Question

10. Your company sold out the stocks (200.000 shares) of BCD A. in MKB (Market stock price for per share is 1,8 TL). The company

10. Your company sold out the stocks (200.000 shares) of BCD A. in MKB (Market stock price for per share is 1,8 TL). The company paid 2.000 TL for the commission. (all payments made and revenues received by using bank account)

11. Whole Notes Receivable has gotten bad debt. The company decided to separate provision for bad debt.

12- A check received (130.000 TL) from the customer collected via Garanti Bank.

13. The Given (150.000TL) cheque to the whole-seller were paid by using bank account.

14- Remember, the company paid interest expense of 7.000 TL and made instalment payment 50.000 TL for its bank loan. (They were paid by cash at the end of April)

15- At the end of April, the company paid salaries of 25.000TL to various employees.

16- During April, the company bought some fuel for its motor vehicle, and paid telephone, electric and water bills (Tax included) 7.080TL. ( Paid by cash)

17- Remember that, if, 391.VAT calculated >191.Deductible VAT + 190. Deferred VAT;

360 VAT payable = 391.VAT calculated -191.Deductible VAT - 190. Deferred VAT

If, 191.Deductible VAT > 391. VAT calculated;

190. (Transferred)Deferred VAT= 191.Deductible VAT - 391. VAT calculated

18- Useful life for truck is 4 years, for furniture is 3 years and for rights is 5 years.

Required:

1-Prepare the journal entries (including boot and closing recording) in the general journal and post them to the ledger. If you decide it is necessary to prepare trial balance for your study, you can use it. But it is not necessary to prepare trial balance. (90 Points)

2-Prepare Income Table (5 Points)

undefined

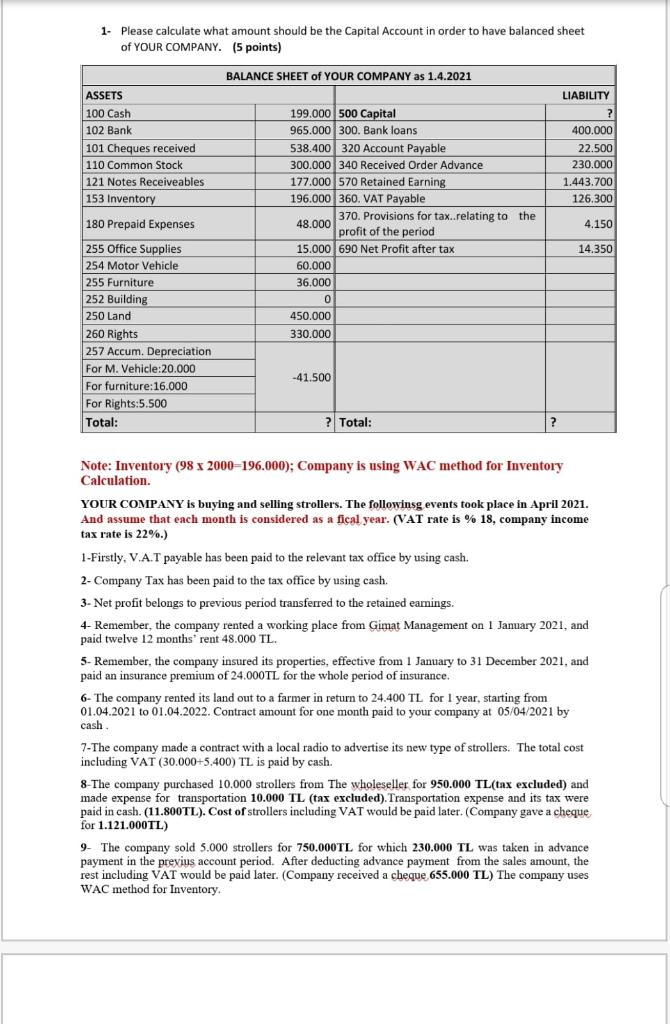

1. Please calculate what amount should be the Capital Account in order to have balanced sheet of YOUR COMPANY. (5 points) BALANCE SHEET of YOUR COMPANY as 1.4.2021 ASSETS 100 Cash 102 Bank 101 Cheques received 110 Common Stock 121 Notes Receiveables 153 Inventory 199.000 500 Capital 965.000 300. Bank loans 538.400 320 Account Payable 300.000 340 Received Order Advance 177.000 570 Retained Earning 196.000 360. VAT Payable 370. Provisions for tax.relating to the profit of the period 15.000 690 Net Profit after tax 60.000 36.000 LIABILITY ? 400.000 22.500 230.000 1.443.700 126.300 48.000 4.150 14.350 0 450.000 180 Prepaid Expenses 255 Office Supplies 254 Motor Vehicle 255 Furniture 252 Building 250 Land 260 Rights 257 Accum. Depreciation For M. Vehicle:20.000 For furniture:16.000 For Rights:5.500 Total: 330.000 -41.500 ? Total: ? Note: Inventory (98 x 2000=196.000); Company is using WAC method for Inventory Calculation. YOUR COMPANY is buying and selling strollers. The followinsg events took place in April 2021. And assume that each month is considered as a fical year. (VAT rate is % 18, company income tax rate is 22%.) 1-Firstly, V.A.T payable has been paid to the relevant tax office by using cash. 2- Company Tax has been paid to the tax office by using cash. 3- Net profit belongs to previous period transferred to the retained earnings. 4- Remember, the company rented a working place from Gimat Management on 1 January 2021, and paid twelve 12 months' rent 48.000 TL 5- Remember, the company insured its properties, effective from 1 January to 31 December 2021, and paid an insurance premium of 24.000TL for the whole period of insurance. 6- The company rented its land out to a farmer in return to 24.400 TL for 1 year, starting from 01.04.2021 to 01.04.2022. Contract amount for one month paid to your company at 05/04/2021 by cash 7-The company made a contract with a local radio to advertise its new type of strollers. The total cost including VAT (30.000+5.400) TL is paid by cash. 8-The company purchased 10.000 strollers from The wholeseller for 950.000 TL(tax excluded) and made expense for transportation 10.000 TL (tax excluded). Transportation expense and its tax were paid in cash. (11.800TL). Cost of strollers including VAT would be paid later. (Company gave a cheque for 1.121.000TL) 9- The company sold 5.000 strollers for 750.000TL for which 230.000 TL was taken in advance payment in the previus account period. After deducting advance payment from the sales amount, the rest including VAT would be paid later. (Company received a cheque 655.000 TL) The company uses WAC method for Inventory. 1. Please calculate what amount should be the Capital Account in order to have balanced sheet of YOUR COMPANY. (5 points) BALANCE SHEET of YOUR COMPANY as 1.4.2021 ASSETS 100 Cash 102 Bank 101 Cheques received 110 Common Stock 121 Notes Receiveables 153 Inventory 199.000 500 Capital 965.000 300. Bank loans 538.400 320 Account Payable 300.000 340 Received Order Advance 177.000 570 Retained Earning 196.000 360. VAT Payable 370. Provisions for tax.relating to the profit of the period 15.000 690 Net Profit after tax 60.000 36.000 LIABILITY ? 400.000 22.500 230.000 1.443.700 126.300 48.000 4.150 14.350 0 450.000 180 Prepaid Expenses 255 Office Supplies 254 Motor Vehicle 255 Furniture 252 Building 250 Land 260 Rights 257 Accum. Depreciation For M. Vehicle:20.000 For furniture:16.000 For Rights:5.500 Total: 330.000 -41.500 ? Total: ? Note: Inventory (98 x 2000=196.000); Company is using WAC method for Inventory Calculation. YOUR COMPANY is buying and selling strollers. The followinsg events took place in April 2021. And assume that each month is considered as a fical year. (VAT rate is % 18, company income tax rate is 22%.) 1-Firstly, V.A.T payable has been paid to the relevant tax office by using cash. 2- Company Tax has been paid to the tax office by using cash. 3- Net profit belongs to previous period transferred to the retained earnings. 4- Remember, the company rented a working place from Gimat Management on 1 January 2021, and paid twelve 12 months' rent 48.000 TL 5- Remember, the company insured its properties, effective from 1 January to 31 December 2021, and paid an insurance premium of 24.000TL for the whole period of insurance. 6- The company rented its land out to a farmer in return to 24.400 TL for 1 year, starting from 01.04.2021 to 01.04.2022. Contract amount for one month paid to your company at 05/04/2021 by cash 7-The company made a contract with a local radio to advertise its new type of strollers. The total cost including VAT (30.000+5.400) TL is paid by cash. 8-The company purchased 10.000 strollers from The wholeseller for 950.000 TL(tax excluded) and made expense for transportation 10.000 TL (tax excluded). Transportation expense and its tax were paid in cash. (11.800TL). Cost of strollers including VAT would be paid later. (Company gave a cheque for 1.121.000TL) 9- The company sold 5.000 strollers for 750.000TL for which 230.000 TL was taken in advance payment in the previus account period. After deducting advance payment from the sales amount, the rest including VAT would be paid later. (Company received a cheque 655.000 TL) The company uses WAC method for InventoryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started