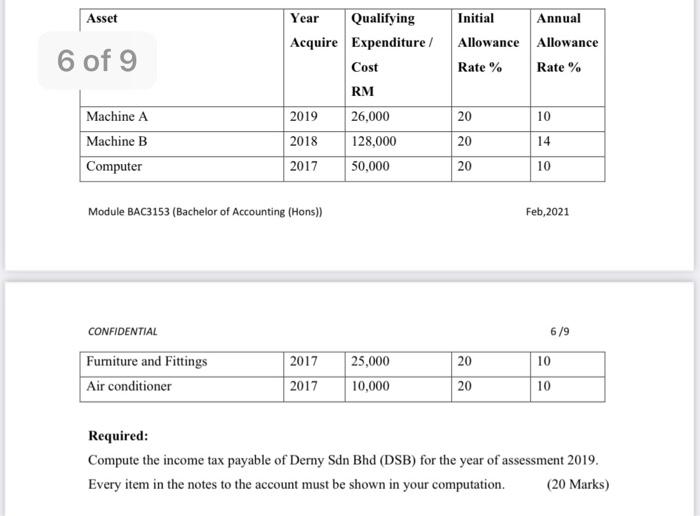

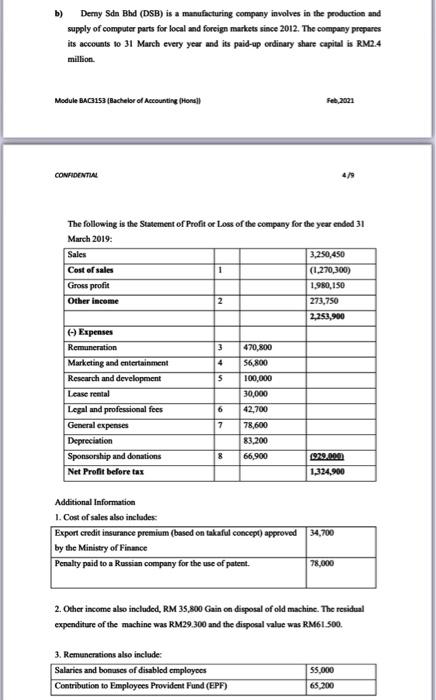

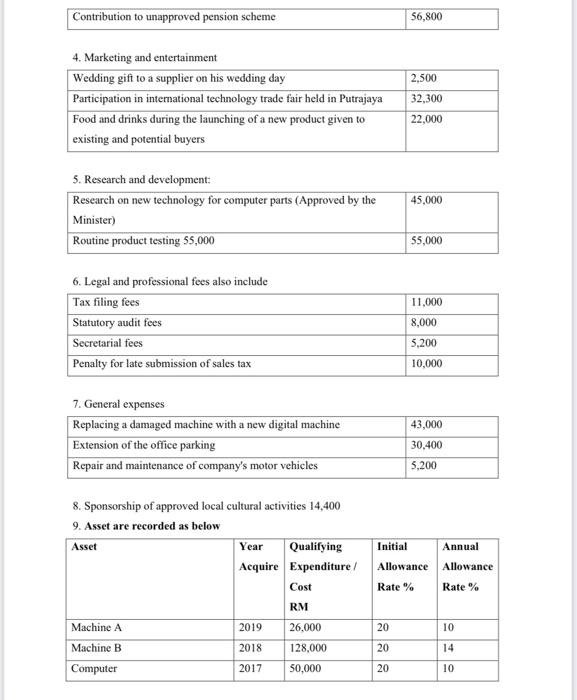

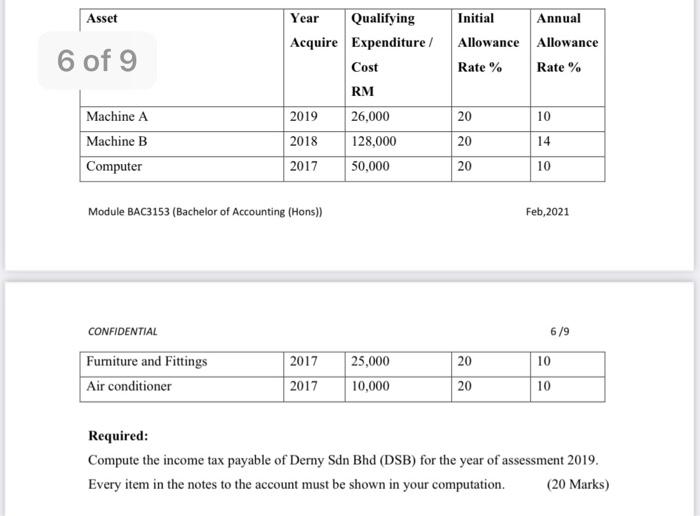

b) Derny Sdn Bhd (DSB) is a manufacturing company involves in the production and supply of computer parts for local and foreign markets since 2012. The company prepares its accounts 10 31 March every year and its paid-up ordinary share capital is RM2.4 million Module BAC3153 Bachelor of Accounting (Hons) Feb,2021 CONFIDENTIAL 4/9 The following is the Statement of Profit or Loss of the company for the year ended 31 March 2019: Sales 3.250,450 Cost of sales (1.270,300) Gross profit 1,980,150 Other income 2 273,750 2,253,900 Expenses Remuneration 3 470,800 Marketing and entertainment 4 56,800 Research and development 5 100,000 Lcase rental 30,000 Legal and professional fees 6 42,700 General expenses 7 78,600 Depreciation 83.200 Sponsorship and donations 8 66,900 1979.000 Net Profit before tax 1,324,900 Additional Information 1. Cost of sales also includes: Export credit insurance premium (based on takaful concept) approved by the Ministry of Finance Penalty paid to a Russian company for the use of patent. 34,700 78.000 2. Other income also included, RM 35,800 Gain on disposal of old machine. The residual expenditure of the machine was RM29.300 and the disposal value was RM61.500. 3. Remunerations also include: Salaries and bonuses of disabled employees Contribution to Employees Provident Fund (EPF) 55.000 65.200 Contribution to unapproved pension scheme 56,800 4. Marketing and entertainment Wedding gift to a supplier on his wedding day Participation in international technology trade fair held in Putrajaya Food and drinks during the launching of a new product given to existing and potential buyers 2,500 32,300 22,000 45,000 5. Research and development: Research on new technology for computer parts (Approved by the Minister) Routine product testing 55,000 55,000 6. Legal and professional fees also include Tax filing fees Statutory audit fees Secretarial foes Penalty for late submission of sales tax 11,000 8,000 5,200 10,000 7. General expenses Replacing a damaged machine with a new digital machine Extension of the office parking Repair and maintenance of company's motor vehicles 43,000 30,400 5,200 8. Sponsorship of approved local cultural activities 14,400 9. Asset are recorded as below Asset Year Qualifying Initial Annual Acquire Expenditure / Allowance Allowance Cost Rate % Rate % RM Machine A 2019 26,000 20 10 Machine B 2018 128,000 20 14 Computer 2017 50,000 20 10 Asset Initial Annual Allowance Allowance Rate % Rate % 6 of 9 Year Qualifying Acquire Expenditure / Cost RM 2019 26,000 2018 128,000 2017 50,000 10 Machine A Machine B Computer 20 20 14 20 10 Module BAC3153 (Bachelor of Accounting (Hons)) Feb,2021 CONFIDENTIAL 6/9 20 10 Furniture and Fittings Air conditioner 2017 2017 25,000 10,000 20 10 Required: Compute the income tax payable of Derny Sdn Bhd (DSB) for the year of assessment 2019. Every item in the notes to the account must be shown in your computation. (20 Marks) b) Derny Sdn Bhd (DSB) is a manufacturing company involves in the production and supply of computer parts for local and foreign markets since 2012. The company prepares its accounts 10 31 March every year and its paid-up ordinary share capital is RM2.4 million Module BAC3153 Bachelor of Accounting (Hons) Feb,2021 CONFIDENTIAL 4/9 The following is the Statement of Profit or Loss of the company for the year ended 31 March 2019: Sales 3.250,450 Cost of sales (1.270,300) Gross profit 1,980,150 Other income 2 273,750 2,253,900 Expenses Remuneration 3 470,800 Marketing and entertainment 4 56,800 Research and development 5 100,000 Lcase rental 30,000 Legal and professional fees 6 42,700 General expenses 7 78,600 Depreciation 83.200 Sponsorship and donations 8 66,900 1979.000 Net Profit before tax 1,324,900 Additional Information 1. Cost of sales also includes: Export credit insurance premium (based on takaful concept) approved by the Ministry of Finance Penalty paid to a Russian company for the use of patent. 34,700 78.000 2. Other income also included, RM 35,800 Gain on disposal of old machine. The residual expenditure of the machine was RM29.300 and the disposal value was RM61.500. 3. Remunerations also include: Salaries and bonuses of disabled employees Contribution to Employees Provident Fund (EPF) 55.000 65.200 Contribution to unapproved pension scheme 56,800 4. Marketing and entertainment Wedding gift to a supplier on his wedding day Participation in international technology trade fair held in Putrajaya Food and drinks during the launching of a new product given to existing and potential buyers 2,500 32,300 22,000 45,000 5. Research and development: Research on new technology for computer parts (Approved by the Minister) Routine product testing 55,000 55,000 6. Legal and professional fees also include Tax filing fees Statutory audit fees Secretarial foes Penalty for late submission of sales tax 11,000 8,000 5,200 10,000 7. General expenses Replacing a damaged machine with a new digital machine Extension of the office parking Repair and maintenance of company's motor vehicles 43,000 30,400 5,200 8. Sponsorship of approved local cultural activities 14,400 9. Asset are recorded as below Asset Year Qualifying Initial Annual Acquire Expenditure / Allowance Allowance Cost Rate % Rate % RM Machine A 2019 26,000 20 10 Machine B 2018 128,000 20 14 Computer 2017 50,000 20 10 Asset Initial Annual Allowance Allowance Rate % Rate % 6 of 9 Year Qualifying Acquire Expenditure / Cost RM 2019 26,000 2018 128,000 2017 50,000 10 Machine A Machine B Computer 20 20 14 20 10 Module BAC3153 (Bachelor of Accounting (Hons)) Feb,2021 CONFIDENTIAL 6/9 20 10 Furniture and Fittings Air conditioner 2017 2017 25,000 10,000 20 10 Required: Compute the income tax payable of Derny Sdn Bhd (DSB) for the year of assessment 2019. Every item in the notes to the account must be shown in your computation. (20 Marks)

page 1

page 1  page 2

page 2 page 3 (Question)

page 3 (Question)