Answered step by step

Verified Expert Solution

Question

1 Approved Answer

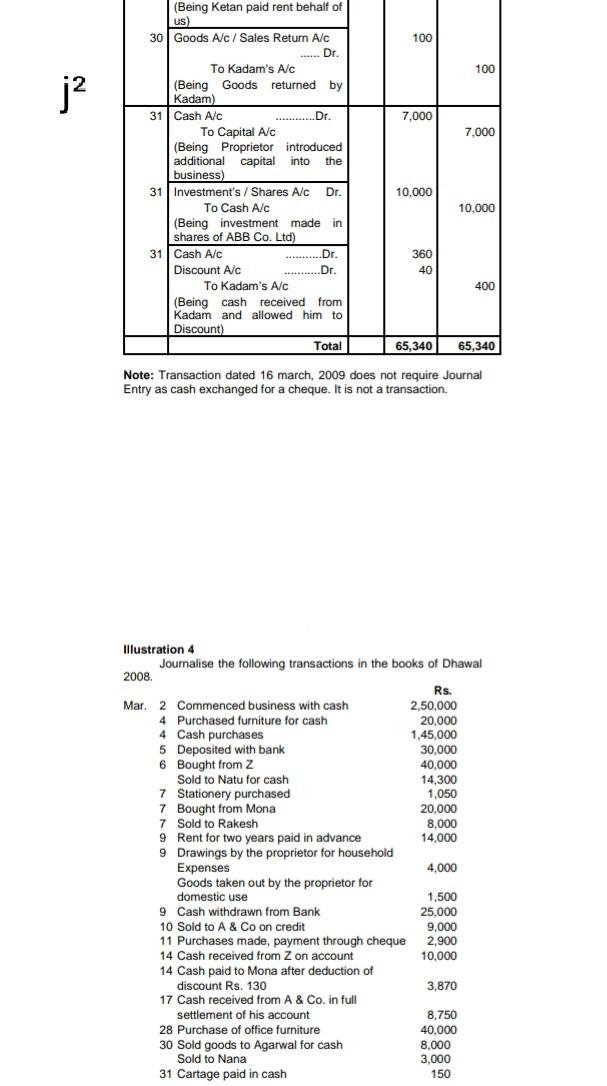

100 100 j? .........Dr. 7,000 7.000 (Being Ketan paid rent behalf of us) 30 Goods A/c / Sales Return A/C ...... Dr. To Kadam's A/C

100 100 j? .........Dr. 7,000 7.000 (Being Ketan paid rent behalf of us) 30 Goods A/c / Sales Return A/C ...... Dr. To Kadam's A/C (Being Goods returned by Kadam) 31 Cash A/C To Capital A/C (Being Proprietor introduced additional capital into the business) 31 Investment's / Shares A/c Dr. To Cash A/C (Being investment made in shares of ABB Co. Ltd) 31 Cash A/C Discount Alc ...........Dr. To Kadam's A/C (Being cash received from Kadam and allowed him to Discount) Total 10,000 10,000 ...Dr. 360 40 400 65,340 65,340 Note: Transaction dated 16 march, 2009 does not require Journal Entry as cash exchanged for a cheque. It is not a transaction. 40,000 Illustration 4 Journalise the following transactions in the books of Dhawal 2008 Rs. Mar. 2 Commenced business with cash 2,50,000 4 Purchased furniture for cash 20,000 4 Cash purchases 1,45,000 5 Deposited with bank 30,000 6 Bought from Z Sold to Natu for cash 14,300 7 Stationery purchased 1,050 7 Bought from Mona 20,000 7 Sold to Rakesh 8,000 9 Rent for two years paid in advance 14,000 9 Drawings by the proprietor for household Expenses 4,000 Goods taken out by the proprietor for domestic use 1,500 9 Cash withdrawn from Bank 25,000 10 Sold to A & Co on credit 9,000 11 Purchases made, payment through cheque 2,900 14 Cash received from Z on account 10,000 14 Cash paid to Mona after deduction of discount Rs. 130 3,870 17 Cash received from A & Co. in full settlement of his account 8,750 28 Purchase of office furniture 40,000 30 Sold goods to Agarwal for cash 8,000 Sold to Nana 3,000 31 Cartage paid in cash 150

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started